'Value-Up Program Response Strategy Webinar'

The widening gap in profitability and capital efficiency between Korean companies and those in the US and Japan has been identified as one of the causes of undervaluation in the Korean stock market. Samjong KPMG announced on the 6th that it held a ‘Value-Up Program Response Strategy Webinar’ the previous day, attended by about 600 corporate representatives from over 400 listed companies.

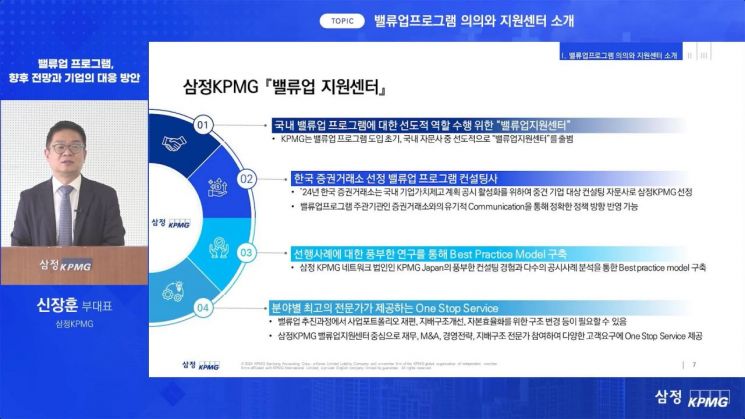

On the 5th, Samjong KPMG held a 'Value-Up Program Response Strategy Webinar' for corporate representatives, during which Shin Jang-hoon, head of the Samjong KPMG Value-Up Support Center, gave a presentation.

On the 5th, Samjong KPMG held a 'Value-Up Program Response Strategy Webinar' for corporate representatives, during which Shin Jang-hoon, head of the Samjong KPMG Value-Up Support Center, gave a presentation. [Photo by Samjong KPMG]

This webinar was held to share the background and key preparation points of the Value-Up Program with listed companies considering participation, and to find causes of undervaluation in the Korean stock market compared to major global markets such as the US and Japan, as well as countermeasures.

Kim Gyurim, Executive Director of the Samjong KPMG Economic Research Institute, who gave the presentation, introduced the expected effects and prospects of the Value-Up Program through a comparison between the Korean and global markets. He analyzed that the gap in profitability and capital efficiency between Korean companies and those in the US and Japan is widening through a comparison of profitability and return on capital among companies in Korea, the US, and Japan. In Japan, a clear difference was observed in the market capitalization growth rates between companies that disclosed corporate value enhancement plans after introducing the Value-Up Program and those that did not, and it was confirmed that companies selected for excellent disclosure showed significantly higher market capitalization growth rates, highlighting the importance of the quality of Value-Up disclosures.

Jo Ilsang, Executive Director of the Samjong KPMG Value-Up Support Center, provided guidance on key considerations for disclosing corporate value enhancement plans. Jo identified six core elements that the market desires through Value-Up disclosures: ▲Vision & Value, ▲Expected Returns and Capital Efficiency, ▲Portfolio Management, ▲Shareholder Returns, ▲Governance, and ▲Communication between the company and shareholders.

Yoo Seungmin, Director of the Samsung Securities Research Center, explained how to utilize the Value-Up Program from an investor’s perspective, while Ko Ilgyu, Head of the Value-Up Operations Team at the Korea Exchange, delivered the milestones and detailed operational directions including the background and future plans of the Value-Up Program.

Shin Janghoon, Head of the Samjong KPMG Value-Up Support Center, stated, “The Value-Up Program is an important policy for revitalizing the capital market, and it is necessary to fully consider market expectations formed based on Japan’s precedent cases. Selecting profitability, capital efficiency, and dividend policies as core items for shareholder returns, and enhancing execution power through governance to restore trust with the market are crucial.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)