Monitoring the Balloon Effect of Secondary Financial Sector Loans

The financial authorities have requested the National Agricultural Cooperative Federation to strengthen risk management for household loans in relation to the selection of a second-tier financial institution, the local Nonghyup, as the collective loan handling agency for the Dunchon Jugong reconstruction complex in Seoul. This is due to concerns that including a local cooperative as a collective loan handling agency in the country's largest reconstruction complex could trigger a 'balloon effect,' where loan demand shifts from banks to mutual finance institutions.

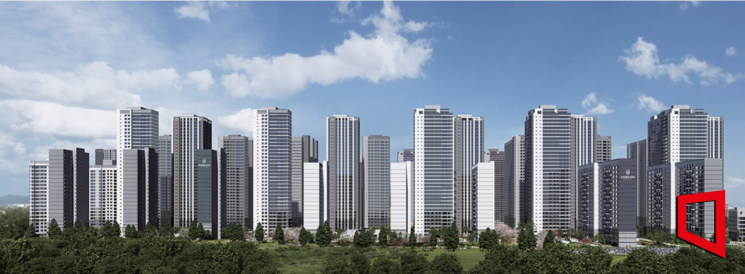

According to the financial sector on the 18th, the Financial Supervisory Service recently instructed the National Agricultural Cooperative Federation to oversee soundness management following the selection of Seoul Gangdong Nonghyup as the balance payment loan institution for the Dunchon Jugong reconstruction complex's 'Olympic Park Foreon.' Last month, the Dunchon Jugong reconstruction association selected not only commercial banks and Busan Bank but also the local Nonghyup, Seoul Gangdong Nonghyup, as balance payment loan financial institutions.

Collective loans are primarily handled by first-tier financial institutions, making the selection of a second-tier institution unusual. In particular, it is rare to find a second-tier financial institution included as a collective loan handling agency for large apartment complexes in Seoul and the metropolitan area. Analysts suggest that as banks, facing household loan regulations, offered conservative loan conditions, the reconstruction association turned to second-tier financial institutions.

As of the end of June, Seoul Gangdong Nonghyup's asset size was 2.782 trillion KRW, making it one of the largest local cooperatives nationwide. Although the interest rates are somewhat higher than those of first-tier financial institutions, the debt service ratio (DSR) limit of 50% could be advantageous for borrowers.

The financial authorities plan to monitor whether other local Nonghyup cooperatives are attempting to participate in apartment collective loans. There is also analysis that the balloon effect, where loan demand shifts to mutual finance institutions as bank household loan management tightens, is only a matter of time.

Across the entire second-tier financial sector, some movement has been detected where demand restricted by first-tier financial institution loans is shifting. According to the Financial Services Commission's 'August Household Loan Trends,' household loans in the second-tier financial sector increased by 500 billion KRW last month, marking the first increase this year.

However, the financial authorities do not yet view the balloon effect in the second-tier financial sector as significant. If the increase in household loans in the second-tier financial sector accelerates, additional measures such as adjusting the DSR limits are expected to be discussed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)