Strengthening Governance Lacks Direct Link to Stock Price Rise

Asian Cases Show Various Factors Determine Stock Indices

Need for Capital Market Revitalization Over Regulatory Tightening

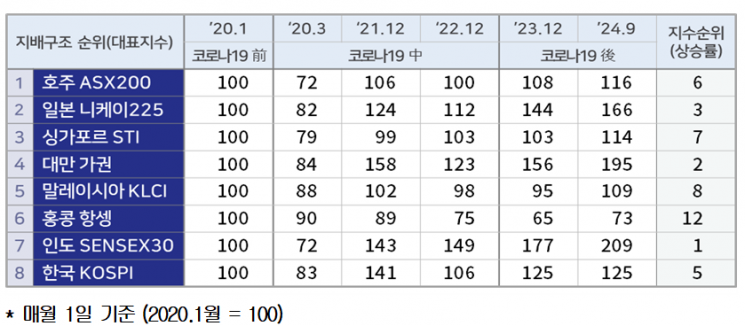

As regulatory strengthening bills aimed at enhancing the domestic capital market and corporate value-up are being discussed, it has been pointed out that there is no clear correlation between governance and stock index growth rates in the cases of Asian countries.

The Korea Chamber of Commerce and Industry analyzed in its report titled "A Study on the Correlation between Governance and Stock Indexes in Asian Countries," released on the 1st, that the governance evaluations and stock index growth rates of major Asian countries, including South Korea, do not align. The report emphasized that stock index growth is the result of a combination of various factors such as economic and corporate conditions, structural reforms, and policies that induce increased investment.

In this year's Asian Corporate Governance Association (ACGA) governance evaluation, South Korea ranked 8th out of 12 countries, but from January 2020 to September this year, its stock index growth rate was 25%, ranking 5th. The report indicated that this suggests it is difficult to conclude a direct correlation between governance and stock indexes.

Australia ranked 1st in governance evaluation but was 6th in stock index growth rate. This was analyzed as partly due to rising raw material prices driven by supply chain crises, which propelled stock prices.

India ranked 7th in governance but recorded the highest stock index growth rate, attributed to high economic growth and the influx of individual investors into the stock market.

The report pointed out that strengthening governance is not the sole solution for revitalizing the capital market and argued that other measures should also be considered. It suggested that policies such as tax benefits on long-term stock holdings and separate taxation on dividend income, applied in the United States and Japan, could help activate the capital market.

Song Seung-hyuk, head of the Financial Industry Team at the Korea Chamber of Commerce and Industry, said, "Value-up should be pursued from a comprehensive and long-term perspective, considering corporate conditions, economic environment, and investors. If regulations are introduced too strongly, the possibility of foreign companies and capital investing or listing in South Korea will gradually decrease, and the domestic market will remain like a frog in a well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)