Composed of 100 Stocks Including Samsung Electronics and Hyundai Motor

Follow-up Measures Needed Such as Tax Incentives and Abolition of Financial Investment Tax

Stock Market Stimulus Effect Is Limited

Experts believe that for the 'Korea Value-Up Index' to take root in the market, follow-up measures such as tax benefits included in the government's tax law amendment and the participation of listed companies must follow. This is because, without clear incentives such as tax benefits, it would be difficult to induce voluntary participation from companies. Additionally, since the value-up rally led by large-cap stocks has already been reflected in the market in the first half of the year, the prevailing view is that the value-up index's effect on boosting the stock market will be limited.

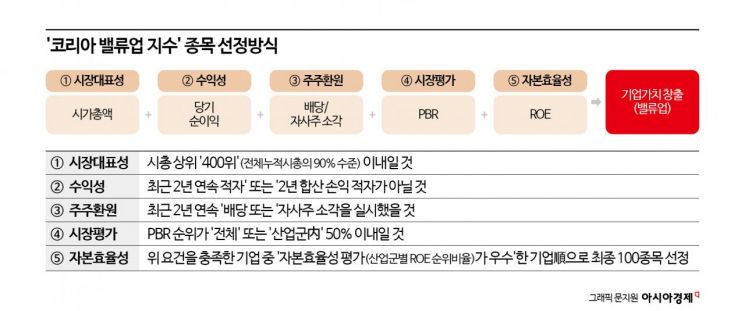

According to the Korea Exchange on the 25th, the government announced the Korea Value-Up Index, which includes representative domestic companies such as Samsung Electronics and Hyundai Motor, as well as financial companies that had previously made value-up disclosures. The index consists of a total of 100 stocks selected from companies ranked within the top 400 by market capitalization that have either returned value to shareholders for two consecutive years or have a price-to-book ratio (PBR) in the top 50%, indicating undervaluation. In November, an exchange-traded fund (ETF) composed of the value-up index stocks will also be launched. The Korea Exchange plans to review and replace the constituent stocks every June based on whether companies have fulfilled their value-up disclosure obligations.

Experts say that for the value-up index to succeed, follow-up measures such as tax benefits and the abolition of the financial investment income tax must be supported. Legislative amendments, including tax incentives that play a key role in investor participation and the abolition of the financial investment income tax, are currently pending in the National Assembly. The Democratic Party of Korea held a public debate on the 24th to finalize its stance on the financial investment income tax but failed to reach a consensus.

Byungjae Kwon, a researcher at Hanwha Investment & Securities, said, "Tax benefits will be a major variable in the success or failure of the value-up index," adding, "If the scope of tax benefits expands to ETFs related to the value-up index, it will gain momentum."

The voluntary participation of listed companies is also a factor that determines the success of the value-up index. If investors invest based on the value-up index → funds flow into companies included in the index → this leads to efforts to enhance corporate value and expand shareholder returns, establishing a virtuous cycle, which ultimately requires the participation and efforts of companies. However, so far, only 37 listed companies have participated in value-up disclosures.

Yoonjung Kim, a researcher at LS Securities, noted, "The success of corporate value-up programs will ultimately depend on the participation of stakeholders such as companies and investors," adding, "It is necessary to check the results of the upcoming launch of the value-up index ETF and whether corporate participation improves following the implementation of incentives for excellent value-up companies."

Since excellent value-up disclosure companies receive preferential treatment for index inclusion, the value-up index is expected to have some effect in inducing corporate participation. Jaeun Kim, a researcher at NH Investment & Securities, explained, "Because value-up plan disclosure is the top priority requirement for index inclusion, we expect the spread of corporate participation in value-up programs in the future," adding, "Hyundai Motor, Shinhan Financial Group, Woori Financial Group, and Mirae Asset Securities were specially included due to early disclosure of value-up plans."

However, the market expects that the announcement of the value-up index will not have a significant effect on boosting the index. Jaewoon Jo, a researcher at Daishin Securities, analyzed, "The stock market boost effect led by large-cap stocks has already been pre-reflected since February 2024, so additional boosting effects are expected to be limited," adding, "If previously undiscovered mid-cap stocks are added to the value-up index, their stock prices are expected to rise, but considering the market capitalization scale, the overall boosting effect on the index will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.