TDS Pharm Listed on KOSDAQ on 21st Last Month

IPO Price 13,000 Won → First Day Closing Price 52,000 Won

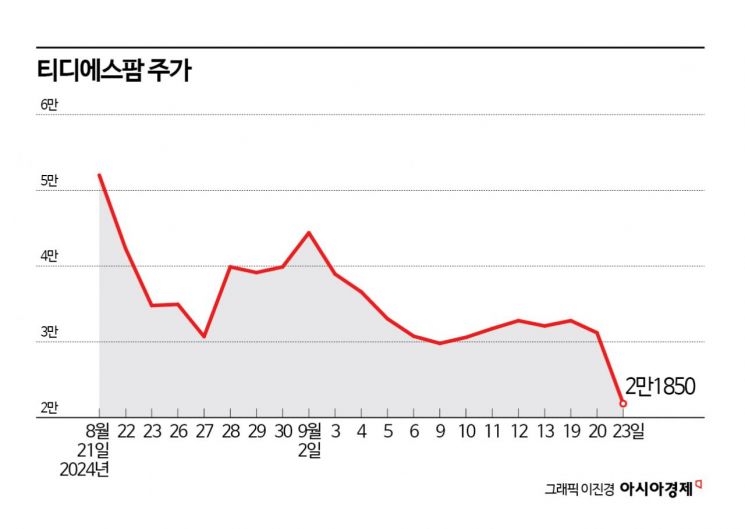

Price Dropped to 21,850 Won One Month After Listing

TDS Pharm, a developer of transdermal drug delivery pharmaceuticals, experienced a plunge to the price limit for the first time since its listing. Although it attracted attention by rising 300% compared to the public offering price on the day of its KOSDAQ market debut last month, its stock price has plummeted more than 60% from its peak in just over a month. Warning signs are growing about newly listed companies becoming 'graveyards for individual investors.'

According to the financial investment industry on the 24th, individual investors have net purchased TDS Pharm shares worth 22.9 billion KRW over the past month. The average purchase price was 41,400 KRW, resulting in an unrealized loss rate of 47% based on the current price of 21,850 KRW.

Founded in 2002, TDS Pharm develops various pharmaceuticals using the transdermal drug delivery system (TDDS) for conditions such as contusions, muscles, and neuralgia. It was listed on the KOSDAQ market on the 21st of last month with a public offering price of 13,000 KRW. On the first day of listing, the opening price was 27,000 KRW, and it closed at 52,000 KRW. The trading volume reached 1.2 trillion KRW. The next day, the stock price briefly surpassed 60,000 KRW during trading.

Contrary to the initial attention it drew at listing, the stock price fell to 21,850 KRW in just over a month. On the 23rd, the stock price dropped to the price limit. It appears that the shares that were agreed not to be sold for one month from the listing date were released. The 25% stake held by professional investors and venture capitalists (VCs) who invested before listing can be sold after one month. The tradable shares surged from 1.03 million to 2.44 million shares. The ongoing stock price weakness due to concerns over overhang (potential large-scale sell-off) and the resulting contraction in investor sentiment were also cited as causes of the price decline.

Although the stock price fell to the price limit, it remains 68% higher than the public offering price. Thanks to the initial surge in the stock price, professional investors and VCs who sold their holdings after one month were able to realize high profits.

The financial investment industry advises confirming the timing of lock-up release volumes when investing in newly listed companies. A financial investment industry official pointed out, "There are many cases where the stock rebounds after concerns about overhang are resolved," and added, "More individual investors are suffering losses after investing by riding the initial listing day momentum."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)