Among the Top 20 Net Buyers in the Past Month, 11 Are Newly Listed Companies

KOSDAQ Market Cap Leaders Surge on Expectations of Financial Investment Tax Abolition

Individuals Caught in New Stock Trap, Principal Halved

The KOSDAQ index surged following news that the Democratic Party of Korea has decided to abolish the financial investment income tax. Among the top 30 KOSDAQ market capitalization stocks, 29 stocks including Alteogen, EcoPro BM, and EcoPro rose. Although expectations for a bottoming out of the KOSDAQ market are growing, many individual investors are not smiling. This is because they were held back after investing in newly listed stocks that entered the KOSDAQ market last month.

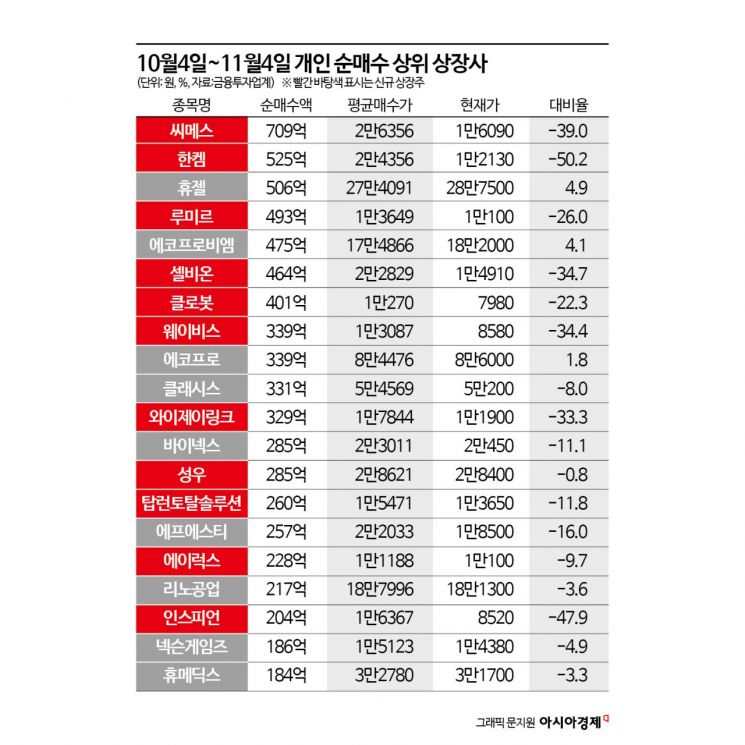

According to the financial investment industry on the 5th, individual investors recorded a cumulative net purchase of 253 billion KRW in the KOSDAQ market over the past month from the 4th of last month to the day before yesterday. Among the top 20 listed companies by cumulative net purchases, 11 are newly listed stocks including Cimes, Hankem, Lumir, Selbion, Clobot, Wavevis, YJ Link, Sungwoo, and Top Total Solution.

Individuals bought Cimes the most in the KOSDAQ market. The cumulative net purchase amount exceeded 70 billion KRW. The average purchase price was 26,400 KRW, and based on the current price of 16,090 KRW, the unrealized loss rate is 39%.

Cimes is a company developing robot solutions through the convergence of artificial intelligence (AI), 3D vision, and robot guidance technology. It entered the KOSDAQ market on the 24th of last month with a public offering price of 30,000 KRW. On the first day of listing, the stock price rose to as high as 37,450 KRW but closed at 23,100 KRW. Since then, the stock price has continued to decline and fell to about half the public offering price within eight trading days. On the first day of listing, institutional investors and foreign investors recorded net sales of 1.45 million shares and 440,000 shares, respectively. Institutional investors sold their holdings at around 33,000 KRW, which was higher than the public offering price.

Individual investors who invested in Hankem, a specialized advanced materials synthesis company, lost half of their principal. It was listed on the 22nd of last month at a public offering price of 18,000 KRW, but the current stock price has dropped to around 12,000 KRW. Individuals bought Hankem shares at an average price of 24,400 KRW per share. Individuals who invested in Lumir and Selbion, which were listed last month, are recording losses of 26% and 35%, respectively.

Among individuals who touched newly listed stocks, Sungwoo investors have relatively smaller losses. Sungwoo, which was listed on the 31st of last month, fell 12.5% compared to the public offering price of 32,000 KRW on the first day of listing. The stock price rebounded slightly the next day but still remains below the public offering price. Since the first day of listing, individuals bought shares at an average price of 28,600 KRW. Based on the current stock price, the unrealized loss rate is only 1%.

Jongseon Park, a researcher at Eugene Investment & Securities, explained, "There were 10 newly listed stocks last month. If sold at the opening price on the first day of listing, the average return compared to the public offering price was 26.3%, showing favorable profitability, but if sold at the closing price, the return was 9.4%, which is lower." He added, "If held until the end of the month, the average return was -22.9%. Overall, the returns by stock have turned downward, and losses tend to widen even when holding."

While individual investors are suffering losses after concentrating on buying newly listed stocks, domestic institutional investors are recording relatively high returns. Institutions bought Techwing shares worth 91.9 billion KRW over the past month. The evaluation return rate reaches 12%. Among the top 20 stocks by net purchases by institutional investors, only five listed companies are recording unrealized losses. They are making profits with a 75% probability.

Among the top stocks by net sales by institutions, newly listed companies such as Hankem, Cimes, YJ Link, and Lumir stand out. The average selling price of Hankem was 31,000 KRW, achieving a return of over 70% compared to the public offering price.

A financial investment industry official pointed out, "Expectations for a KOSDAQ market rebound are growing due to the abolition of the financial investment income tax and the resolution of uncertainties in the U.S. presidential election," but added, "Newly listed stocks are acting as a black hole for individual funds, and cases of individual investors falling into a 'ant trap' after buying for short-term capital gains are increasing." He also added, "Stocks bought by foreigners and institutions tend to have relatively good price trends."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)