National Pension Fund Supporting Korea Zinc Unreliable

Additional On-Exchange Purchases Likely Due to Insufficient Shares

Market Impact When Buying During Korea Zinc Tender Offer Period

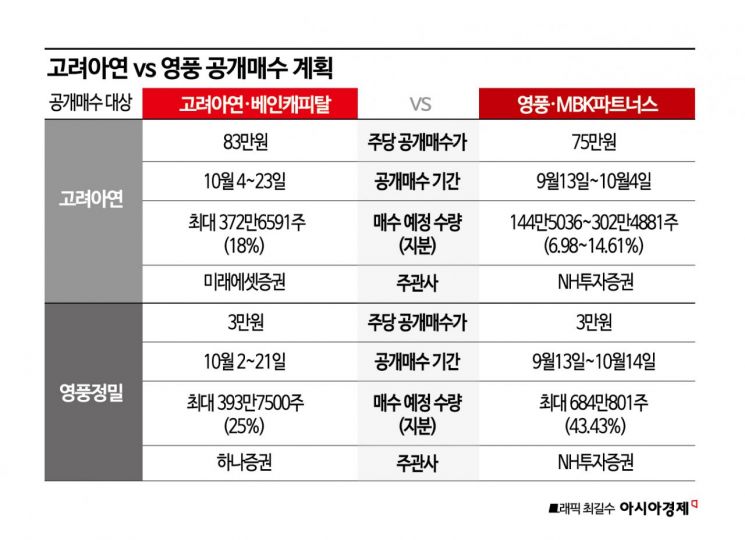

MBK Partners and Yeongpung are considering purchasing Korea Zinc shares on the open market to secure stable management control. Although they effectively became the largest shareholders through a public tender offer, they did not secure a majority, resulting in a 'half-hearted' outcome.

However, concerns have been raised that if they proceed with open market purchases while Korea Zinc's treasury stock tender offer process is still ongoing, it could lead to allegations of 'market manipulation.'

On the 17th, MBK's special purpose company (SPC), Korea Investment Holdings, and Yeongpung plan to purchase 1,105,163 shares (5.34%) tendered in the public offer at 830,000 KRW per share. The volume they intend to buy falls short of the target 14.61% and is 25.7% higher than the previous price of 660,000 KRW per share. However, this purchase will secure voting rights approaching 40% when combined with existing shares.

Nonetheless, this alone is not reassuring. To secure management control, MBK must overcome the barrier posed by the National Pension Service (NPS), which holds a 7.83% stake. The fact that the NPS has historically supported the current management, led by Chairman Choi Yoon-beom of Korea Zinc, at shareholder meetings is a significant variable for MBK.

Looking at the NPS's voting record on Korea Zinc matters, it has generally supported Korea Zinc's proposals. Over the past three years (2022?2024), out of 35 shareholder meeting agenda items, the NPS opposed only three. Notably, in 2022, it opposed the appointment of Jang Hyung-jin, an advisor at Yeongpung, citing concerns that "Mr. Jang's excessive concurrent positions would hinder his duty of loyalty."

This is why MBK is seriously considering purchasing the remaining shares on the open market to secure a majority without facing opposition from the NPS. Currently, Korea Zinc's stock price is lower than the tender offer price of 890,000 KRW, making open market purchases a viable option. As of the closing price on the 16th, at 809,000 KRW, buying shares at the current market price would not interfere with Korea Zinc's tender offer.

The issue is timing. Since Korea Zinc is currently in the treasury stock purchase period, there is a risk of being accused of market manipulation. Article 176 of the Capital Markets Act states, "No securities shall be traded for the purpose of fixing or stabilizing the price of listed securities."

Recently, Kim Beom-su, founder of Kakao and chairman of the management innovation committee, was detained on suspicion of market manipulation during SM Entertainment's tender offer process. Prosecutors believe that Kim secretly drove up the stock price to obstruct the tender offer by competitor HYBE while acquiring SM Entertainment shares.

Korea Zinc is conducting a treasury stock tender offer until the 23rd, targeting 4,140,657 shares (20%) at 890,000 KRW per share. Except for Bain Capital's purchase portion (2.5%), the remaining shares are treasury stocks without voting rights and are scheduled to be canceled later.

If the tender offer concludes as planned, Chairman Choi's friendly shareholding ratio will increase from the current 33.99% to 36.49% with Bain Capital's 2.5% purchase. Consequently, this will not affect the dominant shareholding structure of MBK and Yeongpung. Korea Zinc is reportedly preparing to actively respond, including filing complaints with financial authorities, if MBK proceeds with open market purchases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)