Samsung C&T, SK, Hanwha, Consecutive Corporate Bond Issuance

Repayment of High-Interest Short-Term Borrowings and Maturing Bonds

Improvement in Funding Maturity Structure and Interest Expenses

Increased Funding Demand with Value-Up Participation

Large conglomerate holding companies and companies at the top of corporate governance structures, such as Samsung C&T, SK, and Hanwha, are consecutively issuing corporate bonds to repay short-term borrowings and bank loans. This is interpreted as a move to improve the maturity and interest cost structure of borrowings as corporate bond interest rates fall below the interest expenses of existing borrowings. The increase in dividend and share repurchase costs, as part of efforts to enhance corporate value (value-up), is also cited as a reason for increasing fundraising.

Exterior view of Samsung C&T Corporation Construction Division headquarters in Sangil-dong, Gangdong-gu, Seoul. [Photo by Samsung C&T]

Exterior view of Samsung C&T Corporation Construction Division headquarters in Sangil-dong, Gangdong-gu, Seoul. [Photo by Samsung C&T]

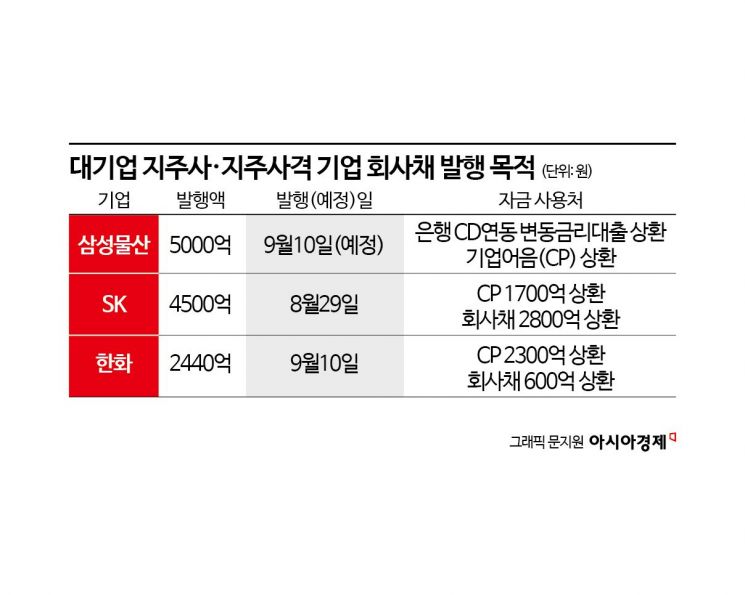

According to the investment banking industry on the 6th, Samsung C&T will issue corporate bonds worth 500 billion KRW on the 10th. In the demand forecast for institutional investors held on the 3rd, investment demand of 2.3 trillion KRW, more than seven times the initially planned issuance amount of 300 billion KRW, was secured. Major institutional investors such as the National Pension Service competitively participated in the demand forecast to secure corporate bond allocations.

The funds raised will mainly be used to repay maturing borrowings. Samsung C&T has loans with maturities coming due in September, including a 200 billion KRW variable-rate loan (linked to CD rate) borrowed from the Korea Development Bank and a 200 billion KRW variable-rate loan borrowed from HSBC Bank. Additionally, 100 billion KRW worth of commercial paper (CP) issued in June must also be repaid or refinanced. Samsung C&T plans to repay all these borrowings with the funds raised through the corporate bond issuance.

SK plans to repay maturing corporate bonds and CP with the 450 billion KRW raised through corporate bond issuance at the end of August. This month, CP worth 170 billion KRW borrowed at 3.63% and corporate bonds worth 280 billion KRW issued from 2019 to 2022 will mature. In the demand forecast conducted last month, investment demand of 1.7 trillion KRW poured in for a 250 billion KRW corporate bond offering.

Hanwha, the holding company of the Hanwha Group, also attracted investment demand exceeding 1.3 trillion KRW for a 150 billion KRW offering. Hanwha decided to increase the bond issuance amount to 244 billion KRW. The funds raised will be used to repay CP and corporate bonds. Hanwha needs to respond to the maturity of 230 billion KRW worth of CP issued in June with a 3-month maturity at around 4%. The maturity of corporate bonds issued in May 2019 with a 5-year term is also approaching.

An IB industry official said, "With recent expectations of interest rate cuts, long-term bond yields have rapidly declined, creating a favorable environment for high-credit-quality companies to raise funds long-term," adding, "Holding companies affiliated with large conglomerates or holding company-type firms are issuing corporate bonds at relatively low interest rates to repay high-interest short-term borrowings."

In particular, it is expected that holding companies will increase corporate bond issuance as they raise dividends and expand share repurchases. A corporate bond market official said, "Holding companies generally have less cash flow (CF) compared to their business subsidiaries," and added, "Under the pressure of value-up such as dividends and share repurchases, if funding needs increase, the likelihood of increasing fundraising is high."

There is sufficient investment demand for high-quality corporate bonds. As market interest rates continue to fall, demand is pouring into high-quality corporate bonds, which offer higher stability and relatively higher interest rates compared to government bonds whose yields have dropped to very low levels. The official forecasted, "The long-term interest rate decline trend centered on corporate bonds will continue for the time being," and "Corporate bond issuance to repay high-interest borrowings will also continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)