10,290 Traffic Accidents During Chuseok in the Last 5 Years

Deaths Increased from 30 in 2019 to 42 Last Year

As the full-scale Chuseok holiday begins, the use of vehicles for visiting hometowns is also surging. During this time, since car accidents tend to increase, it is important to check car insurance riders or travel insurance to prepare for safety incidents.

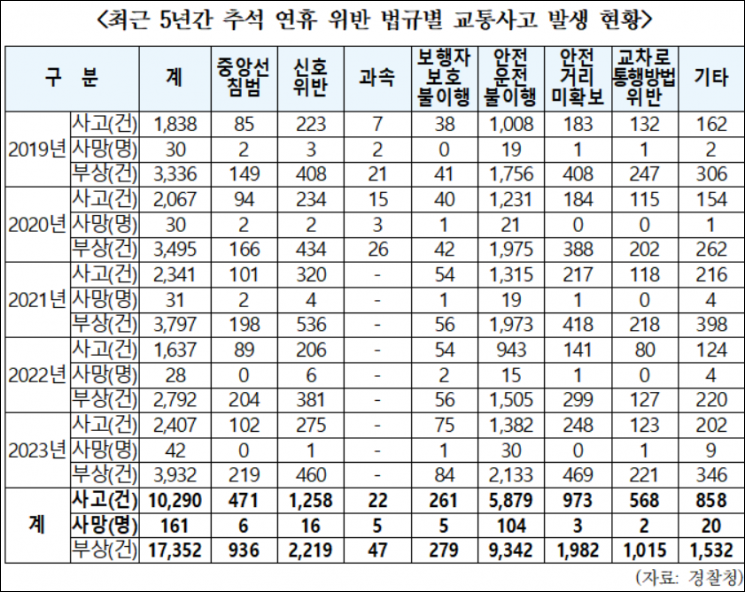

According to data submitted by the National Police Agency to Han Byung-do, a member of the National Assembly's Public Administration and Security Committee from the Democratic Party of Korea (Jeonbuk Iksan-si Eul), the number of traffic accidents during the Chuseok holiday period over the past five years was 1,838 in 2019, 2,067 in 2020, 2,341 in 2021, 1,637 in 2022, and 2,407 in 2023, totaling 10,290 cases. The number of traffic accident fatalities during this period was 30 each in 2019 and 2020, 31 in 2021, 28 in 2022, and sharply increased to 42 last year. Violations of speed limits and traffic signals during the Chuseok holiday also rose significantly. Speeding violations increased from 143,288 cases in 2019 to 385,579 cases last year, a rise of 242,291 cases (169.1%) over four years. During the same period, signal violations increased from 18,499 to 71,332 cases, an increase of 52,833 cases (285.6%).

Car accidents can happen anytime due to the negligence of other drivers, no matter how careful you are, so it is essential to check various insurance riders in advance to prepare for accidents. If you plan to take turns driving with a friend who shares the same hometown using one vehicle, it is advisable to subscribe to the 'Short-term Driver Extension Rider.' The coverage applies only from 00:00 on the subscription day to 24:00 on the end day, so you must subscribe before the day you hand over the steering wheel. Be cautious because if someone outside the designated driver range specified in the rider drives, insurance coverage may not apply.

If your car breaks down and you need to drive another vehicle, the 'Other Vehicle Driving Rider' can be helpful. It applies to vehicles of the same type as your own (passenger car ↔ passenger car, some small vans, cargo trucks under 1 ton) that are not owned by you or your family members (parents, spouse, children). If you do not have your own car insurance, you can subscribe to 'One-day Car Insurance' by selecting the coverage period in daily units (some companies offer hourly units).

If unexpected car troubles such as battery discharge, fuel depletion, or tire puncture occur, contact your car insurance company to request 24-hour emergency dispatch service. You can receive services such as emergency towing, emergency refueling, battery charging, tire puncture repair or replacement, and unlocking services.

If a traffic accident occurs, first turn on the hazard lights and set up a safety triangle or flare to alert following vehicles and prevent secondary accidents. Also, carefully check your surroundings and quickly evacuate to a safe place such as outside the guardrail. Be sure to report the accident to your insurance company’s call center and notify the police for assistance. Until the police arrive, it is advisable to thoroughly photograph the accident vehicle and scene using a smartphone or other device. If possible, secure witnesses and also obtain dashcam footage from nearby vehicles.

If unexpected damages occur while spending the holiday in your hometown, Personal Liability Insurance for Daily Life can also be helpful. This insurance covers liability for damages caused to others’ bodies or property. It can assist in cases such as damage to someone else’s mobile phone or belongings, or if your child or pet causes harm to others.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)