Housing Subscription Savings Interest Rate 2.0%~2.8% → 2.3%~3.1%

Tenant Savings Converted to Housing Subscription Savings

Private and Public Housing Subscription Available

The interest rate on the Housing Subscription Comprehensive Savings has increased to a maximum of 3.1%. This is higher than the deposit interest rates of major commercial banks such as KB Kookmin, Shinhan, and Hana Bank, which are in the 2% range, enhancing the utility of the subscription savings account. Additionally, subscribers of tenant savings accounts such as subscription installment savings and subscription savings can convert to the Housing Subscription Comprehensive Savings, allowing them to apply for all types of housing, including private and public housing.

The Ministry of Land, Infrastructure and Transport announced these improvements to the Housing Subscription Comprehensive Savings on the 25th.

First, on the 23rd, the interest rates for the comprehensive savings were raised from 2.0%?2.8% to 2.3%?3.1%. This marks a total increase of 1.3 percentage points following previous hikes of 0.3 percentage points in November 2022 and 0.7 percentage points last year. Contributions made before the rate increase will earn interest at the previous rates, while contributions made after the increase will earn interest at the new rates. Approximately 25 million people, about half of the nation, are subscribed to the comprehensive savings.

With this increase, the interest rate on the comprehensive savings now exceeds the deposit rates of the four major banks. According to the Korea Federation of Banks, the base interest rates for 12-month fixed deposits at KB Kookmin, Shinhan, and Hana Bank range from 2.50% to 2.60%. Among commercial banks, only Woori Bank offers a deposit rate of 3.37%, which is higher than the comprehensive savings rate.

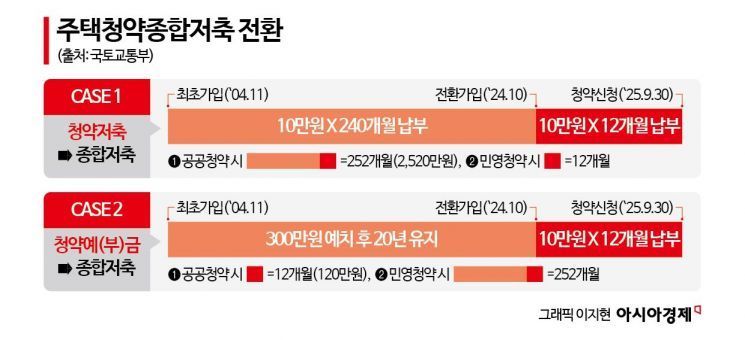

Starting from the 1st of next month, tenant savings accounts such as subscription installment savings and subscription savings can be converted into comprehensive savings. This enables applications for all types of housing, including private and public housing. Subscribers will also benefit from the comprehensive savings’ interest rates, income deduction benefits, and the combined account holding period with their spouse. However, if a subscription savings subscriber converts to comprehensive savings to apply for private housing, only new contributions after conversion will be recognized for eligibility.

Account conversion can be done at the bank where the existing tenant savings account is held. From November 1st, transfers of subscription installment savings to other banks will also be implemented.

Additionally, from November 1st, the monthly recognized payment amount for subscription savings accounts such as comprehensive savings and subscription savings will increase from 100,000 KRW to 250,000 KRW. This adjustment corresponds to the increase in the income deduction limit for subscription savings accounts from 2.4 million KRW to 3 million KRW. Subscribers who have prepaid their monthly recognized payments can increase their prepaid amount to 250,000 KRW starting from the payment installment due after November 1st.

Meanwhile, in February, the Ministry of Land, Infrastructure and Transport launched the 'Youth Housing Dream Subscription Account' for non-homeowning youth aged 19 to 34 with an annual income of 50 million KRW or less. This account offers a maximum interest rate of 4.5% and had reached 1.22 million subscribers as of last month. On the 23rd, the maturity payout of the Military Personnel Tomorrow Preparation Savings was linked to allow a lump-sum payment of up to 50 million KRW into the Housing Dream Subscription Account.

Furthermore, in July, the recognized payment period for minors such as children was extended from 2 years to 5 years when applying for housing subscription. In March, the system was improved so that in the case of a tie in the special selection for elderly parent support and the private housing point system, the subscriber with the longer account holding period wins. Next year, the income deduction (up to 3 million KRW annually) and tax exemption on interest income for subscription savings accounts will be expanded not only to non-homeowning household heads but also to their spouses.

Kim Gyu-cheol, Director of the Housing and Land Office at the Ministry of Land, Infrastructure and Transport, said, "We will continue to support so that families, including parents with subscription installment savings and military personnel sons, can fully enjoy the merits of the 'National Account,' which is the foundation for owning a home."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)