Q3 Earnings Announcement in Mid-Next Month

Operating Loss Expected at 500 Billion KRW

Risky Investment and Front-End Process Development

GAA 3nm 2nd Generation Yield Concerns

Impact Extends to 'Exynos 2500'

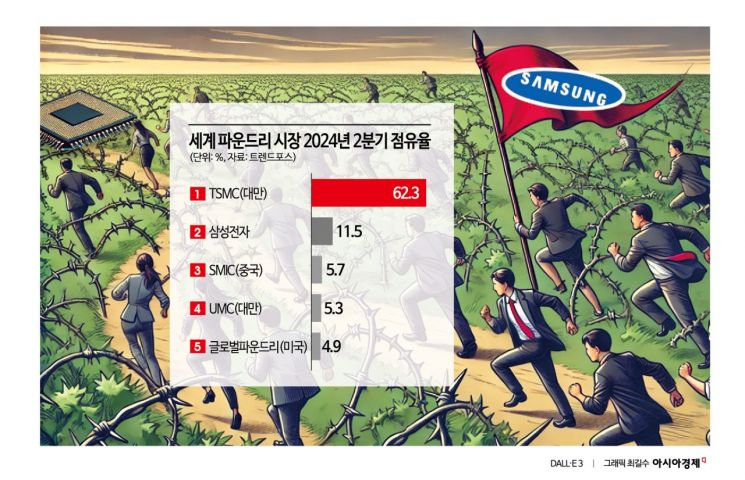

Global Market Share Stagnates at 11.5%

Rumors of 'Workforce Reallocation' and Spin-Off Suggestions

Recent moves by Samsung Electronics' foundry (semiconductor contract manufacturing), such as changing the forum format and halting production lines, are interpreted as reflecting the increasingly difficult situation. The fact that the foundry forum scheduled for the 24th of next month will be held online is gaining credibility as an 'unusual' occurrence in many respects. Although it was a stage where the company could have denied the crisis rumors circulating in some quarters and revealed its future blueprint to use as a stepping stone for a leap forward, deciding to hold it online with minimal contact with clients suggests significant implications.

Whether Samsung Electronics' foundry is facing a crisis is expected to be confirmed soon through concrete indicators. According to the securities industry and the sector on the 30th, Samsung Electronics will announce its Q3 earnings by business division around mid-next month. The securities industry forecasts that Samsung Electronics' non-memory division (foundry and system LSI) will still not emerge from the red. Hana Securities even predicts that this division's Q3 operating loss could reach 500 billion KRW.

If Samsung Electronics' foundry records poor results as expected by the securities industry, the crisis rumors are likely to intensify. The recent moves that seem to be adjusting the pace could be seen not as self-help measures to overcome the crisis but rather as a preliminary step toward a final decision on the fate of the foundry business, fueling pessimistic outlooks.

The industry analyzes that Samsung Electronics' foundry has struggled to produce results due to overextending investments and advanced process development. The 'Gate-All-Around (GAA) 3-nanometer (nm, one-billionth of a meter) 2nd generation process,' which began mass production from the second half of this year, is believed to have failed to win over clients due to unstable yields. The first product made with this process, the in-house AP chip 'Exynos 2500,' is also reported to have poor yields, casting doubt on its inclusion in the Galaxy S25 set to launch next year, which has been a significant blow. Consequently, progress on the 2-nanometer process, which was intended to be introduced swiftly and on schedule, has also become difficult.

The gap with Taiwan's TSMC, the dominant foundry leader, has widened further. According to the foundry market share for Q2 announced by global market research firm TrendForce, Samsung Electronics, ranked second, holds 11.5%, while first-place TSMC holds 62.3%, expanding the gap to 50.8 percentage points, leading to a growing perception that catching up is practically impossible. With global big tech companies such as Nvidia and Apple successively announcing foundry collaborations with TSMC, red flags have also risen regarding Samsung Electronics' customer acquisition.

Due to the difficult situation and news, rumors have circulated internally that some personnel working in the foundry may be reassigned to the memory division. Externally, Samsung Electronics' foundry is even being advised to spin off. Samsung Securities, a fellow Samsung Group affiliate, published a report titled 'Geopolitical Paradigm Changes and Industry' in July 2022, recommending that "since foundry requires closer contact with customers, active localization is necessary, such as Samsung Electronics' additional factory establishment in the U.S.," and also suggested spinning off the foundry. They asked, "How about Samsung Electronics spinning off the foundry and listing it in the U.S.?" Experts say, "Foundry spin-off is a strategic choice for the company, and it is difficult to predict any possibilities or effects," and are closely monitoring Samsung Electronics' situation. However, there is also analysis that if business conditions become extremely difficult, spin-off may be inevitable.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)