Q3 Earnings Conference Call

"Mass production and sales of HBM3E 8- and 12-layer ongoing"

Preparing for HBM4 commercialization

Options include Samsung Foundry and TSMC

Operating profit under 4 trillion KRW but memory performed well

Estimated actual profit excluding costs around 7 trillion KRW

On the 31st, Samsung Electronics announced its third-quarter earnings for this year and officially stated regarding its 5th generation high-bandwidth memory (HBM), HBM3E, that "both 8-stack and 12-stack HBM3E are currently in mass production and sales," adding, "We have secured meaningful progress by completing important stages in the quality verification process with key customers, and sales expansion is expected in the fourth quarter." This message is interpreted as a move to dispel market concerns that arose from over a year of failing to pass Nvidia's HBM3E quality tests, a major player in the AI chip market, and to shift the atmosphere.

Kim Jae-jun, Vice President of Samsung Electronics' Memory Business Division, said during the third-quarter earnings conference call, "Total HBM sales in the third quarter grew by more than 70% compared to the previous quarter," and explained, "The sales proportion of HBM3E increased to the mid-teens percentage range in the third quarter. The HBM3E share is expected to reach 50% in the fourth quarter."

He added, "Although some commercialization delays mean the level announced last quarter will not be met, the HBM3E share is still expected to be 50% in the fourth quarter."

Earlier, Samsung Electronics had noted in reference materials released during the preliminary earnings announcement on the 8th that "commercialization with key customers for HBM3E was delayed compared to expectations." According to market research firm TrendForce, global HBM demand comes from Nvidia (58%), Google (18%), AMD (8%), AWS (5%), among others.

The HBM-related remarks by Vice President Kim were essentially the highlight of the third-quarter earnings announcement. In a situation where Samsung Electronics was evaluated as having lost competitiveness and facing a crisis in the HBM market, the company presented a rosy 'HBM roadmap,' leaving room for a change in the atmosphere. HBM supply to Nvidia also appears to be materializing. Kim explained, "We are expanding sales of both 8-stack and 12-stack HBM3E products through multiple customer usage," adding, "We are also preparing improved HBM3E products tailored to the next-generation graphics processing unit (GPU) projects of key customers."

He continued, "We are currently coordinating schedules with customers to mass-produce these products within the first half of next year," and added, "Existing HBM3E products will expand supply for projects already entered, and improved products will be additionally sold for new projects to broaden the scope of demand response."

The 6th generation HBM4 is being developed as planned, targeting mass production in the second half of next year. Kim said, "We are preparing customized HBM commercialization with multiple customers," emphasizing, "Since customized HBM must meet customer requirements, the selection of foundry partners related to base die manufacturing will be flexibly handled internally and externally, prioritizing customer demands." Considering that the global foundry market is effectively divided between Taiwan's TSMC and Samsung Electronics, this suggests the possibility of cooperation with TSMC depending on customer needs.

Kim also stated, "Despite limited supply capacity of DDR5 based on advanced processes due to concentrated HBM production, the server DRAM average selling price (ASP) increase exceeded the overall DRAM ASP increase." He added, "We are flexibly reducing production of some legacy products to accelerate the transition to advanced processes," and said, "Following the previous quarter, we plan to complete inventory normalization within the year to strengthen the business structure."

Samsung Electronics is considering a capital expenditure (CAPEX) level similar to this year for next year. Kim said, "We will prioritize the construction of next-generation semiconductor R&D complexes, investment in back-end processes, and securing cleanrooms to strengthen future competitiveness," adding, "Regarding facility investment, the focus will be on conversion investment rather than expansion, accelerating the transition of existing lines to 1b nm DRAM and V8·V9 NAND to concentrate on high-value-added products based on advanced processes with strong demand momentum."

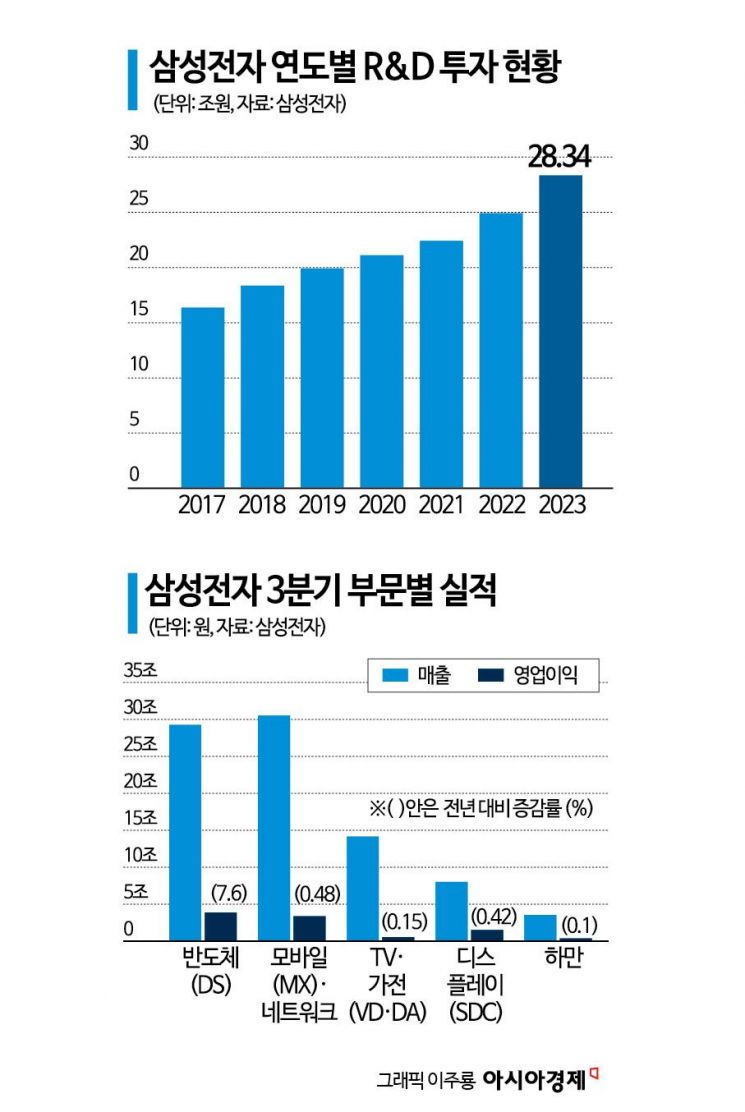

Meanwhile, although Samsung Electronics confirmed operating profit below 4 trillion won in the third quarter, the memory business performed well enough to provide some consolation. The finalized third-quarter results showed sales of 79.1 trillion won and operating profit of 9.18 trillion won. Sales surpassed the previous record high of 77.78 trillion won in the first quarter of 2022, setting a new quarterly record. The semiconductor (DS) division recorded sales of 29.27 trillion won and operating profit of 3.86 trillion won. Operating profit increased by 7.6% year-on-year but decreased by 2.59% compared to the previous quarter. Consequently, the operating profit margin was 13.2%, lower than competitors such as SK Hynix.

However, memory, which accounts for a significant portion of the DS division's performance, held up well. Memory business sales were 22.07 trillion won, a 112% increase compared to the same period last year. The actual operating profit, excluding one-time costs, is estimated to be close to 7 trillion won. The estimated one-time costs, including third-quarter bonuses, are in the 1 trillion won range. Subtracting one-time costs from the DS division's operating profit results in nearly 5 trillion won in profit. This figure is about 20% higher than the securities market estimate of 4.1 trillion won. Considering that the System LSI and Foundry divisions are estimated to have losses around 1.5 trillion won, the memory business operating profit is analyzed to be around 7 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.