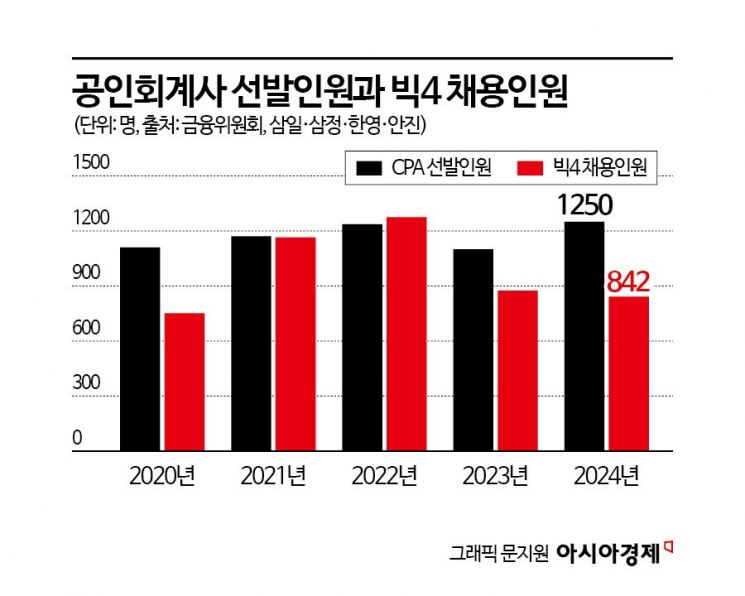

Record High Passers at 1,250, Big 4 Hiring 842

Concerns Over Surge in 'Undesignated Accountants' Due to Lack of Training Institutions

Financial Authorities Face 'Accountability' Amid Demand Forecast Failures and Over-Selection

The photo is not related to any specific expression in the article. [Image source=Getty Images Bank]

The photo is not related to any specific expression in the article. [Image source=Getty Images Bank]

Certified Public Accountant (CPA) is one of the most preferred career paths among liberal arts college students. This is because it is one of the few career paths that combines a professional qualification, appropriate compensation, and social recognition. The CPA exam is becoming increasingly competitive, taking nearly four years to pass the final exam. There is even a saying these days: "For liberal arts, it's 로회대 (Law School, CPA, Large Corporations)."

However, hundreds of CPA passers this year, despite receiving their prestigious certificates, have found themselves in a situation where they must remain 'unemployed' for the time being. This is because, while a record 1,250 candidates passed the exam this year, the hiring scale of the Big Four accounting firms was only 842 (tentative), creating an unprecedented gap. It is expected that about half of the roughly 400 candidates not absorbed by the Big Four will go to local accounting firms, but the remaining 200 or so have no suitable place to go and are anxiously waiting. They are set to spend a bitter Chuseok before the joy of passing fades away.

Decline in Big Four Hiring Scale Due to Industry Downturn

According to the Big Four, who held preliminary orientation on the 12th, a total of 842 CPA passers passed the hiring gateway: Samil with 301, Samjong with 306, Anjin with 120, and Han Young with 115. Since employment contracts are signed at the preliminary orientation, this indicates the actual hiring scale for this year. This is a slight decrease from last year (875). The top scorer and the youngest passer chose Samil.

Since the introduction of the new External Audit Act (New External Audit Act) in 2019, the accounting industry enjoyed a boom but began to decline gradually after peaking in 2022. This was due to a decrease in mergers and acquisitions (M&A) caused by high interest rates and macroeconomic uncertainties. In 2022, the hiring number of the Big Four (1,275) even exceeded the number of final CPA passers (1,237), but it started to decline from last year. Although there were forecasts that the total could drop to the 600s this year due to worsening industry conditions, it is said that the scale held steady at around 800, a slight decrease.

Surge in 'Unassigned CPAs' Expected

Subtracting the Big Four hiring number of 842 from the 1,250 passers this year leaves 408. About half of these are expected to be absorbed by local accounting firms, which are a tier below the Big Four. However, since local accounting firms are also affected by the gloomy industry conditions, even hiring around 200 is uncertain. The problem lies with the remaining 200 or so who cannot even go to local firms. It is known that they are sharing information through KakaoTalk open chat rooms to find ways to survive.

Certified Public Accountants must undergo 1 to 2 years of probationary training to obtain official CPA qualifications. In the industry, this period is known as 'a time when you pay to be trained.' One might think, "Isn't it unreasonable to complain when you have a professional qualification?" but considering the industry characteristics, CPAs who cannot find probationary training institutions are indeed in a difficult position. There is neither reason nor justification for general companies to hire CPAs who have not even completed probation, especially by paying them. There are concerns that a significant number of 'unassigned CPAs (those who cannot find practical training institutions)' will emerge.

"Why did you hire so many?" Blame on Financial Authorities

There is also a 'responsibility theory' that the root cause of the employment crisis lies with the financial authorities, who failed to predict demand. Last year, when the Financial Services Commission set the 2024 passing number at a record high of 1,250, it stated that the decision was made by comprehensively and balancedly considering market supply and demand while maintaining audit quality. However, criticism arose that the number was increased to avoid responsibility for the Audit Board's criticism. Last year, the Audit Board released a CPA exam inspection result stating that the Financial Services Commission had reduced the number of passers by reflecting service results that underestimated the actual increase in CPA demand when deciding the minimum number of passers in the past.

An accounting industry insider said, "The Financial Services Commission was startled by the Audit Board's criticism and increased the number of passers to an all-time high this year," adding, "The Big Four's hiring number could have fallen to the 600s due to difficult circumstances this year, but due to direct and indirect pressure from the financial authorities fearing an employment crisis, they reluctantly increased the hiring number." This means the financial authorities shifted their mistake onto the market. Among CPA passers, there are also complaints that it is "the financial authorities' fault for failing to predict demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)