Assuming Automatic Adjustment Device Operates in 2036

Benefit Amount for Those Born in 1971 Decreases from 384.36 Million Won to 311.62 Million Won

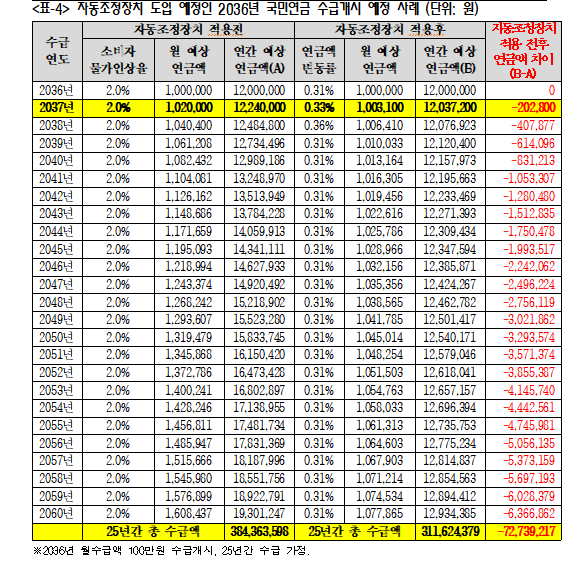

Concerns have been raised that the introduction of the government's automatic adjustment mechanism for the National Pension could reduce lifetime pension benefits by more than 70 million KRW compared to the current system.

According to data received by Assemblyman Kim Seon-min of the Innovation Party from the Ministry of Health and Welfare on the 6th, calculations based on the government's automatic adjustment mechanism scenario show that pension benefits for all representative age groups from their 20s to 50s would be cut by over 70 million KRW.

The current National Pension system is designed to adjust pension amounts according to the previous year's consumer price index changes, ensuring that pension amounts rise at least in line with inflation. The automatic adjustment mechanism, which the Ministry of Health and Welfare plans to introduce as part of pension reform, primarily adjusts the insurance premium rates (the "money paid"), pension amounts received, and eligibility age automatically based on demographic and economic conditions. The government's formula for pension amount increase rate adds the three-year average subscriber growth rate and the increase rate of life expectancy, then subtracts this sum from the consumer price index change rate.

Based on the 5th National Pension financial projection results, the Ministry prepared the "Annual Application Indicators upon Introduction of the Automatic Adjustment Mechanism," setting the annual consumer price inflation rate at the stabilization target of 2.00% and the average increase rate of life expectancy at age 65 at 0.36%, according to Statistics Korea's future population projections. Including the three-year average subscriber decrease rate to calculate the final pension increase rate, the results show that the increase rate falls below the lower limit starting in 2040, repeatedly showing negative values, and only rises above the lower limit to 0.34% in 2081.

Assemblyman Kim's office stated that calculating lifetime pension benefits under this scenario results in all individuals in their 20s to 50s receiving over 70 million KRW less in benefits. Assuming the automatic adjustment mechanism activates in 2036 (when pension expenditures exceed insurance premium income), a beneficiary born in 1971 who receives a monthly pension of 1 million KRW at age 65 and collects pension for 25 years until 2060 would see their total pension amount reduced by 72.73 million KRW (from 384.36 million KRW under the current system to 311.62 million KRW).

Using the same method, the expected 25-year pension benefits for a 20-year-old born in 1996, a 30-year-old born in 1986, and a 40-year-old born in 1976 were calculated. The reductions after applying the automatic adjustment mechanism are estimated at 72.5 million KRW for the 1996-born, and 72.93 million KRW each for the 1986-born and 1976-born. Assemblyman Kim Seon-min emphasized, "During parliamentary discussions on pension reform, the necessity of introducing the automatic adjustment mechanism, which is effectively an 'automatic reduction device,' must be thoroughly scrutinized."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)