While loan interest rates remain unchanged, Woori Bank and NH Nonghyup Bank have started to lower their savings and time deposit interest rates. Although regional banks and savings banks have previously reduced savings and time deposit rates, this is the first time that major commercial banks have taken such action. This move is expected to trigger a wave of interest rate cuts across commercial banks, further widening the gap between deposit and loan interest rates.

According to the financial sector on the 23rd, from this day, Woori Bank lowered the applied interest rate for the 'Woori First Time Deposit' (12 months) from 2.2% per annum to 2.0%, a 0.2 percentage point decrease. On the same day, NH Nonghyup Bank also decided to reduce fixed deposit interest rates by 0.25 to 0.40 percentage points. Installment savings interest rates will be lowered by 0.25 to 0.55 percentage points, and subscription savings and long-term savings rates will each be reduced by 0.25 percentage points. This is the first case among commercial banks to reduce savings and time deposit interest rates.

Previously, regional banks and savings banks had lowered deposit interest rates ahead of commercial banks. On the 17th, Gyeongnam Bank cut savings and time deposit interest rates by up to 0.75 percentage points. The 'Manimani Time Deposit' (12 months) rate dropped from 3.15% to 2.9%, and the 'General Time Installment Savings' (12 months) also decreased from 3.2% to 2.95%. The 'Manimani Free Installment Savings' (5 years) was sharply reduced by 0.75 percentage points from 3.55% per annum to 2.8% per annum. Busan Bank also lowered interest rates on major deposit products by 0.15 to 0.35 percentage points starting from the 18th. The savings bank industry followed suit. SBI Savings Bank reduced deposit interest rates by 0.1 percentage points from the 11th, and Daol Savings Bank lowered rates by 0.05 percentage points from the 21st. Among the 79 savings banks nationwide, the '4% per annum interest' product for regular time deposits (12-month maturity) has disappeared.

The reduction in deposit interest rates by banks is a response to the Bank of Korea's base rate cut on the 11th. The Bank of Korea declared a 'pivot' for the first time in 38 months since August 2021, lowering the base rate by 0.25 percentage points from 3.5% to 3.25% per annum.

However, despite the Bank of Korea's base rate cut, loan interest rates remain unchanged. This is due to the financial authorities strengthening their household loan management policies. Commercial banks determine loan interest rates by adding a spread to the benchmark rate and then subtracting preferential rates. Benchmark rates such as the COFIX rate reflect changes in the Bank of Korea's base rate but take more than a month to be reflected. Additionally, banks have raised their spreads, resulting in loan interest rates that do not reflect the Bank of Korea's rate cut. As of this day, the fixed mortgage loan interest rates at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) range from 3.71% to 6.11%, and variable rates range from 4.57% to 6.67%.

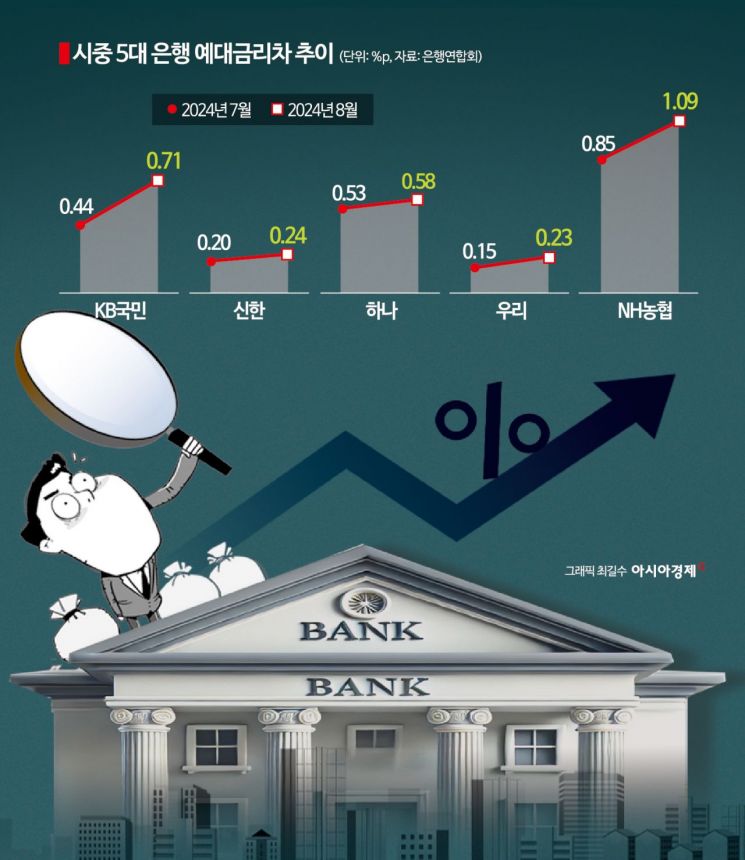

With loan interest rates remaining unchanged and deposit interest rates being lowered, the gap between deposit and loan interest rates is expected to widen further. According to the Korea Federation of Banks, the average household deposit-loan interest rate spread for new transactions at the five major commercial banks in August was 0.57 percentage points. This is an increase of 0.136 percentage points from July (0.434 percentage points). The deposit-loan interest rate spread has widened for the first time in four months since April (0.05 percentage points). The larger the deposit-loan interest rate spread at commercial banks, the greater the banks' profits.

An official from a commercial bank said, "There has been criticism that banks profit from interest, so even when the base rate is cut, it has been difficult to immediately lower savings and time deposit interest rates," adding, "It is only a matter of timing, and most commercial banks are internally reviewing adjustments to deposit interest rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)