'Samsung Bio with Quarterly Sales of 1 Trillion'

Celltrion Expects Record Performance with 'Jimpentra'

Yuhan's 'Reclaza' and Green Cross's 'Aliglo' Also Target US Market

Large Tech Exports Anticipated Ahead of Year-End Holidays

The pharmaceutical and bio industries continue their streak of strong performance, driven by sustained investment and the resulting achievements. In particular, companies that have launched new drugs overseas are recording record-breaking results as actual sales begin to be reflected.

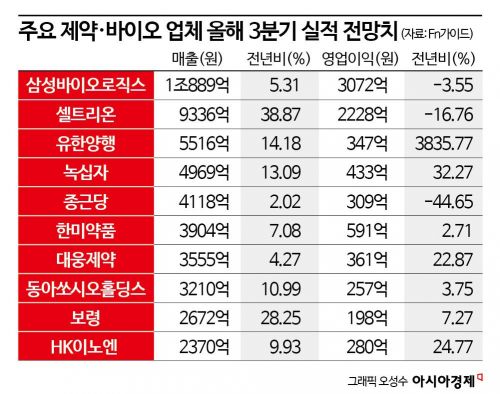

Major domestic pharmaceutical and bio companies plan to announce their earnings one after another, starting with Samsung Biologics' Q3 earnings disclosure on the 23rd. Samsung Biologics, which recorded annual sales of 4 trillion KRW last year, is understood to have surpassed 1 trillion KRW in sales for two consecutive quarters following 1.1569 trillion KRW in Q2. According to FnGuide, the securities industry forecasts sales of 1.0889 trillion KRW, a 5.31% increase compared to the same period last year. The sustained strength of the dollar and the beginning of a reflection effect due to the U.S. push for the Biosecurity Act are contributing to further improvements in performance.

Celltrion is estimated to achieve record quarterly sales of 933.6 billion KRW. With the completion of accounting improvements following the merger with Celltrion Healthcare earlier this year, operating profit is also expected to rebound. The core of Celltrion's profit improvement is the autoimmune disease treatment new drug Jimpendra, launched in the U.S. last March. It has kickstarted market entry by signing contracts with all three major PBMs (Pharmacy Benefit Managers), which dominate about 80% of the PBM market, a gateway to the U.S. market. This sales are estimated to be fully reflected from Q3, leading to improved performance. Earlier, Chairman Seo Jung-jin confidently stated about Jimpendra, "It can generate annual sales of up to 3 trillion KRW within three years," adding, "Even conservatively, it could reach 5 trillion KRW."

Traditional pharmaceutical companies also seem to be seeing the fruits of their overseas expansion efforts. Yuhan Corporation is expected to record its highest-ever quarterly sales with 551.6 billion KRW in sales and 34.7 billion KRW in operating profit in Q3. The lung cancer treatment new drug Lekraza contributed significantly. Yuhan Corporation had licensed Lekraza to Johnson & Johnson (J&J), and recently announced that it will receive a technology fee of 60 million USD (about 80 billion KRW) as commercialization of the drug has begun.

Lekraza entered the U.S. market in combination therapy with J&J's bispecific antibody treatment Livrivant. It received approval from the U.S. Food and Drug Administration (FDA) in August and has recently been administered to patients. The U.S. price of Lekraza is 216,000 USD per year (about 300 million KRW), higher than the competitor Tagrisso's 204,000 USD (about 270 million KRW). An industry insider explained, "The U.S. market does not automatically assign high prices to new drugs," adding, "We initially expected a lower price than the competitor, but the higher price is interpreted as a positive sign."

GC Green Cross, which suffered poor performance as the special demand for vaccines and diagnostic kits during COVID-19 disappeared, is believed to have rebounded by launching the blood product Aliglo in the U.S. Aliglo received FDA approval in December last year and began patient administration in August. Aliglo also succeeded in contracts with major PBMs and insurers, securing 80% patient coverage in the private insurance market. Dalmi Lee, a researcher at BNK Investment & Securities, analyzed, "Since July, Aliglo sales have started in earnest, with about 20 billion KRW expected in Q3," adding, "Due to excellent product quality, it has higher prices and margins compared to competing products, so sales are expected to increase significantly in Q4."

The industry expects this performance improvement to continue into Q4. An industry insider said, "Since most of the Q3 performance improvement came from the growth of products whose overseas sales have begun in earnest, growth is expected to continue," adding, "Year-end is a time when global big pharma companies acquire good pipelines ahead of major IR events, so technology export effects are also anticipated." In fact, on the 10th, Rigachem Bio signed a contract to export antibody-drug conjugate (ADC) candidate substances and platform technology to Ono Pharmaceutical in Japan. The candidate substance LCB97 was contracted for up to 700 million USD (about 943.5 billion KRW), while the contract scale for platform technology was not disclosed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)