Fermented Alcohol Production Doubled from 650,000 to 1.3 Million Bottles, Distilled Alcohol from 700,000 to 1.4 Million Bottles with Producer Tax Cuts

Aiming for Increased Rice Consumption and Industrialization of K-Sul

The government will expand the scope of traditional liquor tax reductions to promote rice consumption. It will also lift production area regulations that restrict the use of local agricultural products as the main raw materials in traditional liquor manufacturing. A comprehensive plan to foster the traditional liquor industry, which can achieve the dual effect of 'increasing domestic rice consumption' and 'strengthening the global competitiveness of K-sul,' is scheduled to be announced within this year.

According to the Ministry of Economy and Finance on the 30th, the government plans to prepare the 'Rice Industry Structural Reform Plan' and the 'Comprehensive Plan for the Traditional Liquor Industry' within the year.

Choi Sang-mok, Deputy Prime Minister and Minister of Economy and Finance, stated, "For traditional liquor, tax reductions of up to 50% are provided based on shipment volume, and we will double the scope of eligible recipients for this reduction."

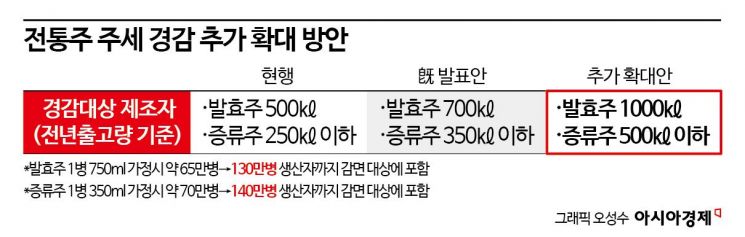

Through the 2024 tax law amendment announced last July, the government decided to reduce tax rates for manufacturers of fermented liquor with a previous year's shipment volume of 700㎘ or less, and distilled liquor with 350㎘ or less. This time, the scope of eligible recipients for the reduction will be expanded to manufacturers of fermented liquor with 1000㎘ or less and distilled liquor with 500㎘ or less.

Deputy Prime Minister Choi explained, "In the case of wine, the current tax reduction applies to producers of about 650,000 bottles (based on 750mL per bottle), but we will expand the reduction to producers of 1.3 million bottles. For soju, the reduction target will increase from 700,000 bottles (based on 350mL per bottle) to producers of 1.4 million bottles."

Just as the Japanese government solved the problem of declining rice consumption through traditional sake, our plan is to foster the traditional liquor industry using rice as a raw material to increase rice consumption and enhance the global competitiveness of K-sul.

The government expects that the expansion of tax reductions on traditional liquor will lead to increased production. For liquor tax, the reduced rate is applied only to the quantity produced within the reduction limit set for the business operator, and the general tax rate applies to quantities produced beyond that limit.

Deputy Prime Minister Choi said, "Traditional liquor producers often produced within the reduction limit to receive tax reduction benefits. (By expanding the eligible scope) companies that previously produced according to the existing standards are expected to increase their production volume."

Regulations on raw materials for traditional liquor will also be eased. There were criticisms that the narrow scope of traditional liquor application, which requires the use of agricultural products from the manufacturing site or nearby areas as the main raw materials, was an obstacle to new product development.

Deputy Prime Minister Choi said, "We are considering lifting the regulation that restricts traditional liquor to use only agricultural products from the manufacturing site or adjacent cities and counties as the main raw materials," adding, "In addition to improving raw material regulations, we will further consider overall industry promotion measures such as traditional liquor research and development (R&D) and the establishment of dedicated funds, and prepare a comprehensive plan within the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)