LG Energy Solution, 'Q4 Bottom Theory' Emerges

Battery Cycle Expected to Reignite After Next Year

"Stock Price to Set Higher Lows"

There is an analysis that LG Energy Solution's stock price is bottoming out. Although the securities industry views the potential deterioration in performance until the end of the year as a burden, it expects the industry to be in a recovery phase and forecasts that it will enter a high-growth cycle from next year onward.

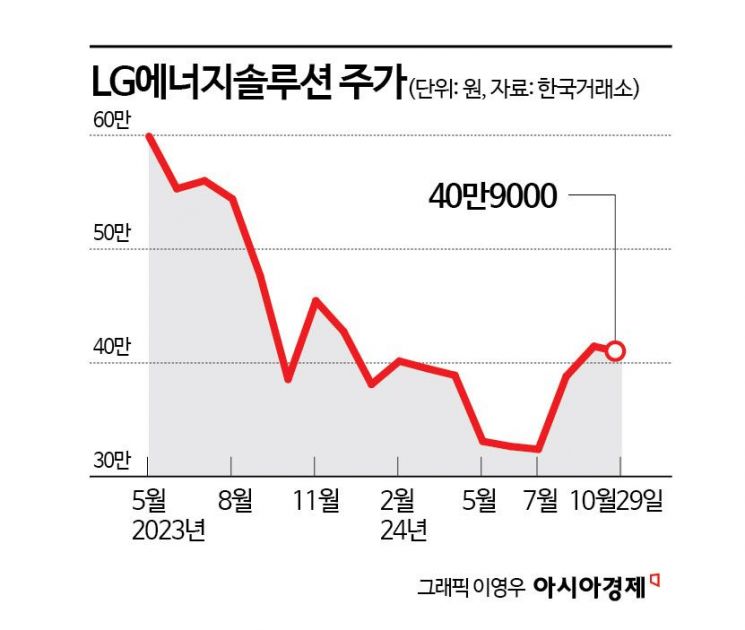

According to the Korea Exchange on the 30th, LG Energy Solution closed at 409,000 won, down 7,500 won (-1.80%) from the previous day. LG Energy Solution attempted a turnaround on the 23rd by rising more than 5% on expectations for the third-quarter results of the U.S. electric vehicle company Tesla, but the stock price faltered again as evaluations indicated that third-quarter results were still sluggish and forecasts suggested that the fourth quarter would also fall short of expectations.

On the 28th, LG Energy Solution announced that its third-quarter sales this year were 6.8778 trillion won, and operating profit was 448.3 billion won. These figures represent decreases of 16.4% and 38.7%, respectively, compared to the same period last year. Lee Yong-wook, a researcher at Hanwha Investment & Securities, analyzed, "Automotive batteries are in deficit excluding the Advanced Manufacturing Production Tax Credit (AMPC). This is because the burden of fixed costs due to low operating rates and the metal price lag effect (time lag in raw material input) continued." He added, "The small battery segment also saw shipments drop by more than 10% compared to the previous quarter due to Tesla's inventory adjustments."

The outlook for the fourth-quarter performance following the third quarter is also bleak. Kiwoom Securities forecasts that LG Energy Solution's fourth-quarter sales will decrease by 15% year-on-year to 6.8 trillion won, and operating profit will record a loss of 211.5 billion won. Kwon Joon-soo, a researcher at Kiwoom Securities, predicted, "Profitability will significantly deteriorate due to the decline in AMPC performance caused by year-end inventory adjustments by North American customers, the drop in metal prices such as lithium, and one-time costs related to large-scale inventory write-offs."

However, despite the expected performance deterioration until the end of the year, the securities industry evaluated that there is a high-growth momentum starting next year. Park Jin-soo, a researcher at Shin Young Securities, pointed out, "Although the expected deterioration in fourth-quarter performance is a burden, the expectation of sales recovery next year remains valid, supported by market expansion based on increased sales of pure electric vehicles (BEV) by major customers and the normal shipment of new products for Tesla."

Researcher Lee Yong-wook also observed, "From this year, development of LFP (Lithium Iron Phosphate) and high-voltage Mid-Nickel (Mid-Ni) batteries is accelerating, and as mid- to long-term orders with OEM companies have become visible, once the critical period until next year is overcome, it will enter a high-growth cycle again from 2026."

There is also a positive analysis that since the battery industry has already changed direction, the stock price will now raise its bottom. Joo Min-woo, a researcher at NH Investment & Securities, said, "Sales growth centered on European and U.S. customers is expected next year, and from the year after next, the full-scale expansion of mid- to low-priced vehicles is planned, so the stock price can reflect this in advance." He added, "We recommend increasing holdings during corrections."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.