Hana Financial Research Institute forecasted South Korea's GDP growth rate for next year at 2.1%. Although export growth is expected to continue, the pace is anticipated to slow due to factors such as the US-China trade conflict. The financial market is expected to see a continued adjustment in the pace of interest rate cuts due to the Bank of Korea's accommodative monetary policy, and the housing market is predicted to favor the preference for a "smart single home" centered on actual demand due to a decrease in housing supply.

Hana Financial Research Institute announced on the 16th that it published the '2025 Economy and Financial Market' report containing these details. The forecast of 2.1% matches those of the Korea Development Institute (KDI) and the Bank of Korea, and is slightly lower than that of the Hyundai Research Institute (2.2%). Among international organizations, the Organisation for Economic Co-operation and Development (OECD) forecasted 2.2%, and the Asian Development Bank (ADB) forecasted 2.3%.

Hana Financial Research Institute cited domestic demand recovery as the reason for forecasting South Korea's GDP growth rate at 2.1% next year. It analyzed that private consumption and facility investment growth rates will improve to 2.0% and 4.1%, respectively, compared to this year, driving GDP growth. It is expected that real purchasing power of households will improve due to falling interest rates and easing inflationary pressures, reviving consumer sentiment. In particular, the decline in international oil prices and stabilization of the won-dollar exchange rate are expected to improve financing conditions and positively impact the expansion of facility investment.

On the other hand, construction investment is expected to continue its negative growth following this year as the adverse effects of decreases in leading indicators such as groundbreaking and permits become more pronounced. It is analyzed that it will be difficult to expect fiscal effects from the government due to the reduction of the SOC (social overhead capital) budget in 2025.

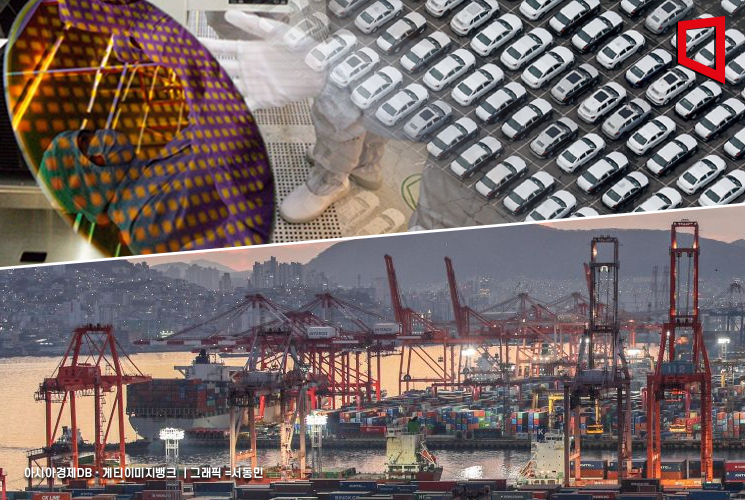

Exports are expected to continue growing mainly in IT (information technology), but the growth rate is likely to slow. Hana Financial Research Institute predicted that customs-cleared exports will increase by 4.9% next year, but external risks such as global economic slowdown and US-China trade conflicts are expected to burden exports. The current account balance is expected to be similar to this year’s level, and consumer prices are forecasted to rise by an average of 2.0% annually, aligning with the Bank of Korea’s target. The decline in international oil prices and exchange rate stability are expected to reduce inflationary pressures, leading to a stable trend in expected inflation.

Hana Financial Research Institute views next year’s economic outlook as generally positive but acknowledges that uncertainties still remain.

Research Fellow Jeong Yutak warned, "If the US-China trade dispute intensifies or instability in the global financial market expands, it could severely damage South Korea’s exports," adding, "Domestically, uncertainties in household debt and the real estate market pose risks that could weaken domestic demand."

Financial market conditions next year are expected to improve due to the Bank of Korea’s accommodative monetary policy. However, it is analyzed that the Bank of Korea will likely limit interest rate cuts to two or three times, fewer than the US Federal Reserve (Fed), due to financial stability concerns. Market interest rates (average 3-year government bond yield) are expected to fall from 3.12% this year to 2.57% next year.

Senior Research Fellow Kim Wanjung predicted, "Since the entire maturity spectrum of government bonds already reflects three interest rate cuts, the future decline in market interest rates will be limited."

The won-dollar exchange rate is expected to continue its downward trend (won appreciation) supported by global dollar weakness and a favorable current account balance, reaching an average of 1,295 won in 2025. However, increased overseas investment by residents and the US-China economic slowdown are expected to slow the pace of won appreciation.

Researcher Jin Okhee added, "It is necessary to be cautious about the possibility of increased exchange rate volatility due to remaining external uncertainties such as US-China conflicts and additional unwinding of yen carry trades."

Next year’s housing prices are forecasted to show a moderate upward trend as buying sentiment improves. Although borrowers’ borrowing capacity will shrink due to phased expansion of stress DSR and strengthened household debt management in the financial sector, concerns over supply shortages are expected to drive price increases. Additionally, with regulations on multi-homeowners maintained and unsold units increasing in provincial areas, the preference for so-called "smart single homes" is expected to expand mainly in the Seoul metropolitan area, where price expectations are high.

Chief Researcher Ha Seojin stated, "In the Seoul metropolitan area, where both actual demand and investment demand are abundant, apartment supply has already decreased, so the perceived supply reduction by buyers will be even greater," adding, "Even if the base interest rate cut begins, it is necessary to monitor whether mortgage loan interest rates fall and buyers’ real borrowing capacity increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)