TSMC Strong Earnings Contribute to Semiconductor Investment Sentiment Recovery

SK Hynix Continues AI Technology Leadership

"Semiconductor Materials and Components Must Also Focus on AI Value Chain"

Within the semiconductor sector, differentiation between artificial intelligence (AI) semiconductors and legacy (general-purpose) semiconductors continues. The securities industry has pointed out that TSMC's strong performance proves that AI is driving the semiconductor cycle, and analysts emphasize the need to focus on the AI value chain, including not only major semiconductor companies but also materials, parts, and equipment (SoBuJang).

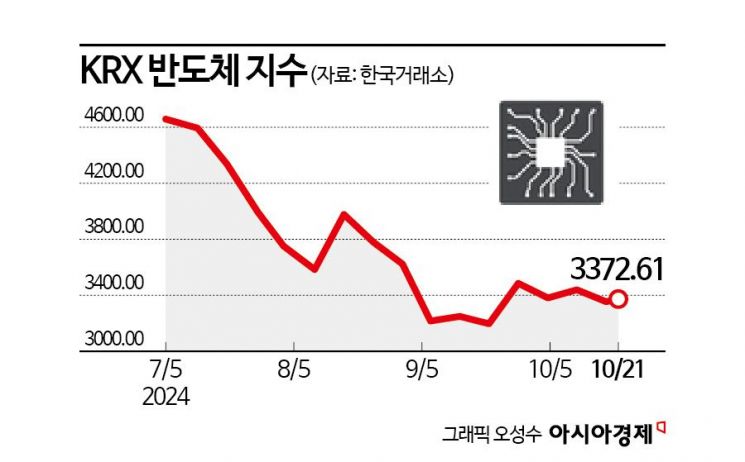

According to the Korea Exchange on the 22nd, the KRX Semiconductor Index closed at 3,372.61 based on the previous trading day's closing price. It has fallen nearly 30% from its peak in July, showing no signs of recovery from the slump. However, individual stocks within the semiconductor index are moving differently. Samsung Electronics, which holds a large weight in this index, hit a 52-week low of 58,500 KRW during intraday trading the previous day, while SK Hynix rebounded 31.93% from its intraday low last month. Notably, foreign investors have continued net selling of Samsung Electronics, offloading more than 11 trillion KRW since last month. Market participants cite Samsung Electronics' historic slump as being due to lower AI expectations compared to competitor SK Hynix and weak demand for legacy semiconductors such as those used in PCs and smartphones.

Experts in the securities industry unanimously agree that when investing in the semiconductor sector going forward, it remains valid to focus on companies with competitiveness in AI semiconductors rather than legacy semiconductors. The superiority of AI semiconductors has already been demonstrated by the divergent performance trends of semiconductor equipment maker ASML and foundry (semiconductor contract manufacturing) company TSMC, which produces Nvidia's cutting-edge AI chips. Recently, ASML reported a shock to its earnings, whereas TSMC's third-quarter revenue increased by 39% year-on-year, surpassing market expectations. In particular, sales for high-performance computing (HPC) applications utilizing AI accounted for more than 50% of total revenue, alleviating market concerns about the AI industry. Jaegu Kang, a researcher at Hanwha Investment & Securities, stated, "The steady demand for AI products from customers related to high-performance computing using 3nm and 5nm technologies and smartphones may reduce market participants' concerns about the AI chasm (temporary demand slowdown). This strong performance by TSMC is expected to restore investment sentiment in the AI and semiconductor industries, which had been damaged by ASML's poor results."

In the domestic stock market, SK Hynix and Samsung Electronics are expected to show differences depending on AI leadership and the degree of memory market improvement. Lee Uijin, a researcher at Heungkuk Securities, said about SK Hynix, "The robust demand for AI-centered high-value-added products such as high-bandwidth memory (HBM), enterprise solid-state drives (eSSD), and double data rate (DDR) 5 is confirmed each quarter as a driver of stock price increases. In particular, the high proportion of HBM and DDR5 reduces exposure to market downturns. The HBM3E 12-stack product will be reflected in fourth-quarter earnings, further highlighting competitiveness."

Regarding Samsung Electronics, the researcher said, "Historical valuation is at the bottom," adding, "Considering the slowdown in earnings forecasts and weak set demand, the scope for further price declines from the current level is limited." However, he noted, "B2C (business-to-consumer) demand in legacy is weakening, and supply is increasing in the Greater China region, absorbing domestic demand, which necessitates a reduction in the sales proportion of general-purpose products." He also predicted, "After inventory adjustments in legacy products are completed in the first half of next year, the memory market may improve."

Since AI is the driving force behind the current semiconductor cycle, there is an analysis that the AI-related value chain is advantageous even in semiconductor SoBuJang investments. Junyoung Park, a researcher at Hyundai Motor Securities, said, "The semiconductor cycle continuing since last year has been driven by AI, and the subsequent decline was due to growing concerns about AI," but he added, "However, the logic supporting concerns about AI that caused the down cycle is weak." He further stated, "Most semiconductor SoBuJang companies have undergone corrections exceeding the average bear market decline of 35%, making a bottom-buying strategy valid. In particular, stocks related to HBM, which are supported by solid demand and pricing, are expected to yield profits when a rebound occurs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)