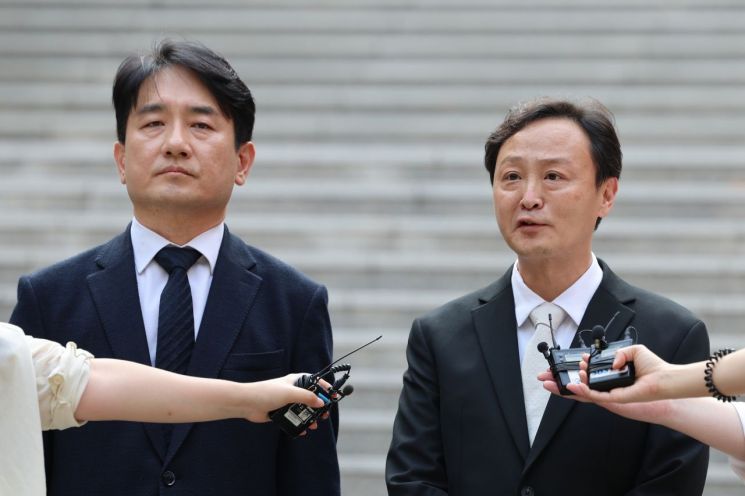

Ryu Hwa-hyun "I will speak after the investigation"

1.4 trillion won fraud and 50 billion won embezzlement charges

The prosecution investigating the large-scale unsettled payment scandal involving TMON and WEMAKEPRICE (WEMAKEPRICE) summoned and questioned Ryu Gwang-jin, CEO of TMON, and Ryu Hwa-hyun, CEO of WEMAKEPRICE, for the first time on the 19th.

The Seoul Central District Prosecutors' Office's dedicated investigation team for TMON and WEMAKEPRICE (led by Chief Prosecutor Lee Jun-dong) began questioning CEOs Ryu Gwang-jin and Ryu Hwa-hyun from the morning, summoning them as suspects on charges including embezzlement and fraud. The prosecution is reportedly investigating when the two CEOs became aware of their inability to pay sales proceeds and how much they were involved in the decision-making process to use WEMAKEPRICE's settlement funds for the acquisition of Wish.

Upon appearing before the prosecution, CEO Ryu Gwang-jin stated, "(Unlike WEMAKEPRICE) TMON showed no signs of delayed settlements," adding, "There was no support from headquarters, so we could not prevent the bank run, which caused the crisis." CEO Ryu said, "There was no reason to think that TMON would have difficulty settling sales proceeds," and explained, "We generate sales to settle payments, but suddenly the bank run happened, so I will explain to the prosecution why the bank run occurred and what efforts we made." Regarding the embezzlement charges, he also said he was not involved in the decision to provide funds for the acquisition of Wish, stating, "I have never seen the corporate bank account, seal, or OTP card, and the corporate seal used was not one I possessed."

Regarding allegations that Koo Young-bae, CEO of Qoo10, ordered a loss-leading promotion to list its logistics subsidiary Qxpress on the U.S. Nasdaq, he said, "I don't remember the exact percentage," but added, "Increasing Qxpress's volume is very important at the Qoo10 group level, and I kept saying that Qxpress must be listed on Nasdaq for the Qoo10 group to grow further." When CEO Ryu Hwa-hyun appeared before the prosecution, he only responded to reporters' questions by saying, "I will speak after the investigation is over."

The summons of each company's CEO by the prosecution came about two months after the investigation began on July 26 at the request of the Financial Supervisory Service. They are suspected of using approximately 50 billion KRW of seller settlement funds from TMON and WEMAKEPRICE to acquire the overseas shopping mall 'Wish' by their parent company Qoo10, and conducting fraudulent business operations amounting to about 1.4 trillion KRW through a Ponzi scheme despite being unable to pay the funds properly. Ultimately, TMON and WEMAKEPRICE, having run out of funds, filed for rehabilitation with the court and are undergoing related procedures. The unsettled sales proceeds identified by the government amount to 1.279 trillion KRW, affecting approximately 48,000 victim companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)