Subscription of 210,000 Shares Out of 600,000 Allocated to Employee Stock Ownership Association

Employee Response 'Indifferent' Compared to General Subscription Deposit of 11.8038 Trillion Won

Stock Price Prediction Difficult After 1-Year Lock-Up Period Ends

On the 6th, ahead of the listing on the KOSPI market, The Born Korea's employee stock ownership association subscribed to only 35% of the allocated shares. In contrast, the public offering subscription for general investors attracted nearly 12 trillion won in deposits, marking a successful reception. While the undersubscription by the employee stock ownership association is seen as a sign of concerns about The Born Korea's growth potential, some suggest that the mandatory holding period may have been a hindrance. Accordingly, calls for improving the employee stock ownership association system in the domestic IPO market are growing.

CEO Baek Jong-won of The Born Korea is giving a corporate presentation at The Born Korea corporate briefing session (IPO) held at the Conrad Hotel in Yeongdeungpo-gu, Seoul, on October 28. Photo by Kang Jin-hyung

CEO Baek Jong-won of The Born Korea is giving a corporate presentation at The Born Korea corporate briefing session (IPO) held at the Conrad Hotel in Yeongdeungpo-gu, Seoul, on October 28. Photo by Kang Jin-hyung

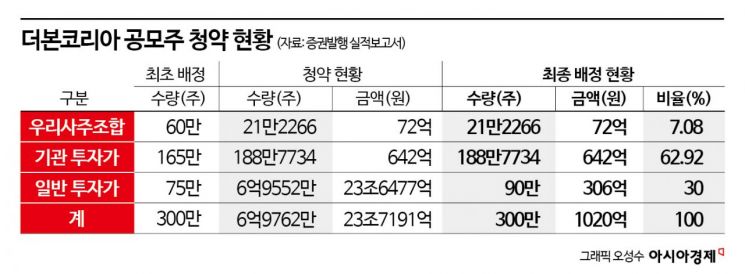

According to the Financial Supervisory Service's electronic disclosure system on the 2nd, The Born Korea's employee stock ownership association subscribed to 212,266 shares out of the allocated 600,000 shares.

According to the prospectus, The Born Korea has about 700 employees, which means each employee subscribed to an average of about 290 shares. Based on the public offering price of 34,000 won, each employee purchased employee stock worth around 10 million won. The average salary of employees from January to July this year was 24.95 million won, which annualized amounts to 42.77 million won. The average subscription amount compared to the average salary is not small. To subscribe to all 600,000 shares, employees would need to invest about 29 million won each.

Separately from the undersubscription by the employee stock ownership association, the public offering subscription for general investors was successful. Over two days starting from the 28th of last month, the subscription for general investors recorded a competition rate of 772.80 to 1. The subscription deposits amounted to approximately 11.8238 trillion won. The number of shares applied for to receive the 750,000 shares allocated to general investors reached 697.62 million shares.

Institutional investors participating in the demand forecast were not much different from general investors. From the 18th to the 24th of last month, 2,216 domestic and foreign institutions participated in the demand forecast. This is why the public offering price was set at 34,000 won, exceeding the upper limit of the expected price range of 23,000 to 28,000 won.

Concerns have been raised that the undersubscription by the employee stock ownership association reflects worries about The Born Korea's growth potential. Many investors interpret the lack of active subscription by employees, who know the company best, as a negative signal.

The Born Korea plans to raise 102 billion won to expand its value chain through mergers and acquisitions (M&A) and equity investments. The plan includes acquiring wholesale and retail specialized food companies and investing in food tech companies. This is expected to help expand supply capabilities to franchise stores and secure price competitiveness. They are also considering investing in food tech companies developing automated kitchen equipment and serving robots to reduce the labor burden and personnel costs of franchise stores.

Franchise headquarters employees may have judged that investing more in developing new brands and menus would be better. The public offering price exceeding the upper limit of the expected range may have influenced employees' subscription due to concerns about a price bubble.

Some investment bankers believe that rather than concerns about growth potential, the mandatory holding period for the employee stock ownership association was a hurdle. Shares allocated to the employee stock ownership association must be deposited with Korea Securities Finance after listing and cannot be disposed of until one year has passed since the deposit date. Recent IPO market trends show that many newly listed companies maintain their public offering shares for one year after listing. Even if the stock price surges on the first day of listing, it often declines afterward as venture capitalists and others who invested before listing sell their holdings. Because it is difficult to predict the stock price after the lock-up period, investors may avoid subscribing through the employee stock ownership association.

Considering that major shareholders and registered executives must hold their shares for six months before listing, some argue that preventing employees from selling their public offering shares for one year is excessive.

A financial investment industry official commented on the employee stock ownership association system, saying, "To share the fruits of growth with employees who strive for the company's growth, system improvements are necessary," and pointed out that "many prospective listed companies preparing for listing do not allocate public offering shares to their employee stock ownership associations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)