First Half Year Small and Medium Cosmetics Export Amount 5 Trillion Won... Record High

Beneficiaries Include Cosmax and Korea Kolmar

Decline in China Subsidiary Sales Negative... "Short-Term Recovery Difficult"

Expected to Offset by Securing New Customers in the US and Others

Cosmax and Kolmar Korea, ODM (Original Design Manufacturing) companies in the cosmetics industry, each recorded over 1 trillion KRW in sales in the first half of the year, setting new record highs. However, to maintain this upward trend in the second half, they will need to overcome the variable of the Chinese market. While K-beauty is gaining attention in overseas markets such as North America, Japan, and Southeast Asia, and manufacturers are increasing export volumes, the Chinese market is showing sluggish performance due to an economic downturn. These companies are expected to seek breakthroughs by expanding their client base into new markets.

Foreign customers, mostly tourists, selecting cosmetics at a cosmetics shopping mall in Myeongdong, Seoul.

Foreign customers, mostly tourists, selecting cosmetics at a cosmetics shopping mall in Myeongdong, Seoul. Photo by Younghan Heo younghan@

First Half Cosmetics Exports Hit Record High... Cosmax and Kolmar Korea Sales Surge

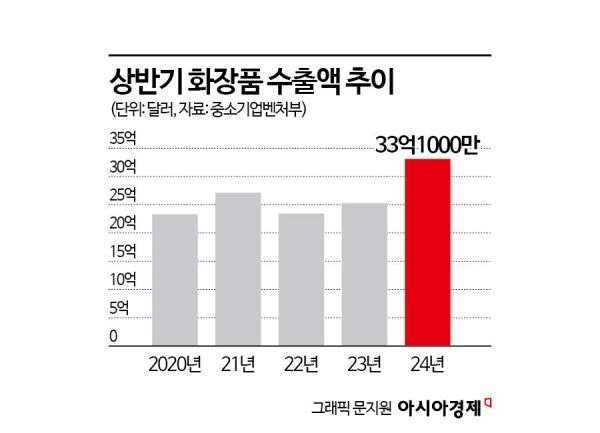

According to the Ministry of SMEs and Startups on the 18th, the export value of small and medium-sized cosmetics companies in the first half of this year reached $3.31 billion (approximately 5 trillion KRW), a 30.8% increase compared to $2.53 billion in the first half of last year. This is the largest scale among export items from SMEs. In contrast, exports from large cosmetics companies decreased by 23% during the same period. As a result, the share of SMEs in total cosmetics exports rose by 7 percentage points from 62% in the first half of last year to 69%.

By country, the United States led with $640 million, marking a 61.5% increase compared to the first half of last year. This was followed by China at $560 million (-3.7%), Japan at $350 million (20.8%), Vietnam at $230 million (33.5%), and Hong Kong at $200 million (40.5%). Except for China, all recorded double-digit growth rates.

As the export scale of SMEs increased, ODM companies Cosmax and Kolmar Korea both surpassed 1 trillion KRW in sales. ODM companies manufacture cosmetics for domestic SMEs. Typically, the second quarter is considered the peak season for cosmetics companies. As the weather gets warmer, demand for sun care products increases, and due to sweat-related skin troubles, sales of basic skincare products also rise. Additionally, demand for summer makeup grows, boosting sales of color cosmetics.

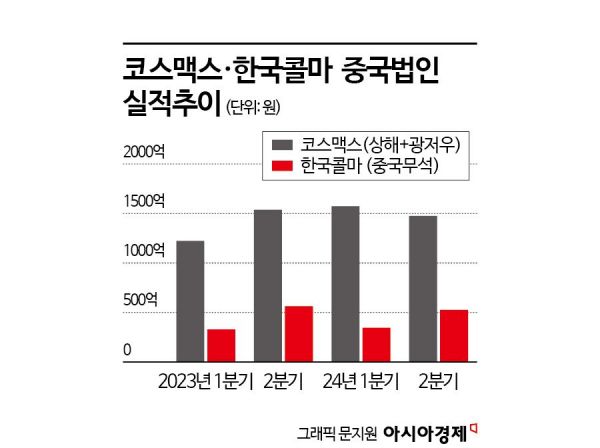

Accordingly, Cosmax recorded sales of 1.0783 trillion KRW in the first half, a 22.2% increase compared to the same period last year. Operating profit rose by 54% to 92.2 billion KRW. For the second quarter alone, sales and operating profit were 551.5 billion KRW and 46.7 billion KRW, up 15% and 1.5% respectively from the second quarter of last year. Cosmax operates mainly in Korea, China, the United States, Indonesia, and Thailand. A Cosmax representative explained, "The increase in exports by SME cosmetics companies and the rise in foreign visitors to Korea improved our performance. Our subsidiaries in Indonesia, Thailand, and the Southeast Asian region recorded high growth."

During the same period, Kolmar Korea's sales reached 1.2351 trillion KRW, a 13.6% increase from the previous half-year, and operating profit grew by 54% to 104.2 billion KRW. For the second quarter, sales and operating profit were 660.3 billion KRW and 71.7 billion KRW, up 10% and 27% respectively year-on-year. Kolmar Korea has a diversified business structure. Besides the cosmetics division (domestic, China, USA, Canada), it includes the cosmetics container company Yeonwoo and pharmaceutical bio company HK Innoen. A Kolmar representative stated, "The expansion of export volumes for indie brands and strong performances from subsidiaries HK Innoen and Yeonwoo contributed to the results."

Wild Card is 'China'... US Market Provides More Support

ODM companies expect continued strong performance in the second half as interest in K-beauty expands. However, the prolonged economic downturn in China and the lack of recovery in local consumer sentiment remain concerns. Additionally, the 'Guochao' consumption trend in China is negative for domestic ODM companies. Guochao refers to Chinese consumers' preference for domestic brands over foreign ones.

Among the two companies, Cosmax has significant sales in China, accounting for 27% of total sales, second only to the domestic market. Cosmax operates subsidiaries in Guangzhou and Shanghai, where second-quarter sales amounted to 147.6 billion KRW, a 4% decrease compared to the same period last year. While sales showed an upward trend in the first quarter of this year compared to the previous year, the second quarter marked the first contraction. Operating profit was not disclosed, and net income turned negative at -1.1 billion KRW.

Cosmax explained, "The contraction in consumer sentiment in China mainly affected online channels, leading to negative growth in key products, and labor cost burdens were significant." In fact, cosmetics retail sales in China in June fell by 15% year-on-year, impacted by a sharp decline in domestic consumption. Eunjeong Park, a researcher at Hana Securities, said, "The second quarter was fully affected by the sluggish consumption in China, and there was an unprecedented surge in bad debt expenses due to delayed collection of accounts receivable from related-party subsidiaries. While the third quarter is expected to show high growth due to increased exports of domestic products, concerns about China's consumption economy and additional loss provisions are anticipated throughout the second half."

Kolmar Korea's dependence on China is not as high, but during the same period, its Wuxi subsidiary recorded sales and operating profit of 52.7 billion KRW and 6.7 billion KRW, down 7% and 27% year-on-year, respectively.

An industry insider noted, "It is difficult for China's economic recovery to happen quickly. Local companies are growing continuously, creating a perception that Korean products are not necessary, and there is a growing atmosphere that ODM can also be done with Chinese technology."

ODM companies are considering the North American market as an alternative, anticipating prolonged sluggishness in China. Kolmar Korea plans to increase utilization rates by producing renewed products for major ODM clients in the US and focus on acquiring additional customers. Cosmax's US subsidiary has started expanding new clients through its Los Angeles (LA) West office from the third quarter.

Meanwhile, securities firms predict that both ODM companies will achieve record-high annual performance this year. Kolmar Korea's expected annual sales are 2.47 trillion KRW, a 15% increase from the previous year, with operating profit rising 57% to 143.3 billion KRW. Cosmax's annual sales are projected at 2.137 trillion KRW, and operating profit at 175.5 billion KRW, representing increases of 20% and 52%, respectively, compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.