With the implementation of the 'Retirement Pension Switching' system starting on the 15th, competition among financial institutions to attract nearly 400 trillion won in 'money moves' is intensifying. Banks, which have already secured a leading position in the market, are striving to retain their customers, while securities firms view the expanding retirement pension market as a new growth opportunity and are engaging in aggressive marketing. The retirement pension market is expected to grow to about 450 trillion won by 2030, prompting the financial sector to stake everything on capturing this market.

According to the financial sector on the 10th, ahead of the implementation of the 'Retirement Pension Switching (Retirement Pension Physical Transfer System),' financial companies have internally established task forces (TF) to focus all efforts on expanding product lineups and marketing. The 'Retirement Pension Switching' system allows subscribers to change the financial institution managing their retirement pension without incurring losses during the cancellation process and without changing the products themselves. Previously, switching financial institutions required selling all held products and transferring cash, which could result in losses or the inconvenience of waiting until maturity to transfer. Now, it is possible to change the managing institution without such inconveniences. In other words, it will be possible to switch retirement pension managers from securities firms to banks, or from banks to insurance companies.

In particular, banks, which have secured a leading position in this market, are preparing to 'defend their home turf' by expanding their product lineups. They are broadening their offerings across various product groups, including retirement pension deposit products, funds, and exchange-traded funds (ETFs). KB Kookmin Bank plans to increase its deposit products from 830 to 890 and ETFs from 68 to 101. Shinhan Bank has strengthened its retirement pension operation funds from 358 to 413 and ETFs from 131 to 177, expanding customer choices. Hana Bank and Woori Bank will add 13 and 15 ETFs respectively. NH Nonghyup Bank is also considering increasing its ETF lineup by more than 10 by the end of the year and is aggressively expanding products by adding principal-guaranteed products.

In addition to expanding product lineups, banks are also focusing on system reorganization, such as strengthening non-face-to-face platforms. Shinhan Bank is developing a robo-advisor service to enable customers to easily use the retirement pension switching service remotely, while Woori Bank established a Pension Direct Marketing Team in July. Marketing efforts to attract customers are also fierce. Kookmin Bank has launched a '1:1 asset management consultation service' and holds pension-related seminars, while Hana Bank has expanded its pension specialized management service called 'Pension The Dream Lounge.' They are also steadily securing pension-related professionals.

The reason banks are fighting desperately to defend the retirement pension market is the concern over customer outflow to securities firms. Although banks hold more than half of the retirement pension assets, securities firms have the highest returns across the financial sector. In the case of ETFs, bank pension accounts can trade 100 to 170 ETFs, but securities firms allow investment in up to 700 ETFs. Moreover, securities firm pension accounts enable real-time ETF trading like stocks, whereas banks only allow pre-ordered trades such as reserved trading, which is considered a limitation.

According to the Financial Supervisory Service, as of 2023, banks hold a majority share of 51.8% of retirement pension assets, followed by securities firms at 22.6%, life insurance companies at 20.5%, and non-life insurance companies at 3.9%. However, looking at the average returns of retirement pension products by financial sector over the past five years, securities firms recorded 2.9%, followed by life insurance companies at 2.3%, and banks at 2.2%. As of last year, securities firms' returns were 7.11%, while banks' were 4.87%.

The securities industry also views the retirement pension market as a new growth area and is engaging in aggressive marketing by emphasizing higher returns compared to banks. Mirae Asset Securities is launching an AI-based robo-advisor discretionary service in earnest. Mirae Asset Securities is also participating in the 'Blue Seed' retirement pension fund system project targeting workers at small and medium-sized enterprises with fewer than 30 employees. Hanwha Investment & Securities has reorganized its existing pension sales and strategy teams into a pension headquarters, focusing on product development. As a result, its managed assets reportedly increased by nearly 40% in one year. Korea Investment & Securities, Samsung Securities, NH Investment & Securities, and others are also strengthening robo-advisor investment services and deploying specialized personnel as part of internal restructuring to capture the retirement pension market.

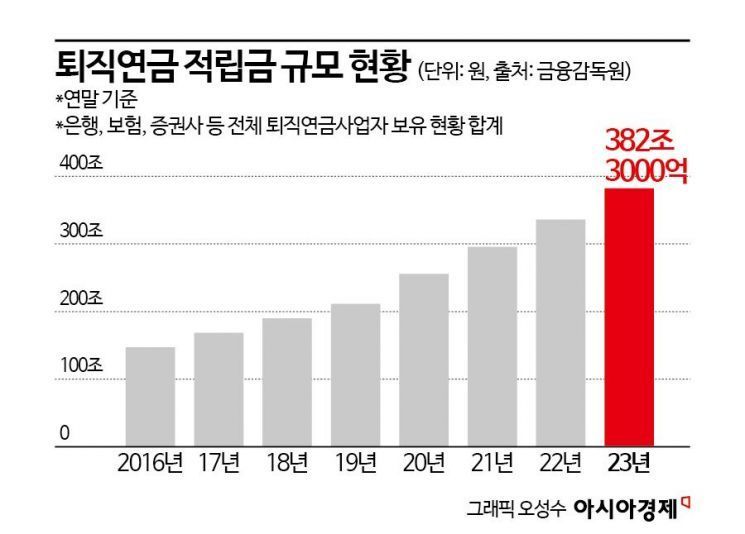

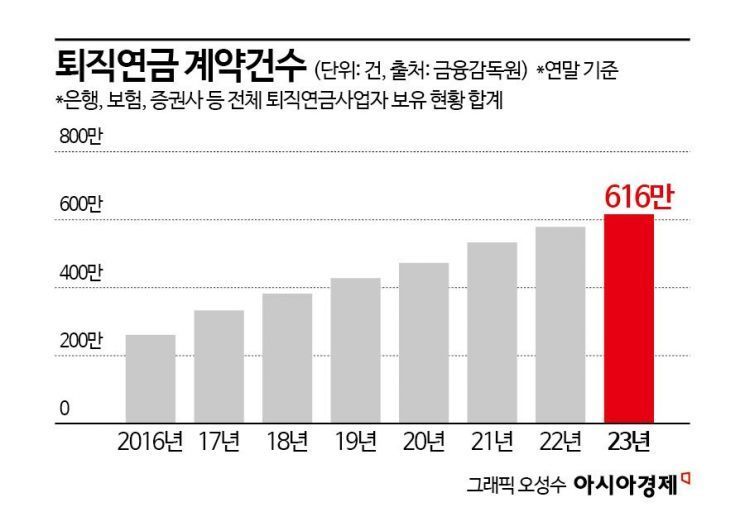

The retirement pension market has grown rapidly, from 147 trillion won in 2016 to 382 trillion won last year, and is expected to reach 445 trillion won by 2030.

Choi Jaewon, a researcher at Kiwoom Securities, said, "Korea's retirement pension reserves reached 382 trillion won last year, recording an average annual growth rate of 15%, continuing rapid growth. With institutional improvements and the emergence of various asset allocation products, competition in the domestic retirement pension market is expected to intensify."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)