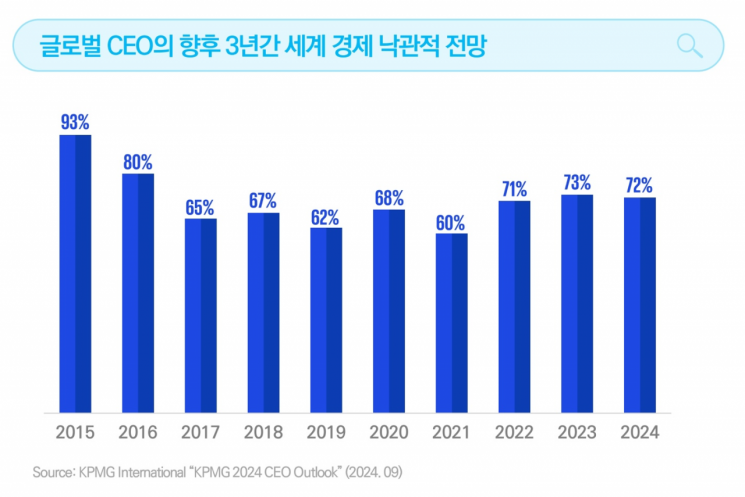

72% of CEOs Expect Global Economy to Be 'Positive' Over Next 3 Years

92% of CEOs Plan to Expand Employment... Largest Since 2020

CEOs (Chief Executive Officers) worldwide are intensively investing in AI (Artificial Intelligence) as a strategy to overcome global uncertainties. According to global accounting and consulting firm KPMG on the 7th, a recent survey of over 1,300 CEOs revealed these findings.

According to the survey, 64% of global CEOs said they would invest in AI regardless of the economic situation. The main benefits of AI adoption included ▲improved efficiency and productivity ▲upskilling of the workforce ▲organizational innovation.

61% of CEOs identified ethical issues as the most difficult challenge to resolve during AI adoption, while insufficient regulation (50%) and lack of technical capabilities (48%) were also cited as major concerns. Although 76% of CEOs believed AI would not fundamentally affect the number of jobs in their organizations, only 38% responded that their employees had sufficient capabilities to utilize AI effectively.

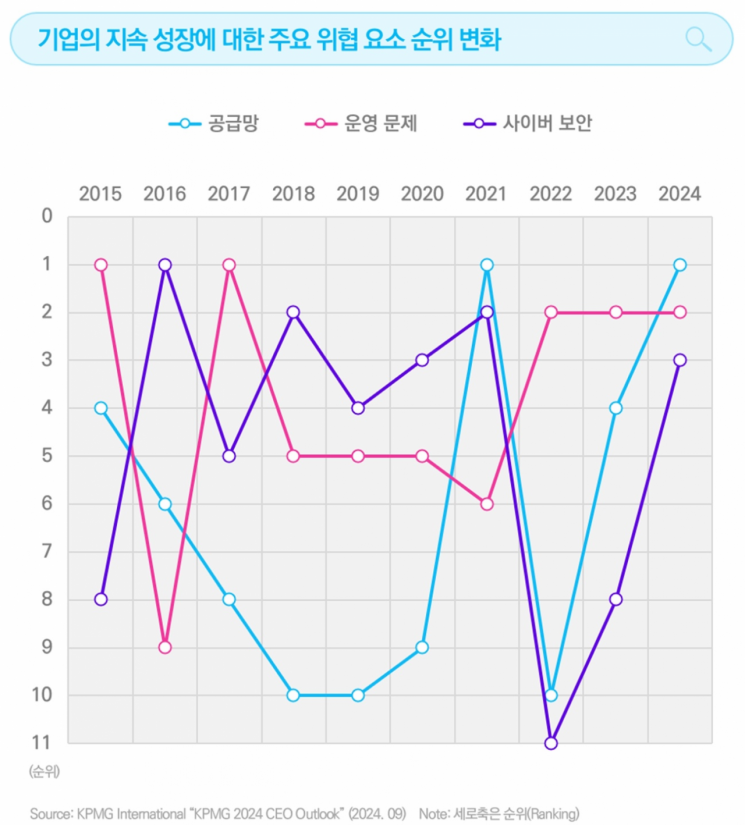

72% of CEOs expressed optimism about global economic growth over the next three years. This confidence in economic growth was also reflected in employment plans. 92% of CEOs planned to increase their workforce over the next three years, the highest rate since 2020. The top threats to sustainable corporate growth were identified as ▲supply chain risks ▲operational issues ▲cybersecurity problems.

CEOs also focused on talent issues that could hinder future growth. About 31% expressed concerns about labor market changes, including employees nearing retirement and the shortage of skilled replacements. In response, 80% of CEOs said companies must invest in skill development and lifelong learning within local communities to secure talent in the future.

While environmental risks were the lowest priority for CEOs in 2015, this year 24% recognized the risk of losing competitive advantage if they fail to meet stakeholders’ ESG (Environmental, Social, and Governance) expectations. 76% responded that they would be willing to divest profitable business units if they negatively impacted the company’s ESG aspects. 68% said they would take a stance on politically or socially controversial issues even if opposed by the board of directors.

Bill Thomas, Chairman of KPMG, stated, “Over the past decade, CEOs have faced rapidly changing market environments including the global pandemic, inflation, and the rise of AI, showing strong determination to invest in the future. In times of uncertainty, leaders must have faster resilience and innovative strategies more than ever, and by investing in technology and talent, they must get on a sustainable growth trajectory.”

Now in its 10th year, the “2024 Global CEO Outlook (KPMG 2024 CEO Outlook)” surveyed global executives’ outlook on corporate and economic growth over the next three years, along with business strategies. One-third of the surveyed companies have annual revenues exceeding $10 billion (approximately 13 trillion KRW). CEOs from 11 major markets (United States, United Kingdom, Germany, France, China, Japan, Spain, Italy, India, Canada, Australia) and 11 key industry sectors (banking, insurance, asset management, automotive, energy, infrastructure, technology, telecommunications, consumer goods & retail, life sciences, manufacturing) participated.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)