10 Non-Life Insurers Submit Opposition Letter to Financial Authorities

"Increasing Insurance Liabilities Worsens Financial Soundness... Also Contradicts Actual Field Conditions"

Financial authorities are facing opposition from 10 non-life insurance companies regarding the 'No/Low Surrender Value Insurance Policy Surrender Rate Reform Plan' they are considering to introduce in order to address the issue of insurance companies 'inflating performance.' There are concerns that the authorities' reform plan does not reflect reality and will undermine the reliability of insurance accounting.

According to the financial sector on the 21st, 10 major domestic non-life insurers (Samsung, DB, Hyundai, KB, Hanwha, Lotte, NH, Heungkuk, Hana, MG) recently submitted a joint opinion letter opposing the no/low surrender value surrender rate reform plan to the authorities. It is unusual for insurance companies to collectively submit an opinion letter on a regulatory reform plan.

No/low surrender value insurance policies are products with low premiums but offer little or no refund to the policyholder in case of early termination. Non-life insurers have been aggressively selling these products since 2016, emphasizing their low premiums. The problem arose with the introduction of the new International Financial Reporting Standard (IFRS17) last year. Under the IFRS17 system, as the insurance contract service margin (CSM) became important for insurers' performance, controversy emerged that insurers arbitrarily and optimistically assumed the surrender rates of these products, thereby inflating the CSM.

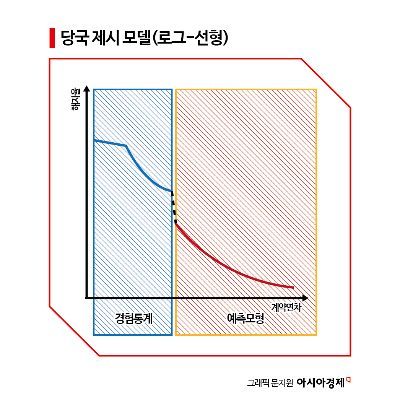

The reform plan proposed by the authorities is a 'log-linear model.' When calculating the surrender rate for no/low surrender value insurance, the plan reflects insurers' experience statistics up to the 4th or 5th year of the insurance contract and applies the log-linear predictive model thereafter. This causes a sharp drop in surrender rates in the period where the experience statistics end and the predictive model is applied. When surrender rates decrease, insurers will have to pay more insurance benefits to customers in the future. This is expected to increase insurance liabilities and lead to a decline in the solvency ratio due to reduced available capital.

'Log-linear prediction model' related to the non-surrender and low-surrender insurance lapse rate reform plan proposed by the financial authorities.

'Log-linear prediction model' related to the non-surrender and low-surrender insurance lapse rate reform plan proposed by the financial authorities.

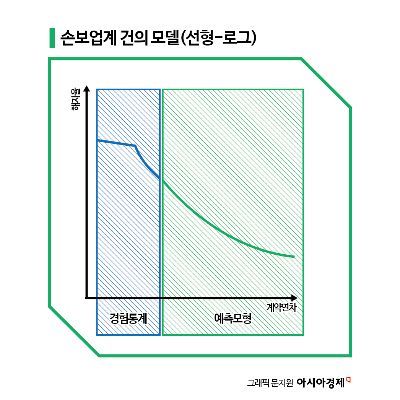

An example of the 'linear-log predictive model' related to the non-surrender and low-surrender insurance lapse rate reform plan proposed by the non-life insurance sector.

An example of the 'linear-log predictive model' related to the non-surrender and low-surrender insurance lapse rate reform plan proposed by the non-life insurance sector.

Non-life insurers argue that the model proposed by the authorities does not consider the actual practice of policy replacement (insurance switching) occurring in the field and assumes surrender rates that are excessively conservative. An industry insider explained, "Although there are areas the industry needs to improve, no/low surrender value insurance often experiences unfair policy replacement in the field due to reasons such as strengthening coverage," adding, "Therefore, it is realistic to assume higher surrender rates over the entire insurance contract period." There are concerns that if assumptions do not match reality, the difference between expected and actual insurance claims (the experience variance) will increase, negatively affecting the reliability of financial statements.

The non-life insurance industry proposes a 'linear-log model.' Unlike the authorities' reform plan, this model does not show a sharp decline in surrender rates from the 5th year of the insurance contract but rather a gradual downward slope. The speed at which the surrender rate approaches zero slows as the insurance contract duration increases. An industry insider said, "The authorities' reform plan has less impact on the CSM, which has been identified as the main culprit for profit inflation, but has a greater negative effect on the solvency ratio," adding, "There is a consensus across the industry that the model is unrealistic and contradicts the best estimate principle of IFRS17."

The authorities stated that although they have derived a predictive model with high goodness-of-fit based on domestic and international statistics regarding the reform plan, nothing has been finalized yet. A financial authority official said, "The impact assessment related to the IFRS17 improvement plan has not yet been completed," and added, "Discussions will continue through future insurance reform meetings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)