[US Election 2024]

The leading cryptocurrency Bitcoin showed weakness on the 3rd (local time), falling to the $68,000 level. This is due to the declining chances of former President Donald Trump, who had been a rally factor for Bitcoin, winning the upcoming November 5 U.S. presidential election.

According to cryptocurrency exchange Coinbase, as of 3:05 PM Eastern Time (5:05 AM Korean Time on the 4th), the price of one Bitcoin is trading at $68,568.60 (approximately 94,659,000 KRW), down 1.32% from 24 hours earlier. Compared to the record high near $73,000 reached on the 29th of last month, this represents a drop of about $5,000 in four days. During the day, the price briefly fell to the $67,400 range.

This bearish trend is interpreted as a result of the decreased probability of former President Trump, the Republican presidential candidate, winning according to betting sites. According to the betting site Polymarket, on the 29th of last month when Bitcoin surpassed $73,000 per coin, Trump's winning probability was 67%. However, since then, his chances have declined to 53% as of today. Meanwhile, the winning probability of Democratic vice-presidential candidate Kamala Harris rose from 33% four days ago to 47%.

According to a poll of seven battleground states released by The New York Times (NYT) and Siena College on the same day, Vice President Harris led narrowly in four states. Two states were tied, and one state showed an advantage for former President Trump.

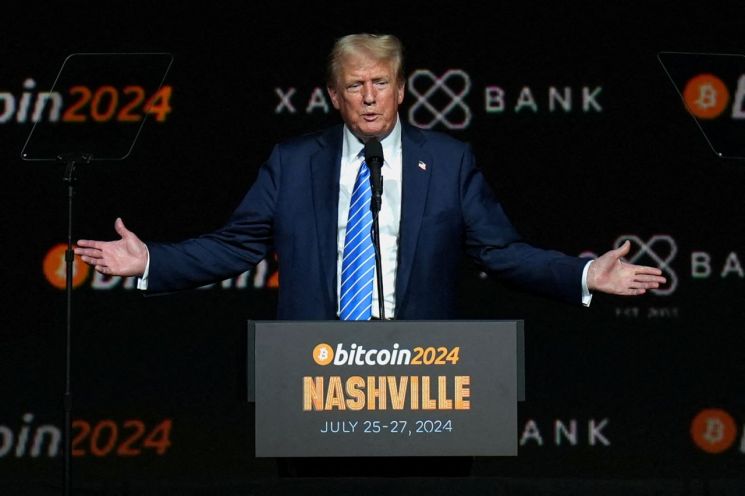

The market has been optimistic that whichever candidate wins, the market conditions will be more favorable compared to the current administration, but it had placed greater hopes on the victory of former President Trump, who has called himself the "cryptocurrency president." Additionally, the recent large net outflows from Bitcoin spot exchange-traded funds (ETFs) are also considered a factor behind the sharp drop in Bitcoin prices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)