Fair Trade Commission Publishes Status of Debt Guarantees by Collusive Groups

It has been revealed that inter-affiliate debt guarantees within large business groups increased by more than 35% compared to a year ago. Meanwhile, the scale of total return swap (TRS) transactions, which are used as a means to circumvent debt guarantees, decreased by 16%.

On the 6th, the Korea Fair Trade Commission (KFTC) disclosed the results of an analysis on the status of debt guarantees and the exercise of voting rights by financial and insurance companies within 48 mutual investment restriction business groups (hereinafter referred to as 상출집단) in 2024.

Under the current Fair Trade Act, mutual investment restriction business groups with total assets exceeding 0.5% of nominal gross domestic product (GDP) (KRW 10.4 trillion) are restricted from providing debt guarantees among affiliates. In accordance with the principle of separation between finance and industry, the exercise of voting rights by financial and insurance companies belonging to restricted groups over their affiliates is also limited.

According to the KFTC, as of May 14 this year, the total amount of debt guarantees by these 상출집단 was KRW 569.5 billion across 5 groups. This represents an increase of KRW 149 billion (35.4%) compared to KRW 420.5 billion across 9 groups last year.

Among these, the amount of restricted debt guarantees was KRW 442.8 billion held by two groups, Ecopro (KRW 242.8 billion) and Shinsegae (KRW 200 billion). Groups such as SK, Junghung Construction, Coupang, Janggeum Shipping, Taeyoung, SeAH, and E-Land, which held KRW 263.6 billion in restricted debt guarantees last year, have all resolved them.

Debt guarantees are generally prohibited under the Fair Trade Act, but if a group is newly designated or incorporated as a large business group, the restricted debt guarantees are classified as such and given a two-year grace period for resolution.

Additionally, debt guarantees excluded from restrictions, which the government exceptionally permits in relation to social overhead capital (SOC) and overseas construction, amounted to KRW 126.7 billion across 3 groups. This is a decrease of KRW 30.2 billion (19.2%) compared to last year due to partial resolution of existing group debt guarantees without new occurrences.

Jung Reum, Director of the Corporate Group Management Division at the KFTC, explained, "Since the beginning of this year, with Ecopro and others newly incorporated into the 상출집단, an additional KRW 110.7 billion in debt guarantees was added, and among the 46 groups continuously designated as 상출집단 since last year, there was a net increase of KRW 38.3 billion."

The government introduced the debt guarantee prohibition system in 1998 to eliminate unreasonable guarantee practices by large business groups. Except for the years 2011, 2015, 2021, and this year, when the scale of debt guarantees increased due to new groups entering the 상출집단, the overall trend has been a decrease.

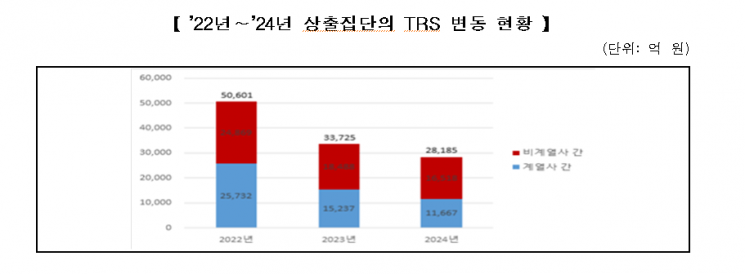

The scale of total return swap (TRS) transactions, which have similar effects to debt guarantees and are used as a circumvention method, was recorded at 40 cases totaling KRW 2.8185 trillion. This is a decrease of KRW 554 billion (16.4%) compared to KRW 3.3725 trillion last year. The newly contracted amount (KRW 32.8 billion) was minimal, while many transactions ended contracts (KRW 586.8 billion). The scale of TRS transactions has been shrinking, showing a 44.3% decrease compared to the first survey in 2022 (KRW 5.0601 trillion).

Director Jung stated, "The decrease in TRS transaction scale is due to contract expirations amounting to KRW 386.8 billion and early settlements before maturity amounting to KRW 200 billion, confirming that these are due to contract terminations."

Over the past five years, the number of non-financial affiliates invested in by financial and insurance companies belonging to 상출집단 slightly increased from 38 in 2020 to 44 this year, but the investment amount in non-financial affiliates decreased from KRW 420 billion to KRW 310 billion during the same period.

Reviewing the exercise of voting rights by financial and insurance companies in 18 상출집단 that invested in non-financial affiliates over the past two years, it was found that 16 financial and insurance companies belonging to 9 groups exercised voting rights 247 times at shareholders' meetings of 22 non-financial affiliates.

The KFTC stated, "We will regularly monitor and disclose the status of debt guarantees by 상출집단 and the exercise of voting rights by financial and insurance companies to prevent credit concentration and joint insolvency within business groups, and continuously monitor to ensure that customer funds of financial and insurance companies are not used for unfair maintenance or strengthening of control."

It added, "To block attempts to evade debt guarantee prohibition regulations by effectively using derivatives such as TRS as a means of debt guarantees, we plan to specify illegal acts and establish effective regulatory measures."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)