Resuming Trading Since the 27th After Demerger

Price Rises Over 30% Since Resumption

Intraday High of 392,500 KRW on the 16th Sets 52-Week Record

Upward Revisions Amid Strong Earnings Outlook

The stock price of Hanwha Aerospace, which has completed its spin-off, continues its soaring run. The recent strength in defense stocks, inflow of foreign buying, and favorable earnings outlook are cited as factors driving the stock price increase.

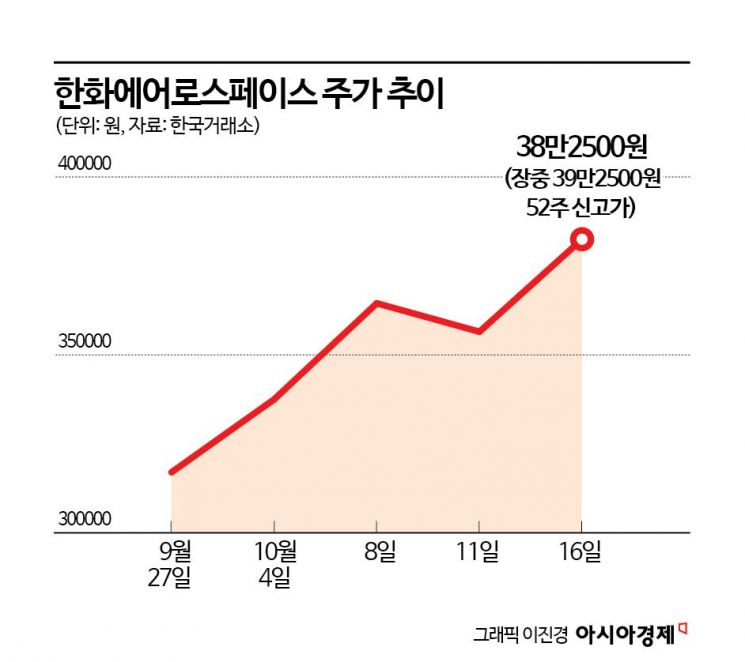

According to the Korea Exchange on the 17th, Hanwha Aerospace reached an intraday high of 392,500 KRW, marking a 52-week high. It closed at 382,500 KRW, up 2.27% from the previous close, bringing it close to breaking the 400,000 KRW mark.

Hanwha Aerospace, which resumed trading on the 27th of last month after completing the spin-off, has seen its stock price rise by more than 30% since the trading resumption. The stock price, which was 290,000 KRW before trading resumed, has climbed to around 380,000 KRW.

Recently, with geopolitical risks in the Middle East and escalating military tensions between North and South Korea, defense stocks have shown strength, boosting Hanwha Aerospace's stock price. In particular, foreign buying has driven the price increase. Since trading resumed on the 27th of last month until the day before, foreigners have net purchased Hanwha Aerospace shares worth 295 billion KRW, making it the second most purchased stock after SK Hynix.

The earnings outlook is also positive. Jiho Lee, a researcher at Meritz Securities, said, "Hanwha Aerospace's Q3 earnings this year are estimated at 2.56 trillion KRW in sales, a 29.2% increase year-on-year, and operating profit of 350 billion KRW, up 205.1%. Although the sales estimate has decreased compared to before the spin-off, operating profit is expected to exceed the consensus (average securities firm forecast) by 5.2%. Since the current consensus partially includes pre-spin-off earnings forecasts, this is considered a significant surprise."

Reflecting the favorable earnings outlook, securities firms have recently raised their target prices for Hanwha Aerospace one after another. Hana Securities raised its target from 375,000 KRW to 440,000 KRW, Meritz Securities from 360,000 KRW to 460,000 KRW, and KB Securities adjusted its target price upward by 30.8% to 425,000 KRW.

The recently announced new facility investment plan is also evaluated positively for mid- to long-term growth. Earlier, on the 25th of last month, Hanwha Aerospace disclosed a new facility investment worth 667.3 billion KRW for propellant production equipment. Researcher Lee said, "Currently, there is low necessity to expand domestic shell production capacity, so this expansion is expected to respond to external demand. Europe currently has only about a quarter of Russia's ammunition production capacity and is experiencing ammunition shortages, so Hanwha Aerospace's presence is expected to gradually expand. Hanwha Aerospace already has a track record of receiving propellant orders from a British defense company, so through this expansion, it can join Europe's shell value chain," he analyzed. He added, "The propellant export business, which generates steady sales, is expected to have an effect greater than just receiving artillery equipment orders and can be considered a sufficient mid- to long-term growth driver, making it a positive investment." Researcher Kijaeng Wi of Hana Securities said, "Attention should be paid to the possibility that ammunition will steepen the earnings improvement slope. Despite ammunition sales not being reflected in Q2, strong performance was recorded, and on an annual basis, the ammunition sales ratio could reach the high teens percentage-wise. Therefore, this facility investment decision is judged to be a cornerstone for future ammunition sales growth."

There is a forecast that joining the 20 trillion KRW market capitalization club is not far off. Researcher Wi said, "It is on the verge of joining the 20 trillion KRW club," and evaluated, "Despite losses due to Setrec Eye and consolidation adjustments, it is still possible to derive a corporate value at the 20 trillion KRW level, indicating high investment attractiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)