Record High of 301,000 Won

"Expecting Sales Growth in the US and China Next Year"

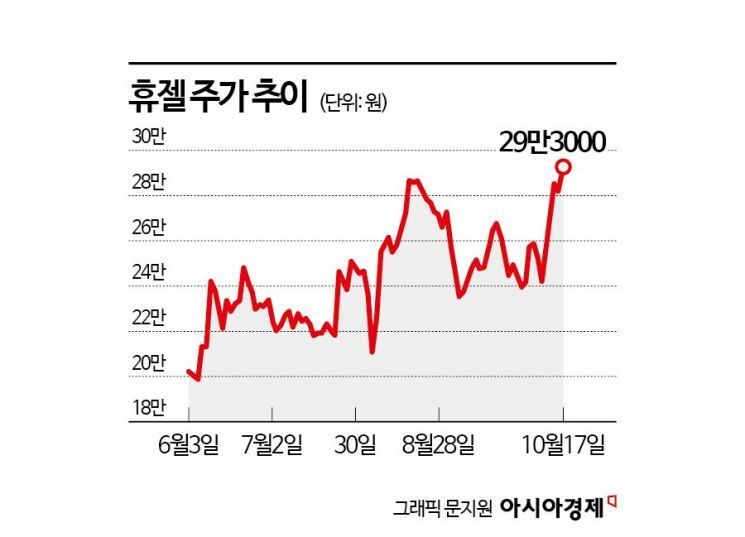

Hugel's stock price is trending upward, reaching an all-time high. This appears to be influenced by expectations that overseas sales will increase further following the resolution of litigation risks.

According to the financial investment industry on the 18th, Hugel closed at 293,000 KRW the previous day. During the trading session, it reached 301,000 KRW, marking an all-time high. The closing price represents a 96.12% increase compared to the end of last year.

This rise is attributed to improved performance and the resolution of litigation risks. Hugel recorded consolidated sales of 169.7 billion KRW and operating profit of 66.4 billion KRW in the first half of this year, representing increases of 16.30% and 42.81%, respectively, compared to the same period last year. In the second quarter alone, sales reached 95.4 billion KRW with an operating profit of 42.4 billion KRW, exceeding market expectations. The key factor behind the improved performance was increased exports. In the second quarter, exports of toxins and fillers amounted to 57.8 billion KRW, a 24% increase compared to the same period last year, thanks to continuous growth in exports to China and Europe.

Additionally, Hugel's favorable ruling in the U.S. International Trade Commission (ITC) lawsuit against Medytox has acted as a positive factor. On the 11th of this month, Hugel announced that it received a final decision from the ITC stating "no violation by Hugel" in the investigation of "unfair acts related to the import of botulinum toxin pharmaceuticals into the U.S." previously filed by Medytox. Earlier, in 2022, Medytox had filed a request with the ITC to ban the import and sale in the U.S., alleging that Hugel and Hugel America had stolen trade secrets such as botulinum toxin strains and manufacturing processes.

Mi-hwa Seo, a researcher at Mirae Asset Securities, commented on the lawsuit outcome, saying, "The biggest reason Hugel traded at below-average valuations over the past two years was the ITC lawsuit," and added, "With the lawsuit resolved in favor of Hugel, it is expected that the company will be assigned an appropriate valuation."

Expectations for third-quarter performance are also high. Securities firms forecast Hugel's sales and operating profit for the third quarter of this year to be 100.1 billion KRW and 43.9 billion KRW, respectively. These figures are higher than the projections three months ago, which were 98.7 billion KRW and 39.9 billion KRW. Dong-joo Wi, a researcher at Korea Investment & Securities, explained, "Following shipments of finished toxin products to Benev in the U.S. in July and again in September, toxin sales will act as a growth factor," adding, "Finished toxin products for the U.S. have a lower cost ratio compared to the selling price, which will contribute to an increase in gross profit margin."

The outlook for next year is also positive. This is because new sales in the U.S. will be fully reflected, and growth in China is also expected. Dong-hee Jung, a researcher at Samsung Securities, said, "In 2025, normalization of Chinese sales, which had been below expectations, is anticipated," and added, "With the reflection of new U.S. sales, elimination of litigation costs, and expected structural margin improvements, the medium- to long-term direction is expected to be solid."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)