Criticism Grows Over Commission Increase

More Store Owners and Users Leaving

'Differentiated Commission' Proposal Presented to Win-Win Council

Baedal Minjok (Baemin), the number one delivery app company, is cornered to the extent of considering a differentiated commission rate as low as 2%. This is due to the backlash that has not subsided since it raised its own delivery commission rate to 9.8% last August. As more merchants and users leave, the crisis has become apparent. Conflicts have erupted in the franchise industry with the introduction of a ‘dual pricing system,’ and to make matters worse, while Baemin is under intense pressure, Coupang Eats, ranked second, is rapidly increasing its user base despite applying the same commission rate, posing a threat.

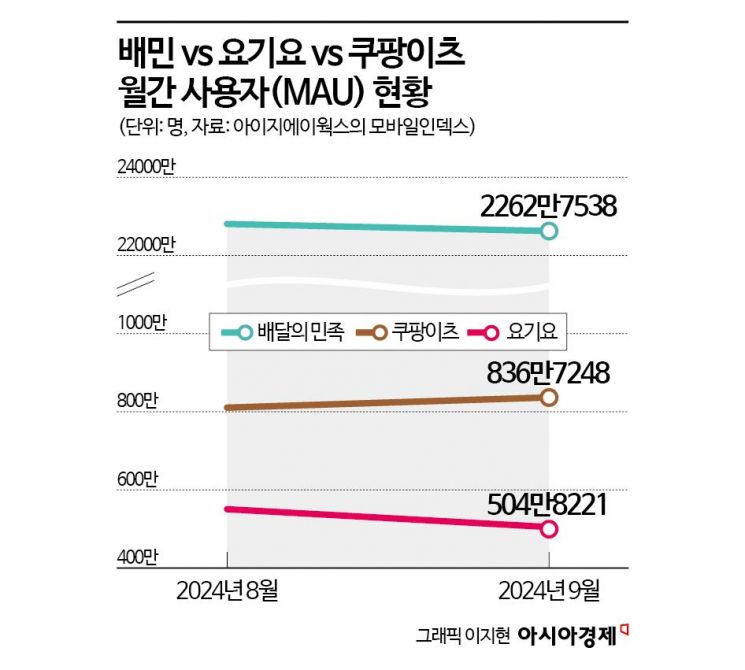

According to Mobile Index by data company IGAWorks on the 7th, last month Baemin, Coupang Eats, and Yogiyo recorded monthly active users (MAU) of 22.63 million, 8.37 million, and 5.05 million respectively. Compared to the previous month, Baemin and Yogiyo saw a decrease in users, while Coupang Eats alone increased. Baemin lost 0.8% of its users, and Yogiyo lost 8.3%. Coupang Eats grew by 3.2%. Compared to March, when Coupang Eats launched its free delivery service, the user base increased by 2.11 million. Notably, last month marked a turning point in the free delivery subscription battle against Baemin, as Baemin’s subscription product ‘Baemin Club’ became paid starting from the 11th. It is said that Coupang Eats succeeded in gaining the upper hand in this competition.

Industry insiders believe that unlike Coupang Eats, which offers free delivery service to existing Coupang Wow Membership members, Baemin requires users to subscribe and register a payment method to receive free delivery benefits, which may have been perceived as a barrier by users. Negative public opinion was also influenced by backlash from merchants against Baemin’s commission increase. Self-employed organizations such as the National Franchise Store Owners Association, the National Merchants Federation, and the Korea Franchise Industry Association reported Baemin to the Fair Trade Commission, accusing it of raising commissions without justifiable reasons by abusing its monopoly position. Franchise companies pointed out that the reason for charging higher prices for delivery food than in-store prices was due to Baemin’s commission increase.

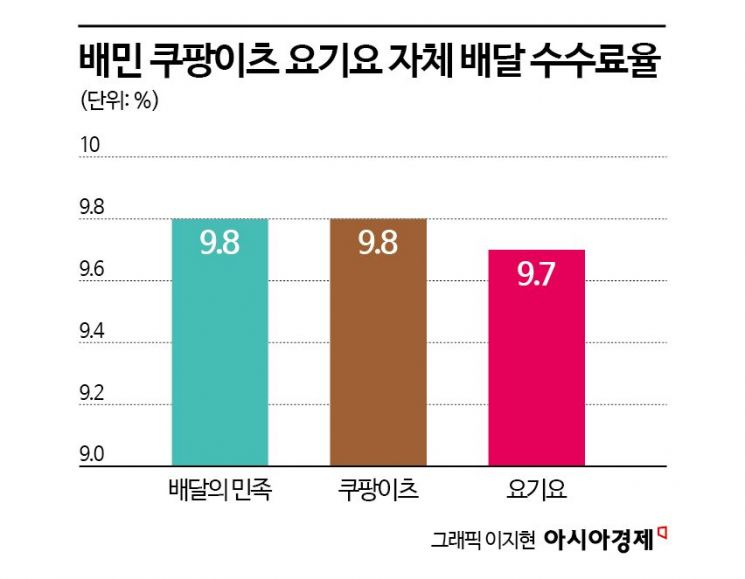

Baemin’s own delivery commission rate is 9.8%, the same as Coupang Eats. It had been applying 6.8%, but as competition intensified, it decided to charge the same commission as Coupang Eats from August, citing that the market had accepted the rate. Yogiyo lowered its commission from 12.5% to 9.7% in the same month. Although the three companies have almost no difference in their own delivery commissions, criticism is directed at Baemin because it is the number one company and recently raised its commission by 3 percentage points. The recent increase in merchants switching from Baemin to Coupang Eats also seems to be influenced by this negative public opinion. According to Mobile Index, the number of users of ‘Baemin Sajangnim,’ an app exclusively for merchants, was 310,000 last month, down 2.5% from the previous month. On the other hand, the number of users of ‘Coupang Eats Store,’ used by Coupang Eats merchants, continued to increase, reaching a record high of 190,000.

Ultimately, Baemin recently submitted a win-win plan including commission reduction measures to the ‘Delivery Platform-Merchant Win-Win Council.’ The plan classifies merchants by delivery sales within the app and applies lower commission rates to lower-tier businesses with lower sales. Baemin is considering lowering the commission rate to as low as the 2% range through this method. An industry insider said, "Merchants who depended on Baemin, which holds a market share of 60%, have recently expressed feelings of betrayal amid various controversies," adding, "It remains to be seen whether Baemin’s win-win plan can reverse the current situation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)