Up 87% This Year... Surpasses Kia to Rank 7th in Market Cap

Cheers for the Triple Boost of Earnings, Shareholder Returns, and Value-Up Announcements

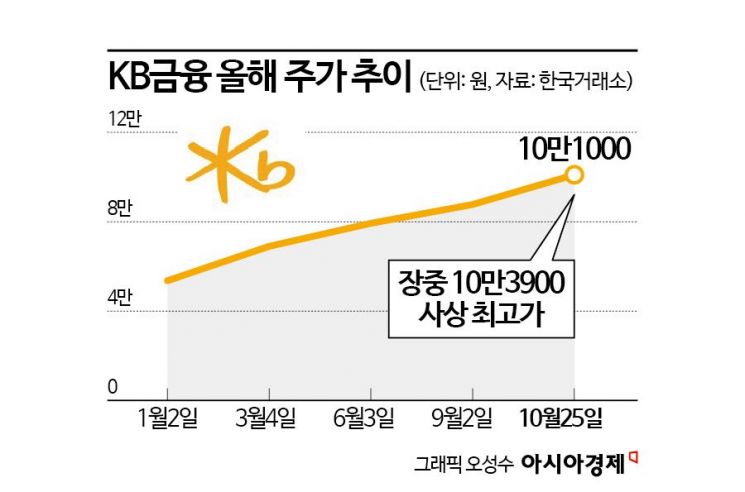

KB Financial's stock price surpassed 100,000 KRW, reaching an all-time high. Having experienced ups and downs with its value-up program, KB Financial has emerged as the true winner of value-up this year, with its stock price soaring by 87%. Given its shareholder return plan that exceeded market expectations, attention is focused on whether it will be included in the year-end value-up index.

According to the Korea Exchange on the 28th, KB Financial reached an intraday high of 103,900 KRW on the 25th, marking an all-time high. On that day, KB Financial closed at 101,000 KRW, up 8.37%. This closing price also set a new record. The surge in stock price pushed its market capitalization ranking above Kia, rising to 7th place.

Strong third-quarter earnings and announcements enhancing corporate value were factors driving the stock price surge. KB Financial's third-quarter net income (based on controlling interest) increased by 17.9% year-on-year to 1.614 trillion KRW, the largest ever for a third quarter since its founding. The cumulative net income for the first three quarters rose 0.4% year-on-year to 4.3953 trillion KRW, also setting a record high.

It also announced a bold shareholder return plan. KB Financial stated that starting next year, surplus capital exceeding a 13% Common Equity Tier 1 (CET1) ratio will be returned to shareholders, and the total shareholder return rate?including cash dividends and share buybacks and cancellations?will be maintained at the industry's highest level. Accordingly, capital exceeding a 13% CET1 ratio at the end of this year will be used as the first tranche of shareholder returns next year, and capital exceeding 13.5% during next year will be allocated for share buybacks and cancellations in the second half.

Alongside this, targets were set including an average annual earnings per share (EPS) growth rate of 10%, an average annual share buyback and cancellation of over 10 million shares, and managing risk-weighted assets (RWA) growth at 6.1% or below (the past 10-year average). Choi Jung-wook, a researcher at Hana Securities, commented, "Earnings, shareholder returns, and value-up disclosures all exceeded expectations." He analyzed, "Assuming the CET1 ratio of 13.85% at the end of the third quarter is maintained until year-end, theoretically about 2.9 trillion KRW of shareholder returns would be possible." He added, "The company is expected to do its best to manage the CET1 ratio to increase shareholder return rates, and every time the ratio rises, expectations for expanded shareholder returns will be maximized, which will be viewed very positively by the market."

The generous shareholder return plan was met with market cheers, and the stock price surged. This year, KB Financial's stock price has risen 86.7%. Its market capitalization ranking jumped 10 places from 17th at the beginning of the year to 7th.

The Korea Corporate Governance Forum gave KB Financial the highest rating of 'A+' for its corporate value enhancement plan, citing detailed and rational mid- to long-term plans. The forum highlighted the reasons for awarding the highest score to KB Financial as ▲establishing a value-up framework through rational procedures and approvals centered on the board of directors ▲the sincerity of management and excellent governance ▲strategies focused on sustainability and predictability. The forum stated, "As evidenced by the 78% foreign ownership ratio, KB Financial is already far ahead of other listed companies in shareholder communication and trust-building," adding, "Other listed companies should learn the basics of value-up from KB Financial."

Having experienced ups and downs with value-up, KB Financial has become a true value-up powerhouse. Since the government's value-up plan announcement at the beginning of the year, KB Financial was regarded as the biggest beneficiary of value-up and enjoyed steady success. However, it became an unfortunate protagonist when it was excluded from the value-up index announced in September. Through this value-up disclosure, KB Financial has risen again as a winner of value-up. Eun Kyung-wan, a researcher at Shinhan Investment Corp., evaluated, "The value-up disclosure, which attracted everyone's attention, is positive in terms of differentiation," and added, "It will maintain its position as the leading value-up stock due to its capital ratio advantage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)