Shinhan and NongHyup Temporarily Waive Early Repayment Fees

We Are 'Reviewing', Kookmin and Hana Have No Plans

Early Repayment Fee System Reform Also Imminent

Amid the financial authorities' strong stance on household debt management, major commercial banks have introduced varying policies on waiving prepayment penalties for household loans, forcing borrowers to make 'strategic choices.' Especially with the upcoming revision of the prepayment fee system in the banking sector scheduled for January next year, financial consumers appear to be weighing whether to repay early based on their bank's policy or wait until the fee reduction takes effect.

According to the banking sector on the 29th, the waiver policies for prepayment penalties among major commercial banks currently differ. Shinhan Bank is the most proactive, implementing a waiver policy for all household loans (excluding fund loans), while NongHyup Bank temporarily waives fees for household loans of low-credit customers with a specific rating (BS grade 5 or below) until February next year. Shinhan Bank's waiver period lasts until November 30, with no plans announced thereafter. Woori Bank waives prepayment penalties only for the 'Woori WON Jeonse Loan,' which has a maximum limit of 222 million KRW, and is currently reviewing a plan to waive fees for all household loans.

On the other hand, Kookmin Bank temporarily waived fees for mortgage loans among household loans in September, but that policy ended in early October, and fees are currently being charged. The bank has no plans to reinstate the waiver policy this year. Hana Bank is also not considering a waiver policy.

The banks' prepayment fee waiver measures are publicly promoted as part of 'win-win management' to alleviate the financial burden on vulnerable groups. However, industry insiders believe the real background is pressure from financial authorities to stabilize household debt. Waiving prepayment fees encourages borrowers with extra funds to repay loans, thereby reducing household debt. Banks that have proactively introduced or are reviewing fee waivers tend to carry relatively high household debt volumes, necessitating active management.

Currently, the prepayment fee rates for mortgage loans at the five major banks are 1.4% for fixed-rate and 1.2% for variable-rate loans, while the prepayment fee rates for Jeonse loans range from 0.6% to 0.7%. Borrowers considering early repayment of household loans can save millions of KRW depending on their bank's policy, making a thorough review of their bank's policy essential. Customers of banks like Shinhan Bank, which offer full waivers, benefit from repaying now, whereas customers of other banks might be better off waiting until the fee reduction takes effect. The financial authorities announced in November last year that, referencing overseas cases, they would improve the fee system based on actual costs reflecting operational expenses and business characteristics. The 'Amendment to the Financial Consumer Protection Supervision Regulations for Improving the Prepayment Fee Charging System' is scheduled to be implemented from mid-January. Some banks are also expected to apply the reduced fee rates earlier than January.

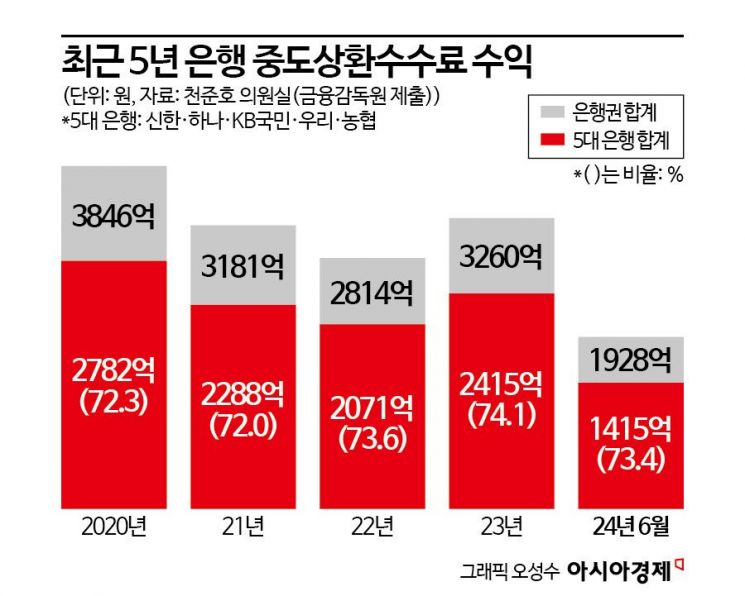

Since the prepayment fee income of the five major banks accounts for more than 70% of the total banking sector's income, there is keen interest in how much the fee rates will be reduced. Among the banking sector, internet banks have waived prepayment fees on household loans since their inception. A financial industry official explained, "Internet banks have built their entire systems to be non-face-to-face, enabling relative cost savings, but they also bear costs for customer convenience."

The problem is that some financial companies produce different results each time they run simulations. Consequently, the financial authorities have instructed these companies to recalculate the figures. An FSC official explained, "If there are too many differences among financial companies, it could confuse consumers and direct criticism toward the authorities, so we intend to encourage disclosure of numbers that can be responsibly supported."

There are also discrepancies within the same sector, posing a challenge for the authorities. According to the FSC's supervisory standards draft, financial companies can set fee rates considering administrative costs, recruitment costs, and opportunity costs. However, the authorities explain that differences in standards and practices among companies have led to larger-than-expected variations within sectors. The financial authorities consider differences of a few basis points (1bp = 0.01 percentage points) acceptable, but if the gap is larger, they intend to verify whether the calculations properly followed the guidelines.

A financial authority official stated, "Since opportunity costs and real estate collateral-related costs are fixed, fees charged by banks cannot differ significantly. Banks handle large volumes, so economies of scale will reduce fees in the banking sector, whereas fees might increase in the secondary financial sector such as savings banks," adding further explanation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.