FCP Proposes Acquisition Price of 1.9 Trillion

Hong Kong Securities Firm Says "Pressure to List Ginseng Business

... KT&G Can Just Ignore It"

Activist fund Flashlight Capital Partners (FCP) has announced plans to acquire Korea Ginseng Corporation, a ginseng business subsidiary of KT&G, for 1.9 trillion won. However, the investment banking (IB) industry is analyzing that the likelihood of this deal materializing is low. The purpose of the proposal is not the acquisition itself but rather profit realization through a separate listing.

According to the IB industry on the 16th, Hong Kong-based investment firm CLSA stated in a report on KT&G on the 14th, "There is no obligation to respond to the acquisition proposal, and the possibility of acceptance is low," adding, "Since FCP has proposed to acquire Korea Ginseng Corporation, which is not even listed and has no plans for sale, the likelihood of the deal is considered very low."

"Doubts about the sincerity of the acquisition purpose... Likely a pressure tactic for Korea Ginseng Corporation's 'listing'"

Within the industry, the prevailing view is that the purpose of this acquisition proposal is to pressure Korea Ginseng Corporation into going public. FCP has argued since 2022 that "Korea Ginseng Corporation, as a 100% subsidiary under a tobacco company, has its value not reflected at all in the stock price," and has proposed to spin off Korea Ginseng Corporation for separate listing to grow it into a global company. Korea Ginseng Corporation is a 100% subsidiary established separately from the ginseng business division spun off by KT&G, which was privatized in 2002, originally in 1999.

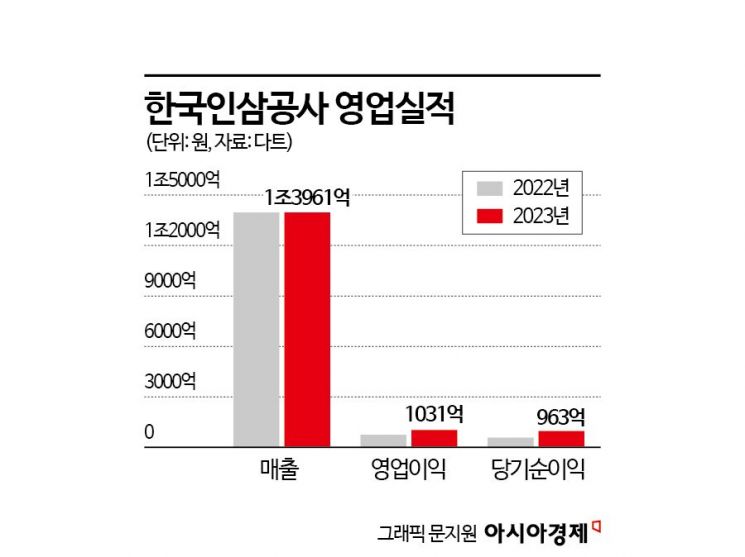

The CLSA report states, "FCP has proposed to acquire 100% of Korea Ginseng Corporation shares held by KT&G for about 1.9 trillion won, but it is uncertain whether they have sufficient capital to pay or the sincerity to acquire," it pointed out. FCP's proposed price is 150% of the 1.2 to 1.3 trillion won valuation based on the EBITDA multiple of 7 to 8 times estimated by analysts at last year's Investor Day. FCP's stake in KT&G is known to be around 0.5%.

An industry insider said, "(FCP) used mocking or critical expressions such as 'They don't have the ability to grow it but are reluctant to give it away,' and 'If they oppose blindly, the board is merely a rubber stamp for management, not shareholders,' provoking the other side," adding, "This proposal itself revealed that it is not intended for an actual acquisition."

On the same day, most securities industry reports on KT&G focused more on core business growth and shareholder return plans than on FCP's proposal. Eunji Kang, a researcher at Korea Investment & Securities, said, "KT&G's core tobacco business performance is improving, and shareholder returns are being actively implemented," adding, "The sector has high investment attractiveness."

KT&G draws a line on FCP's proposal... "Korea Ginseng Corporation is one of the company's three core businesses"

KT&G also issued a statement saying, "FCP unilaterally disclosed the acquisition proposal for Korea Ginseng Corporation without prior discussion." KT&G stated, "The health functional food business of Korea Ginseng Corporation, along with NGP (heated tobacco products) and Global CC (overseas heated tobacco), was announced last year as part of KT&G's mid-to-long-term future plan to nurture three core businesses. We will do our best to achieve these goals," drawing a clear line against FCP's proposal.

The stock price movement has also been calm. On the day of the acquisition proposal, KT&G's stock closed at 107,300 won, up 4.99% from the previous trading day, but on the 15th, it closed at 105,300 won, down 1.86% from that. The largest increase was on the 10th, when KT&G announced the completion of its share buyback for shareholder return purposes, with a 12.95% rise.

Another notable point is the court's low likelihood judgment on the possibility of a spin-off of Korea Ginseng Corporation. Ahead of last year's KT&G shareholders' meeting, FCP filed an injunction with the court requesting to include "the matter of the spin-off of the ginseng business division" on the agenda. At that time, the Daejeon District Court ruled, "It is an agenda that violates the law or is impossible for the company to realize," and "The company's refusal to include it on the shareholders' meeting agenda is justified."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)