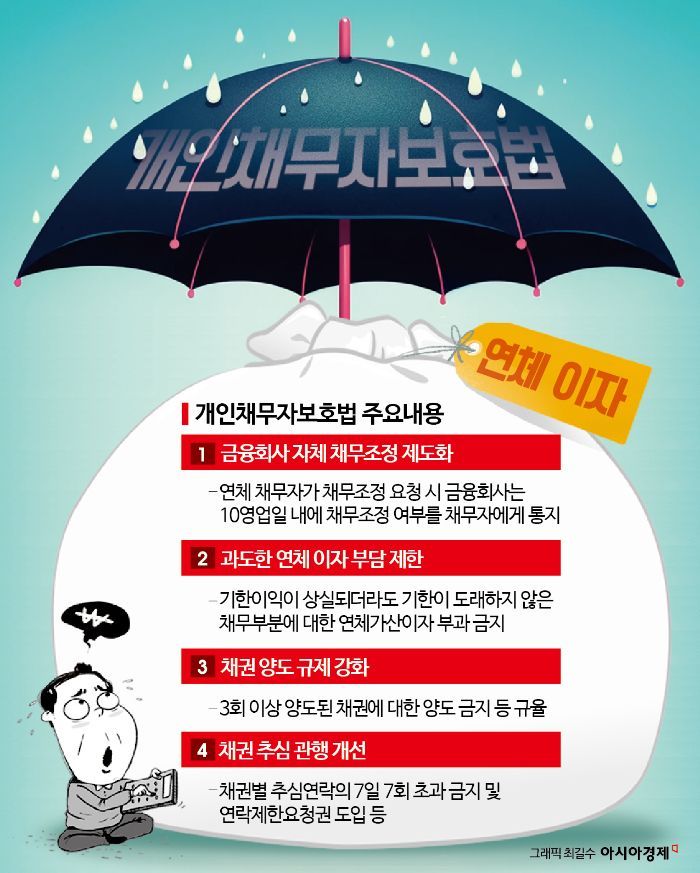

Financial companies handle primary debt adjustment... Adjustment document must be prepared within 10 days after debtor's request

Alleviating excessive overdue interest burden... 'Overdue additional interest' applied only to loans with due dates

Transfer of claims more than 3 times restricted... Debt collection contacts limited to 7 times in 7 days

From now on, individual debtors with overdue loans under 30 million KRW can directly request debt adjustment from the financial institution that issued the loan to ease their 'debt burden.' Additionally, financial institutions can only impose 'overdue additional interest' on loans with repayment due dates that have arrived if the loan amount is under 50 million KRW, and collection contacts cannot exceed 7 times within 7 days.

According to financial authorities, starting today (the 17th), the "Act on the Management of Personal Financial Claims and Protection of Personal Financial Debtors (Personal Debtor Protection Act)" containing these provisions will be enforced. The core points of the Personal Debtor Protection Act include ▲ institutionalizing financial institutions' own debt adjustment systems ▲ limiting excessive overdue interest burdens ▲ strengthening regulations on claim transfers ▲ improving debt collection practices. The Financial Services Commission plans to grant a grace period until January 16 next year for the system to settle, and will consider extending it by an additional 3 months if necessary after comprehensively reviewing law enforcement conditions.

The Personal Debtor Protection Act first allows overdue debtors to proceed with debt adjustment procedures directly with financial institutions. Financial institutions become the primary agents for debt adjustment of individual debtors. This measure aims to effectively protect overdue debtors who have conventionally been pushed toward debt adjustment through the Credit Recovery Committee or court rehabilitation procedures. When an overdue debtor requests debt adjustment, the financial institution must notify the debtor of the decision within 10 business days. Financial authorities expect that proactive debt adjustment between parties will prevent defaults early and minimize social costs.

However, it should be noted that if the debtor fails to comply with the repayment plan for more than 3 months without special circumstances, the financial institution can cancel the previously agreed debt adjustment. Also, if the debtor hides assets or income, or if an agreement is reached through the Credit Recovery Committee's debt adjustment, the financial institution can cancel the debt adjustment agreement. In cases of special circumstances such as hospitalization or unemployment, the agreement can be canceled if non-compliance exceeds 6 months.

The overdue interest burden on individual debtors has also been eased. For example, if the loan principal is 40 million KRW and 10 million KRW of the principal is due for repayment, before the law's enforcement, the financial institution imposed contracted interest and overdue additional interest on the entire 40 million KRW. However, going forward, overdue additional interest can only be charged on the 10 million KRW due for repayment, while contracted interest is charged on the remaining 30 million KRW.

In particular, for loan companies not subject to bad debt processing standards, future interest will be waived on transferred claims that have been overdue for more than one year and have no repayment history within that year. Since loan companies lack separate write-off standards and do not have the concept of deductible expenses, this measure aims to eliminate the blind spot where interest continues to be charged. Generally, financial institutions waive future interest claims when transferring claims with significantly low recovery prospects and include this in transfer contracts for write-off processing.

Claims transferred more than 3 times are prohibited from further transfer... Collection contacts limited to 7 times in 7 days

Requirements for financial institutions' claim transfers and collections are becoming stricter. Strengthening regulations on claim sales aims to prevent situations where debtors are exposed to intensified collection efforts and increased illegal collection risks as claims are repeatedly transferred. Accordingly, the Personal Debtor Protection Act prohibits the transfer of claims with unclear claim-debt relationships such as identity theft and bans the transfer of claims that have been transferred more than three times.

A Financial Services Commission official explained, "Debtors who have been under collection for a long time are expected to face reduced chances of intensified or illegal collection after claim sales. It is also expected to reduce personal information leaks and confusion among debtors during repeated claim sales."

Collection requirements have been significantly strengthened. Collection is restricted for claims that harm debtor protection, and a total collection volume system limits collection contacts to 7 times within 7 days. The Act also includes a collection suspension system that allows collection to be deferred for a certain period in cases of disasters or accidents. Collection is prohibited for claims that have undergone financial institutions' own debt adjustment, Credit Recovery Committee debt adjustment, or court rehabilitation.

In particular, debtors can request debt collectors not to contact them during specific time periods or through specific means. Debtors can limit collection contacts to designated time slots within 28 hours per week and specify up to two methods such as visits to a specific address, calls to a specific phone number, text messages to a specific phone number, emails to a specific email address, or faxes to a specific fax number. A Financial Services Commission official said, "This is expected to prevent collection contacts from interfering with daily life and preserve the debtor's normal life."

Meanwhile, the Financial Services Commission plans to treat the next 3 months as a grace period but will impose sanctions on acts that seriously undermine the law's purpose. This includes cases of intentional or gross negligence violations, significant financial losses to individual financial debtors, or serious disruption of market order caused by violations. Sanctions will also apply if supervisory agencies request correction of violations of the Personal Debtor Protection Act and such corrections are not made.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.