Executive in charge of ETF LP department where issue occurred

International Sales Headquarters Director likely cannot avoid responsibility

Leading PBS Business Unit restructuring... New sales expected to face setbacks

Shinhan Investment Corp. has experienced a financial accident involving 130 billion KRW, causing setbacks to the Prime Brokerage Service (PBS) business that had been relaunched after about four years since the 'Lime Fund Incident.' Although the issue occurred in the department responsible for liquidity provision (LP) for Exchange-Traded Funds (ETFs), there are expectations that the new business operations will inevitably be affected, as the senior head, who has been held accountable alongside others, has also been leading the PBS business division.

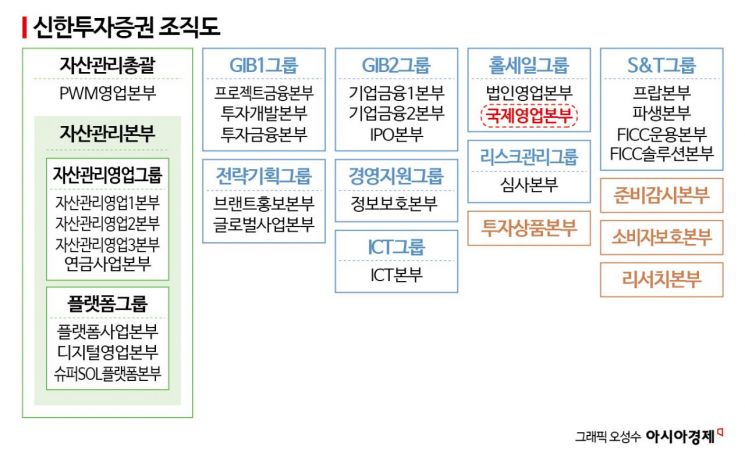

According to the financial investment industry on the 18th, Shinhan Investment Corp. reorganized its structure in December last year, transferring securities lending operations from the Corporate Futures and Options Department under the Wholesale Group's International Sales Headquarters to the PBS business division. This was done to expand the PBS infrastructure targeting private equity funds.

According to market sources, the person who led the reorganization of the PBS business division was Taehoon Lim, Head (Executive Director) of the International Sales Headquarters. Lim is a senior executive of the department where the unprecedented operational loss occurred in the ETF LP division. Shinhan Investment Corp. is expected to take disciplinary actions such as personnel measures after the Financial Supervisory Service completes its ongoing on-site inspection and audit and confirms sanctions. Lim is also known for his rapid promotion within the company, advancing from Managing Director to Executive Director within a year. In 2021, Taehoon Lim received an annual salary of 1.917 billion KRW, earning him the title of 'highest-paid employee' within the company.

A financial investment industry insider said, "Shinhan Investment Corp. was known as the only one among the six major firms without a PBS organization for a while due to the aftermath of the Lime Fund Incident," adding, "I understand that Head Lim led the reorganization of the PBS business division, and the accident occurred in that division." However, it has been confirmed that the PBS business division is currently operating normally.

PBS is a hedge fund support service that provides credit extension, securities lending, research services, and more, tailored to the needs of hedge funds. It encompasses all services required by hedge funds, offering customized solutions. This area is only permitted for comprehensive financial investment business operators (CIBs) with a capital of over 3 trillion KRW. It is a highly competitive field among CIBs as it allows for stable and high fee income.

Shinhan Investment Corp., which entered the PBS business late in 2017, effectively withdrew from PBS operations after about three years due to the impact of the Lime Fund Incident in 2019. At that time, the former head of the PBS business division concealed the insolvency of the Lime Trade Finance Fund and sold 48 billion KRW worth of shares to investors, leading to significant negligence recognized on the company's part. The company received severe disciplinary actions from financial authorities and faced disadvantages such as being excluded from the list of securities firms for domestic stock trading by the National Pension Service from the second quarter of 2022.

Since then, Shinhan Investment Corp., determined to restore trust, took bold steps such as transferring PBS trust contracts with asset management companies to other securities firms. A hedge fund industry insider said, "At that time, Shinhan said they would no longer handle PBS operations, so we had to quickly change the fund trustee," adding, "Now, they have resumed PBS operations targeting private equity funds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)