4Q Operating Profit Estimates Drop Nearly 6% in One Month

Concerns Grow Over Weak 2H Performance

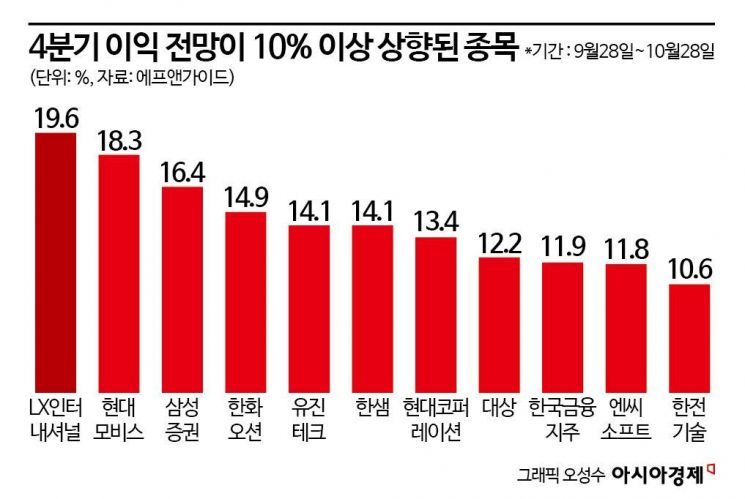

Focus on Companies with Earnings Forecasts Raised Over 10%

Estimates of operating profit for domestic listed companies in the fourth quarter have dropped by nearly 6% compared to a month ago. As the earnings outlook for the fourth quarter rapidly declines following the third quarter, experts advise focusing on stocks whose earnings forecasts have actually been revised upward compared to a month ago.

According to FnGuide on the 1st, the combined consensus (average of securities firms' estimates) of operating profit for 263 listed companies, compiled from three or more securities firms over the past month, stands at KRW 61.5956 trillion. This is a 5.7% decrease compared to a month ago (KRW 65.3308 trillion).

The combined third-quarter earnings outlook for 271 listed companies also shrank by 16%, from KRW 70.502 trillion to KRW 58.5747 trillion, casting a shadow over corporate earnings in the second half of the year. This is due to concerns over economic slowdown in major export countries, depreciation of the dollar caused by U.S. interest rate cuts, and declining earnings forecasts for export-driven stocks. Additionally, earnings expectations for leading stocks such as semiconductors and secondary batteries are gradually being lowered.

Accordingly, experts suggest paying attention to sectors or stocks that are undervalued relative to earnings and whose consensus estimates have been revised upward compared to a month ago. Among the stocks with the largest upward revisions in fourth-quarter earnings forecasts is Hyundai Mobis (18.3%). Hyundai Mobis, which recorded an earnings surprise in the third quarter, still has shareholder return events pending, indicating potential for further stock price gains. Hyundai Mobis is scheduled to announce its shareholder return plans at an Investor Day on the 19th of this month. Securities firms have also raised their target prices for Hyundai Mobis one after another. Of 18 reports related to Hyundai Mobis, 13 have raised their target prices. Hyundai Motor Securities proposed a target price of KRW 400,000, a 14.3% increase from KRW 350,000. The estimated operating profit for Hyundai Mobis in the fourth quarter is KRW 781.2 billion, an 18% increase compared to KRW 660.2 billion a month ago.

Hanwha Ocean, which turned profitable in the third quarter, also saw its operating profit estimates rise compared to a month ago, but the stock price outlook from securities firms is not optimistic. NH Investment & Securities, Kiwoom Securities, and Meritz Securities have lowered their target prices for Hanwha Ocean, citing slower-than-expected profitability improvement.

Samsung Securities, which could benefit from interest rate cuts, also saw its operating profit estimates increase by 16.4% compared to a month ago. The estimated net profit for Samsung Securities in the fourth quarter is KRW 202 billion, a 36% increase from KRW 148.2 billion a month ago. In the gaming sector, NCSoft is expected to deliver strong fourth-quarter results. Securities firms have raised NCSoft’s operating profit estimates by 11.8% compared to a month ago. This reflects expectations for the global service of the recently launched game ‘Throne and Liberty (TL)’. NH Investment & Securities recently analyzed in a report that the worst phase for stock prices and earnings has somewhat passed, and with the launch of TL Global and subsequent new releases continuing into next year, a turnaround in earnings can be expected starting from this fourth quarter.

LX International, which has seen a significant decline in earnings including a halving of operating profit last year, recorded a 142% surge in third-quarter operating profit compared to the same period last year, resulting in the largest increase in operating profit forecasts. Jae-seon Yoo, a researcher at Hana Securities, analyzed that this was due to the continuous upward trend in container freight indices since the second quarter and raised the target price to KRW 40,000.

Korea Investment Holdings, the parent company of Korea Investment & Securities, is also expected to post solid results in the fourth quarter. Since early this year, Korea Investment Holdings has increased IB fee income through active project financing (PF) investments, and bond management performance is expected to remain steady due to the effects of interest rate cuts. Accordingly, the net profit for the fourth quarter is projected at KRW 206.3 billion, up from KRW 163.4 billion a month ago, and the annual net profit is expected to comfortably exceed KRW 1 trillion. Other companies with improved fourth-quarter earnings forecasts include KEPCO Engineering & Construction, Eugene Technology, Daesang, and Hanssem.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)