Co-founded Youngpoong Enterprises in 1949... Circular Shareholding Maintained

Seorin Corporation's Youngpoong Shares Acquired by Youngpoong 2nd Generation Causing Rift

Korea Zinc 3rd Generation Expands Friendly Shares through Third-Party Paid-in Capital Increase

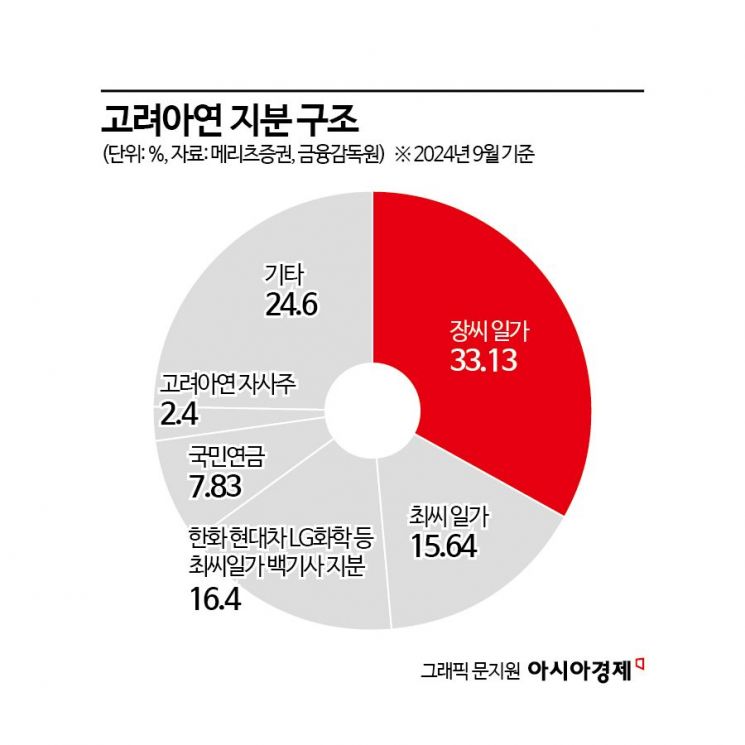

The management dispute triggered by Youngpoong and MBK Partners' declaration of a tender offer to secure shares of Korea Zinc is reaching its peak. If this tender offer is successfully completed, Youngpoong and MBK Partners are expected to control the Korea Zinc board of directors based on the shares they secure. This would signify a complete break from the Jang and Choi families. Conversely, if Korea Zinc successfully defends its management rights, the conflict between the two families is expected to enter a new phase.

The 75-Year Partnership History of the Jang and Choi Families

The partnership between the two families began when the late founders Jang Byeong-hee and Choi Gi-ho jointly established Youngpoong Enterprises, the predecessor of Youngpoong Group, in 1949. Although the business was temporarily halted due to the Korean War six months after its founding, they reestablished the company in Busan, a refuge area. In 1970, they built the Seokpo Smelter in Seokpo-myeon, Bonghwa-gun, Gyeongbuk, and four years later established Korea Zinc as a sister company. The Jang family managed Youngpoong, while the Choi family managed Korea Zinc, maintaining their relationship through mutual shareholding and a circular shareholding structure.

The relationship between the two families continued organically up to the second generation of the co-founders, Jang Hyeong-jin, an advisor at Youngpoong, and Choi Chang-geol, honorary chairman of Korea Zinc. However, cracks began to appear in the relationship between the two companies in 2017 when Youngpoong restructured its governance. At that time, the circular shareholding chain of ‘Korea Zinc → Seorin Corporation → Youngpoong Co., Ltd. → Korea Zinc’ was broken when Advisor Jang directly acquired 10% of Youngpoong shares held by Seorin Corporation. This strengthened the Jang family's control over Youngpoong but relatively reduced the influence of the Choi family. Since then, rumors of Korea Zinc's separation from the group began to circulate.

Youngpoong: "Ignoring the Spirit of Partnership" vs. Korea Zinc: "Environmental Risks"

The conflict surfaced when the third-generation owner, Choi Yoon-beom, chairman of Korea Zinc, took control of management rights. Unlike Youngpoong, which had managed conservatively without borrowing, Chairman Choi aggressively pursued new businesses such as secondary battery materials and renewable energy. He expanded friendly forces by conducting paid-in capital increases with various partners including Hanwha and Hyundai Motor Group, naturally reducing Youngpoong's shareholding ratio.

In 2022, Korea Zinc conducted a third-party paid-in capital increase targeting Hanwha H2 Energy USA, a U.S. affiliate of Hanwha Group, which invested 471.7 billion KRW to acquire a 5% stake in Korea Zinc. Last year, Hyundai Motor's overseas subsidiary HMG Global invested 527.2 billion KRW to secure about 5% of Korea Zinc's total shares. The friendly forces' shares thus increased to 16.4% currently. Kang Sung-doo, president of Youngpoong (Head of Management Support Office), said at a press conference at the end of last month, "We trusted the management representatives through a long partnership of over 70 years and agreed in the board, but as the situation repeated, we thought it necessary to strengthen governance."

Chairman Choi Yoon-beom of Korea Zinc and Advisor Jang Hyung-jin of Young Poong. [Photo by each company]

Chairman Choi Yoon-beom of Korea Zinc and Advisor Jang Hyung-jin of Young Poong. [Photo by each company]

Korea Zinc also struggled with waste disposal from Youngpoong's Seokpo Smelter. During the transportation of sulfuric acid produced at the Seokpo Smelter to Onsan Port, Youngpoong was using some sulfuric acid tanks and pipelines at Korea Zinc's Onsan Smelter for a fee. It is known that Korea Zinc's newly established Sustainability Management Committee in 2021, aimed at strengthening ESG (Environmental, Social, and Governance) management, recommended halting the transaction because if Korea Zinc handled the Seokpo Smelter waste on behalf of Youngpoong, it could pose legal and ESG risks to Korea Zinc. Lee Jae-joong, vice chairman of Korea Zinc, pointed out that "Youngpoong tried to offload hazardous waste stored at the Seokpo Smelter's waste storage site onto Korea Zinc," attributing the cause of the conflict to Youngpoong.

The conflict escalated at Korea Zinc's shareholders' meeting held in March this year. Youngpoong demanded an increase in dividends, while Korea Zinc proposed allowing third-party paid-in capital increases for domestic corporations, leading to heated debates before and after the meeting. As a result, the dividend proposal was maintained as Korea Zinc wished, and the articles of incorporation amendment was concluded as Youngpoong desired, but the conflict was not resolved. Korea Zinc accelerated its independent actions by taking control of the board of directors of Seorin Corporation, an export-specialized affiliate symbolizing the partnership between the two companies, and terminating the sulfuric acid handling agency contract with Youngpoong.

Management Dispute Involving Private Equity Funds

Youngpoong adopted a ‘do-or-die strategy’ to prevent Chairman Choi's independent management, even if it meant giving up management rights. On the 12th of last month, they signed a shareholder agreement with MBK Partners, the largest private equity fund (PEF) in Korea, agreeing to jointly exercise voting rights. MBK Partners thus became the largest shareholder of Korea Zinc alongside Youngpoong. Subsequently, they launched a tender offer for Korea Zinc shares. If the tender offer is successfully completed, MBK Partners will hold the actual management rights of Korea Zinc.

Youngpoong explained the background of the tender offer as "to strengthen the management rights of the largest shareholder." Since Chairman Choi took office, he began actions violating the partnership spirit of Youngpoong Group's co-founders, harming shareholders' interests, which Youngpoong declared it would rectify. Along with the tender offer, Youngpoong filed a provisional injunction to inspect and copy Korea Zinc's accounting books, raising suspicions surrounding Chairman Choi and applying pressure. On the 25th, they filed a complaint with the Seoul Central District Prosecutors' Office accusing Chairman Choi of breach of trust.

Korea Zinc strongly opposed, calling it a hostile takeover. They fiercely criticized the alliance with MBK Partners, backed by Chinese capital, warning that a national key industry might be transferred overseas. They argued that if a private equity fund acquires management rights, it would cause enormous damage to employees, local communities, and stakeholders, and likely engage in arbitrary management contrary to the interests of all shareholders and members to secure investment returns.

Two Trading Days Left Until Tender Offer Ends... What Is the Outcome of the Management Dispute?

Only two trading days remain until the tender offer deadline (the 4th). Youngpoong and MBK have raised the tender offer price from 660,000 KRW to 750,000 KRW, showing their determination to succeed. Korea Zinc also pulled out a counterattack card by launching a share buyback to defend its management rights. Youngpoong countered that using company funds to defend Chairman Choi's management rights constitutes breach of trust. However, Korea Zinc adopted a ‘buy and cancel’ strategy. If Youngpoong and MBK respond by raising the tender offer price again, this ‘war of money’ is expected to prolong.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)