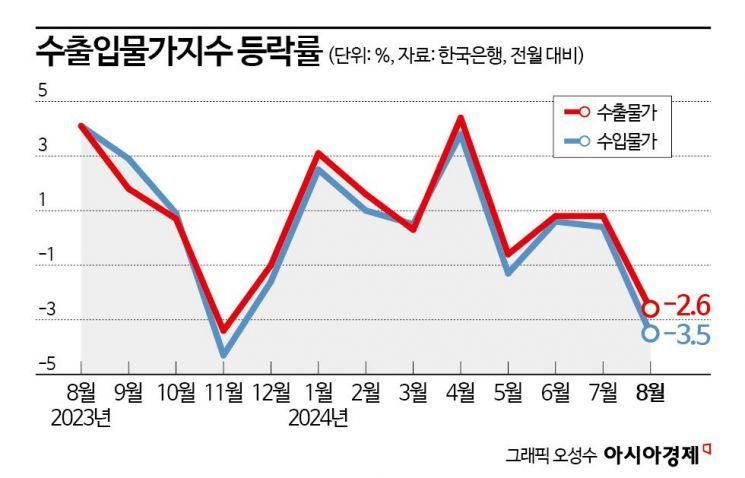

Last month, import prices recorded the largest decline this year as international oil prices fell sharply. Due to the drop in import prices, consumer prices are also expected to remain stable in the future.

According to the "August Export and Import Price Index and Trade Index (Provisional)" released by the Bank of Korea on the 13th, import prices in August fell 3.5% compared to the previous month. This is the largest decline in nine months since a 4.3% drop in November last year.

Import prices fell 1.3% in May but showed a slight increase in June (0.6%) and July (0.4%), before declining again after three months. Import prices are considered an important leading indicator of domestic consumer prices as they affect them with a time lag.

The decline in import prices last month was due to a sharp drop in international oil prices. Based on Dubai crude oil, international oil prices plunged 7.4%, from an average of $83.83 per barrel in July to $77.60 in August.

As oil prices fell, raw material prices such as crude oil (-9.4%) and thermal coal (-6.6%) dropped 6.9% compared to the previous month. Intermediate goods also fell 2.3% month-on-month, led by coal and petroleum products and primary metal products.

Lee Moon-hee, head of the Price Statistics Team at the Bank of Korea's Economic Statistics Bureau, explained, "Import prices fell sharply centered on mining products such as crude oil due to the decline in international oil prices."

Export prices also fell 2.6% month-on-month last month, marking the largest drop this year. The Bank of Korea explained that export prices were significantly affected by the decline in the won-dollar exchange rate. The average won-dollar exchange rate in August fell 2.1% compared to the previous month. The appreciation of the won is interpreted as causing export prices to fall.

By item, manufactured goods fell 2.6% month-on-month, mainly due to coal and petroleum products and chemical products. Detailed items showed notable declines in diesel (-9.8%), jet fuel (-10.6%), and terephthalic acid (-7.5%).

Excluding the exchange rate effect and based on contract currency, import prices in August fell 1.9% month-on-month, and export prices dropped 0.9%.

Last month, the export volume index rose 5.1% year-on-year, driven by increases in coal and petroleum products, computers, electronics, and optical devices. During the same period, the export value index rose 8.3%.

The import volume index increased 2.7% due to rises in mining products and primary metal products, and the import value index also rose 5.4%.

Last month, the net barter terms of trade index rose 0.5% as export prices (3.1%) increased more than import prices (2.5%). The net barter terms of trade index measures the quantity of goods that can be imported with one unit of export revenue.

The income terms of trade index rose 5.6% as both the export volume index (5.1%) and the net barter terms of trade index (0.5%) increased. The income terms of trade index measures the quantity of goods that can be imported with total export revenue.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)