After the 1st Feasibility Assessment, Remaining 182 Trillion Won Projects Targeted

Estimated 2.3 Trillion Won of Non-Performing PF Projects... Classified into 4 Grades

Lee Bok-hyun "Quickly Resolve Non-Performing Projects"

The Financial Supervisory Service (FSS) has completed the second round of feasibility assessments for all real estate project financing (PF) sites ahead of schedule and is set to intensify restructuring efforts for the remaining distressed PF sites. The PF exposure re-evaluated in the first and second rounds since June amounts to a total of 216 trillion KRW, with approximately 10% expected to undergo simultaneous distressed sales or write-off procedures.

According to financial authorities on the 5th, the FSS recently finalized the second evaluation and verification process for real estate PF sites. From June to August, the authorities first re-evaluated projects that had significantly deteriorated before proceeding with the second evaluation for the remaining sites. The second feasibility assessment was initially expected to continue until the end of this month but was completed about a month earlier.

The second evaluation covered projects worth 182.8 trillion KRW, accounting for 84.4% of the total projects (216.5 trillion KRW). However, since the first evaluation targeted major distressed PF projects, the amount of projects expected to receive cautionary or distressed ratings in the second evaluation is reported to be around 2.3 trillion KRW. All PF projects are classified into four grades based on feasibility: sound, normal, cautionary, and distressed. The first evaluation assessed projects totaling 33.7 trillion KRW (15.6%) that showed high risk of distress, such as delinquency, delinquency grace periods, or extensions of maturity (three or more times).

A senior official from the financial authorities told Asia Economy in a phone interview, “The second evaluation was conducted on the remaining projects not included in the first feasibility assessment as of the end of September, and the evaluation is now complete,” adding, “The decision on whether to disclose the evaluation results is under review.”

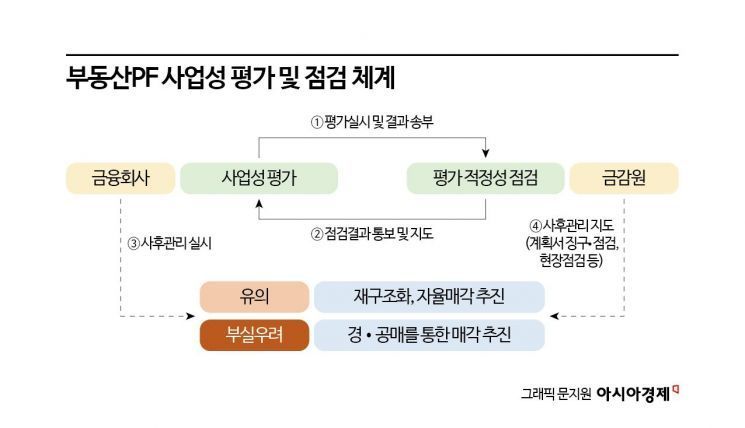

Earlier, in June, the financial authorities improved the feasibility assessment criteria to encourage financial institutions to conduct reasonable PF feasibility evaluations. The criteria were objectified and specified by reflecting key risk factors for bridge loans and main PFs, and the feasibility rating system was expanded from three to four levels. The previous lowest grade, “deterioration concern,” was subdivided into “cautionary” and “distressed concern.” Projects rated as cautionary are required to pursue restructuring or voluntary sales, while those rated as distressed concern must proceed with sales through distressed or public auctions or write-offs.

The financial authorities plan to accelerate the cleanup of distressed projects based on the first and second feasibility assessments. They will request restructuring and disposal plans from financial institutions, review them, and verify the implementation of post-management. If disposal plans are insufficient, on-site inspections may be conducted.

On the 29th of last month, Lee Bok-hyun, Governor of the FSS, also urged at an FSS executive meeting, “For projects subject to disposal, promptly proceed with distressed or public auctions and write-offs, while actively managing normal or restructured projects capable of housing supply to ensure smooth funding through financial sector syndicated loans.”

Additionally, the FSS plans to transition to a continuous feasibility assessment system starting next month. Evaluations will be conducted quarterly for all projects with PF exposure at the end of each quarter. Feasibility assessments will be completed within one month after the quarter ends, and restructuring and disposal plans will be finalized within two months. A financial authority official explained, “As of the end of June, restructuring and disposal plans for most cautionary or distressed concern projects have been finalized, so additional cautionary or distressed projects are expected to be limited going forward,” adding, “We will monitor the implementation of restructuring based on the results of the first and second feasibility assessments on a monthly basis.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.