South Korea Highly Exposed to US-China, Impact Increases if Trade Conflict Deepens

The International Monetary Fund (IMF) has warned that if US-China trade tensions escalate after the US presidential election, South Korea will face relatively greater negative impacts.

Thomas Helbling, IMF Deputy Director for Asia and the Pacific, said at an IMF Asia-Pacific economic outlook press conference held in Washington D.C. on the 24th (local time) that the increased US-China trade conflict following the November election is a "major downside risk" for South Korea.

Deputy Director Helbling stated, "South Korea is strongly integrated into the global supply chain and world markets, and is particularly exposed to both the US and China," adding, "If US-China trade tensions escalate further, South Korea will experience relatively greater negative effects." However, he also noted, "Since much depends on the specific measures both countries will take amid rising trade tensions, I cannot provide more detailed comments."

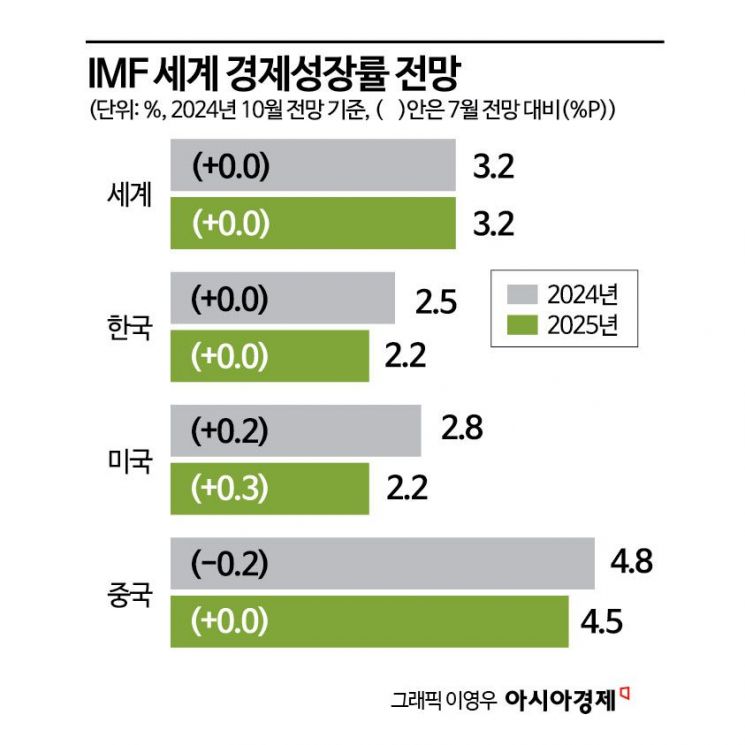

The IMF also reaffirmed its World Economic Outlook (WEO) update, which projects South Korea's economic growth rate to slow from 2.5% this year to 2.2% next year. Helbling commented, "South Korea's growth in the first half of this year was stronger than expected," and "especially the external sector showed remarkable growth." He added, "Compared to the external or export sectors, domestic demand was weak," noting that "this is a consequence of loss of purchasing power due to global inflation and increased private debt burden from monetary policy tightening. Going forward, as inflation is controlled and the Bank of Korea begins monetary easing, nominal wages and real purchasing power are expected to increase, strengthening domestic demand."

The press conference also featured positive outlooks for the Asian economy. Krishna Srinivasan, IMF Director for Asia and the Pacific, explained, "Asia drives 60% of global economic growth," and "due to stronger-than-expected economic growth in Asia during the first half of this year, we have raised the region's economic growth forecasts to 4.6% for 2024 and 4.4% for 2025." However, he pointed out, "Some regions, especially China and South Korea, are expected to face several challenges related to population aging," and noted, "Three factors?population aging, the adoption of artificial intelligence (AI), and climate change?could impact the future economic outlook of these countries (South Korea and China)."

Additionally, economic growth in India and China is expected to slightly slow in 2025. Regarding the IMF WEO update's downward revision of China's economic growth forecast to 4.8% this year, down 0.2 percentage points from the previous forecast (July), Srinivasan assessed, "China's announced economic stimulus measures will not be sufficient." He also emphasized that China needs to allocate about 5% of its gross domestic product (GDP) to stabilize the depressed real estate market. According to Bloomberg News, this amounts to approximately 6.3 trillion yuan (about 1,221 trillion won).

IMF Managing Director Kristalina Georgieva also warned in a separate press conference that "one of the major short-term obstacles to China's consumer confidence lies in the real estate sector," and added, "If China does not take action to address this, potential growth could slow to below 4%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.