The Financial Supervisory Service Collaborates with the National Police Agency to Uncover Fraudulent Claims of Indemnity Insurance Benefits

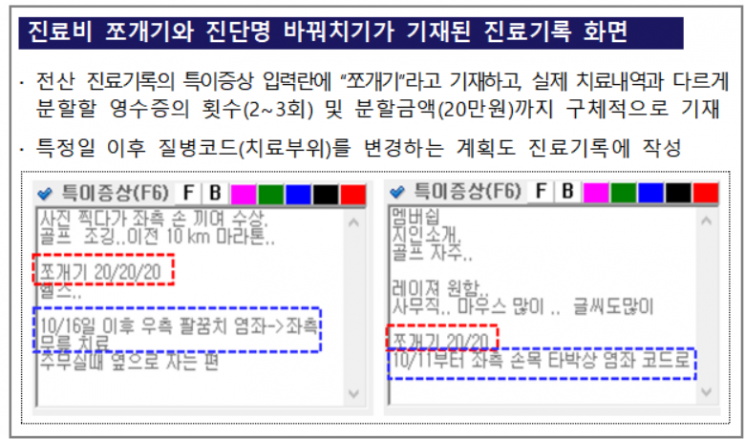

Hospital director Mr. A created false medical records to maximize the amount covered by indemnity insurance once the medical expenses for each patient were determined. For example, if a patient is enrolled in indemnity insurance with a 30% co-payment rate and a daily outpatient insurance limit of 200,000 KRW, a single claim of 600,000 KRW in treatment costs would result in an insurance payout of 200,000 KRW. However, by splitting this into three claims of 200,000 KRW each, the total insurance payout would amount to 420,000 KRW. Mr. A was recently caught engaging in illegal activities such as splitting medical expenses and falsifying diagnosis names.

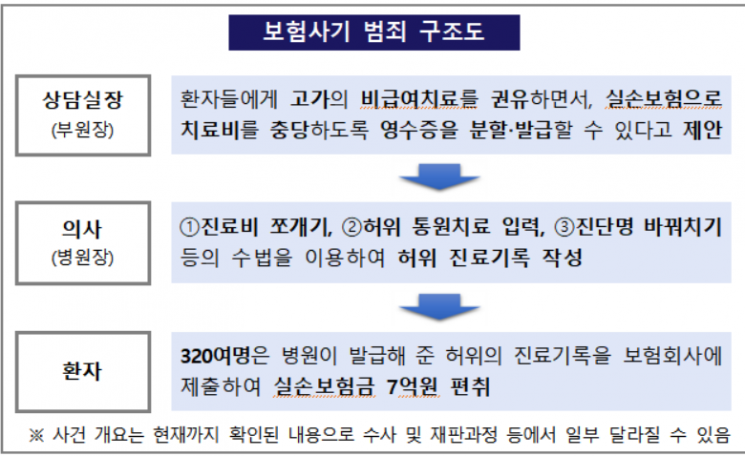

On the 28th, the Financial Supervisory Service (FSS) announced that it had uncovered an organized insurance fraud scheme that embezzled indemnity insurance payments by using methods such as splitting medical expenses, based on numerous reports received by the 'Insurance Fraud Reporting Center.'

Mr. A specifically noted "splitting" in the electronic medical records and detailed the number of times and amounts according to the total medical expenses for each patient. He even entered false outpatient records as if treatment had been provided on days when the patient did not visit the hospital, in order to split the medical expenses. Because the medical records were arbitrarily entered, there were cases where treatment was recorded as having occurred at times before the treatment actually started or even before the patient arrived. To avoid suspicion from insurance companies due to the high number of falsely recorded sessions such as manual therapy, frequent changes to diagnosis codes were also observed.

The consultation manager recommended expensive non-reimbursable treatments to patients and suggested that treatment receipts for extracorporeal shock wave therapy or manual therapy could be split and issued so that the treatment costs could be covered by indemnity insurance. About 320 patients, misled by the medical staff’s recommendations, received expensive non-reimbursable treatments but submitted receipts for extracorporeal shock wave therapy or manual therapy issued differently from the actual medical records to insurance companies, embezzling 700 million KRW in insurance payments.

Not only the hospital and medical staff who led the insurance fraud but also patients who acquiesced to or participated in these tempting proposals have faced criminal penalties in many cases. Insurance policyholders must be especially cautious to avoid being involved in insurance fraud. If caught, under the Special Act on the Prevention of Insurance Fraud, penalties of up to 10 years imprisonment or fines up to 50 million KRW may be imposed.

An FSS official stated, "Insurance fraud undermines the foundation of the insurance system, which should function as a social safety net through reasonable risk distribution, and causes premium increases for many honest policyholders. It is a representative financial crime that harms the public." The official added, "The FSS and the National Police Agency will continue to actively cooperate to eradicate insurance fraud."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)