Housing Market Shows Rising Prices in Seoul Metropolitan Area Until July

Regional Unsold Units Remain High, Highlighting Polarization

Construction Market Leading Indicators Improve in Q3

But Building Decline Continues and Public Construction Expected to Decrease in Second Half

In the fourth quarter of this year, the housing market is expected to continue its polarization between the metropolitan area and non-metropolitan areas, as well as unsold housing units. The construction market is anticipated to see a negative turn in construction investment in the fourth quarter due to sluggishness in the private and building sectors.

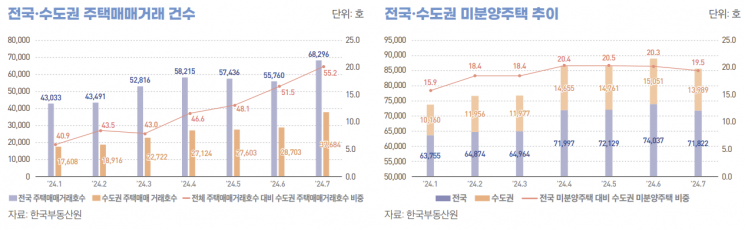

On the 3rd, the Construction Policy Research Institute announced in its report "3rd Quarter Construction Market Trends and Outlook" that the number of housing sales transactions as of July was 68,296 households, a 22.5% increase compared to the previous month. Among these, the proportion of housing transactions in the metropolitan area reached 55.2% (37,684 households).

Housing Sales Transactions and Unsold Housing Trends in Q3 (Data from the Construction Policy Research Institute)

Housing Sales Transactions and Unsold Housing Trends in Q3 (Data from the Construction Policy Research Institute)

Increase in Metropolitan Area Sales Transactions Share and Decrease in Unsold Housing Share

The share of metropolitan area sales transactions relative to total housing sales volume has been steadily increasing since January (40.9%), and the demand concentration in the metropolitan area is expected to continue through the second half of the year.

The number of unsold houses as of July was 71,822 households, slightly down from June (74,037 households). The proportion of unsold houses in the metropolitan area relative to the national total is gradually decreasing to 19.5%.

The Construction Policy Research Institute notes that in local areas, demand conditions are unlikely to improve in the short term, so the risk of unsold housing is expected to persist.

The housing market in the third quarter also showed a strong upward trend in sales prices in the metropolitan area. As of July, the apartment sales price index in the metropolitan area rose 0.5% compared to the previous month, with Seoul increasing by 1.2%, indicating a continued rise centered on the metropolitan area.

Due to the rise in the metropolitan area, the national apartment price index also increased by 0.2% in July. In contrast, the sales price index in local areas fell by 0.2% compared to the previous month, deepening the price polarization between the metropolitan and non-metropolitan areas.

Construction Investment Turns Negative in the Fourth Quarter

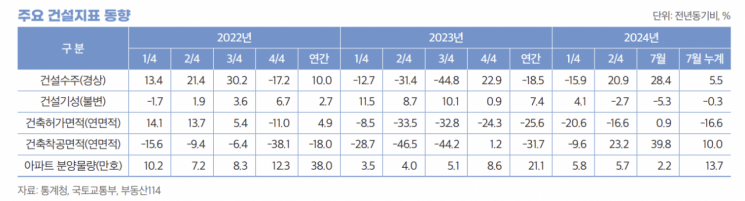

In the third quarter construction market, leading indicators such as orders, building permits, and building starts improved, but the coincident indicator, construction performance, recorded a decline.

Construction orders in the third quarter increased by 28.4% year-on-year as of July, with a cumulative increase of 5.5% up to July. Building permit area decreased by about 20% year-on-year until the first half of the year but rebounded by 0.9% in July.

Building start area decreased by 9.6% year-on-year in the first quarter but showed continuous recovery, increasing by 39.8% in July, resulting in a cumulative increase of 10%. The coincident indicator, construction performance, increased by 4.1% in the first quarter but turned to a declining trend in the second quarter, with a cumulative decrease of 0.3%.

The Construction Policy Research Institute explained, "The previously sluggish leading indicators recovered due to the base effect from the previous year, but the relatively better coincident indicators turned downward due to the lag effect of accumulated leading indicator sluggishness."

The construction market in the fourth quarter is expected to follow a similar trend to the third quarter, but with weak coincident indicators, construction investment is likely to turn negative.

This year, the construction market shows a favorable trend in public and civil engineering volumes due to the government's early fiscal execution, but private and building volumes remain sluggish. Based on coincident indicators such as construction performance, the Construction Policy Research Institute analyzed that the public sector's growth will slow in the fourth quarter, while private sector sluggishness will continue.

As the overall construction economy remains sluggish for a prolonged period, the Bank of Korea's construction business sentiment index, a representative psychological index, recorded its lowest ever at 51.5 this year. The construction business sentiment index averaged 65.1 from 2010 to this year and has been lowest this year (January to August) since recording 57.7 in 2013.

Factors contributing to the contraction of construction business sentiment include △ the burden of construction costs due to rising material prices △ deterioration of accumulated leading indicators △ real estate project financing (PF) crisis and uncertainty. However, the burden of construction costs is expected to gradually ease as the rise in material prices slows down.

The Construction Policy Research Institute stated, "Although it is difficult for leading construction indicators to improve significantly in the short term, there are mid-term factors that can expect a recovery in volume, such as the reconstruction of the first-generation new towns, development of the third-generation new towns, and large-scale SOC projects like new airports." However, "the real estate PF crisis still persists, and the handling of PF default projects is likely to continue at least until the first half of next year, so uncertainty is inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)