In the management rights dispute at Korea Zinc, the repurchase of treasury shares has emerged as a last-minute variable. With financial authorities issuing an unusual verbal warning to protect investors, market attention is focused on whether Korea Zinc will implement a management rights defense strategy through treasury share repurchases. If treasury shares are used for management rights defense rather than being canceled to enhance shareholder value, it would be contrary to the government's recent value-up policy.

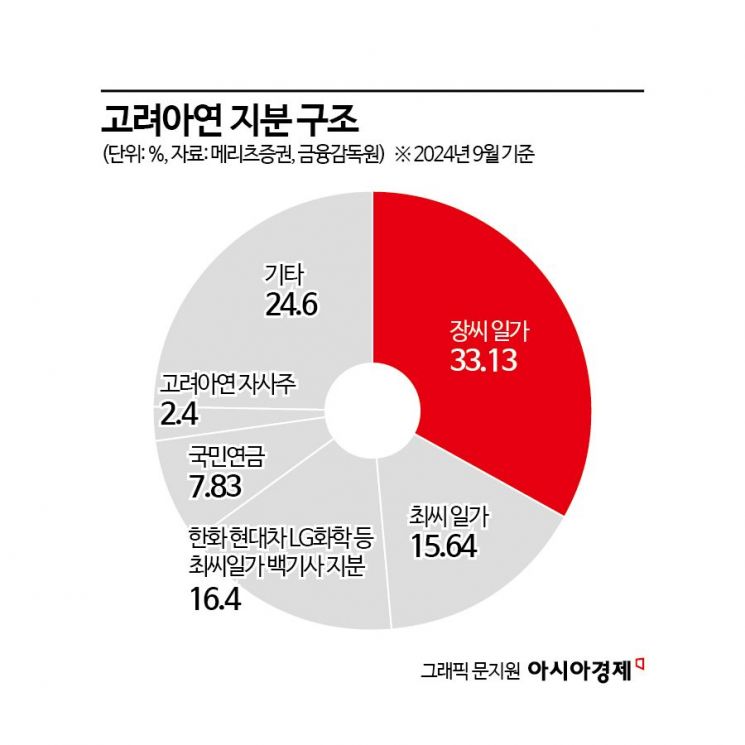

According to the financial investment industry on the 30th, Korea Zinc repurchased treasury shares worth 255.8 billion KRW after the shareholders' meeting in March. This corresponds to 2.4% of the company's shares. Treasury shares do not have voting rights, but they can be exchanged with friendly companies. If other companies such as Hyundai Motor and Hanwha assist, friendly stakes can be secured through treasury share exchanges, and voting rights can be revived.

It is known that Korea Zinc Chairman Choi Yoon-beom's side is preparing to counter with a competing tender offer while simultaneously pursuing a defense strategy through treasury share repurchases. The capital market expects that in this case, Korea Zinc will mobilize more than 1 trillion KRW to repurchase treasury shares at a price slightly higher than the tender offer price presented by MBK.

A financial investment industry official said, "If Chairman Choi Yoon-beom transfers treasury shares to friendly forces as a card he can use, voting rights come alive," adding, "He has done so before." Previously, Korea Zinc exchanged treasury shares with large companies such as Hyundai Motor, Hanwha, and LG. The market's attention is focused on Chairman Choi's decision regarding the cancellation of treasury shares.

Currently holding 2.4% of treasury shares, Korea Zinc is expected to increase this to around 4-5% after the scheduled treasury stock repurchase. A financial investment industry official evaluated, "A shareholder holding a 2.2% stake is trying to strengthen his control with company funds, which goes against the interests of all shareholders and the government's policy direction."

Earlier, MBK filed a provisional injunction with the court requesting that Korea Zinc and its affiliates be prohibited from purchasing treasury shares while the tender offer is ongoing. The Capital Markets Act prohibits tender offerors and their special related parties from increasing their stakes by means other than the tender offer during the tender offer period to prevent stock price manipulation. If the court decides that treasury share repurchases are allowed during the tender offer period (until October 4), Chairman Choi's side is reportedly planning to start repurchasing treasury shares after going through the board of directors and making a public disclosure.

However, the capital market expresses concerns that acquiring treasury shares at a high price with company funds to defend the management rights of Chairman Choi Yoon-beom personally or a specific shareholder could constitute breach of trust as it causes financial harm to the company. Since shares can be purchased at market price, buying them at a price higher than the tender offer price under the guise of treasury share acquisition could damage company assets. Additionally, revealing plans to acquire treasury shares while mentioning a specific price amid ongoing tender offers by MBK Partners and Youngpoong could be considered stock price manipulation.

MBK Partners stated, "Korea Zinc's treasury share repurchase is highly likely to be illegal and has low feasibility." Meanwhile, Korea Zinc's stock price plunged on the day. It closed at 688,000 KRW, down 23,000 KRW (3.23%) from the previous trading day. Although the tender offer deadline is approaching, the stock price weakened as Chairman Choi Yoon-beom's side has not presented a clear countermeasure.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.