K-Value Up Index Selection Criteria Are Ambiguous and Investment Scope Narrow

Using Value Up Index as an Investment Indicator Is a Risk

Harsh Evaluation Calls It Merely a 'Declarative Meaning'

Chief Investment Officers (CIOs) of pension funds and mutual aid associations, the 'big players' in the domestic stock market, showed a lukewarm response to the government-announced 'Korea Value-Up Index.' In the capital market, it is considered crucial for the success of K-Value-Up whether pension funds and mutual aid associations will purchase Value-Up stocks to some extent or benchmark the Value-Up index. However, institutional investors expressed concerns that the K-Value-Up index is difficult to serve as a useful investment reference and that deploying large-scale funds into a narrow range of 100 stocks could pose investment risks.

"Nothing worth referencing for investment... Selection logic is also unclear" ... Somewhat harsh evaluation

On the 26th, CIO of Mutual Aid Association A said, "The index announced this time is merely declarative," adding, "The criteria feel somewhat diluted, and above all, it is simply an exchange index calculation without institutional support such as the core tax issues, so it is difficult to expect direct and positive effects." He mentioned, "There is little content worth referencing for investment strategy," and "Even looking at financial holding companies, Shinhan and Woori are included, but KB and Hana are excluded, and the selection logic is hard to understand."

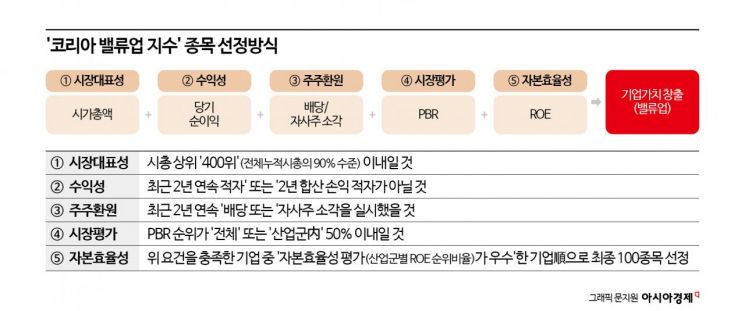

The Value-Up index includes 100 stocks that satisfy various conditions such as market capitalization, profitability, and shareholder returns. However, institutional investors evaluated that the Value-Up index is insufficient to produce a substantial stock price increase effect in the market. CIO of Mutual Aid Association B said, "The Value-Up index is still at a beginner level, making it difficult to have an effect in the market."

Following an index compressed to 100 stocks is 'risky'... Side effects observed in Japan, burden for institutional investors

From the perspective of pension funds that follow market representative indices, investing heavily in the Value-Up index compressed to 100 stocks is not easy from an investment policy standpoint. There is no reason to take risks investing in a narrow, unverified range of stocks while leaving Korea's representative indices like the KOSPI 200 index aside. CIO of Pension Fund C said, "Looking at Japan, which institutionalized this earlier, the performance of the Value-Up index this year is somewhat below that of Japan's representative index," adding, "Similarly, in Korea, there will definitely be performance differences between the two indices, and investors will have to bear that burden." He said, "While I agree with the policy's intent, from the standpoint of institutional investors who have fiduciary responsibility prioritizing client interests, it is just one of many investment options."

Institutional investors unanimously agreed that fundamental changes in the companies constituting the market and the system are necessary rather than the development of the index itself. It is not the inclusion in the index that matters, but actual improvement in corporate performance and fulfillment of shareholder returns. There was consensus that only fundamental and root changes?such as revisions to tax laws and commercial codes, strengthening benefits for long-term investors, and efforts to minimize policy variables?can change the Korean market.

'Declarative' index → Potential positive change through Value-Up index 'rebalancing effect'

Although the Value-Up index disappointed investors somewhat, experts expect positive effects to emerge during the future Value-Up index 'rebalancing' process. Jaehwan Heo, a researcher at Eugene Investment & Securities, sent a message to institutional investors stating, "Still, to be included in this index, companies must make Value-Up disclosures and compete with other companies," analyzing, "The pressure to avoid exclusion and to be included again may encourage companies to strengthen efforts for shareholder value, such as dividends." This aims to increase each company's tension and naturally induce a competitive effect. After the rebalancing scheduled for June next year, companies not participating in the Value-Up program may be excluded from the Value-Up index even if they were previously included. Researcher Heo said, "Although stock prices have already risen significantly due to Value-Up expectations this year, as the year-end approaches and market direction remains unclear, it will be difficult to find alternatives as good as Value-Up-related companies."

Meanwhile, the Korea Exchange announced the selection criteria and constituent stocks of the Value-Up index on the 24th. Previously, Value-Up beneficiaries in the stock market were concentrated in the financial and automotive sectors, but the newly announced Value-Up index surprisingly includes many IT and industrial companies as well. The index was designed to avoid concentration or exclusion of specific industries and to ensure balanced inclusion. In this process, companies that announced plans to improve corporate value in advance, even if they did not meet the criteria, were given special exceptions to be included in the index. Some financial companies such as Hyundai Motor, ranked 5th in market capitalization, Shinhan Financial Group, Woori Financial Group, and Mirae Asset Securities benefited from this. However, LG Energy Solution and Samsung Biologics, ranked 3rd and 4th in market capitalization, were excluded due to not implementing shareholder returns. KB Financial, the financial sector leader, was praised for shareholder returns but excluded due to low profitability. Telecommunications companies such as SK Telecom and KT were all excluded.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)