Up Fourfold Through July This Year, Then Giving Back Gains

Profit Growth Slows, Triggering Surge in Profit-Taking Sales

Individuals Net Buy 26.5 Billion KRW in Past Month

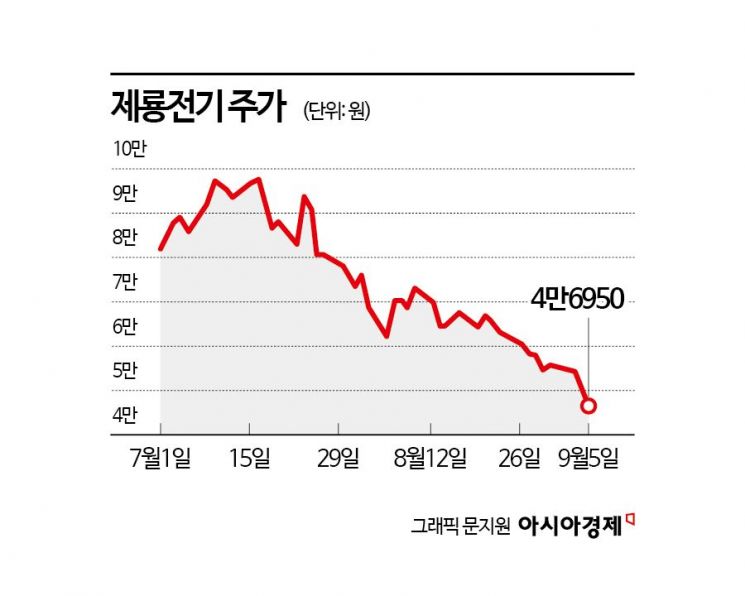

The stock price of Jeryong Electric, which had surged sharply until July this year, has halved over the past two months. Although it soared on expectations of increased demand, it was affected as profit growth slowed and profit-taking sales poured in.

According to the financial investment industry on the 6th, Jeryong Electric's stock price fell 52.0% compared to the closing price on July 16. The stock price, which once surpassed 100,000 won in July, dropped below the 47,000 won level. Considering that the KOSDAQ index fell 13.6% during the same period, the return relative to the market is -38.4 percentage points (P).

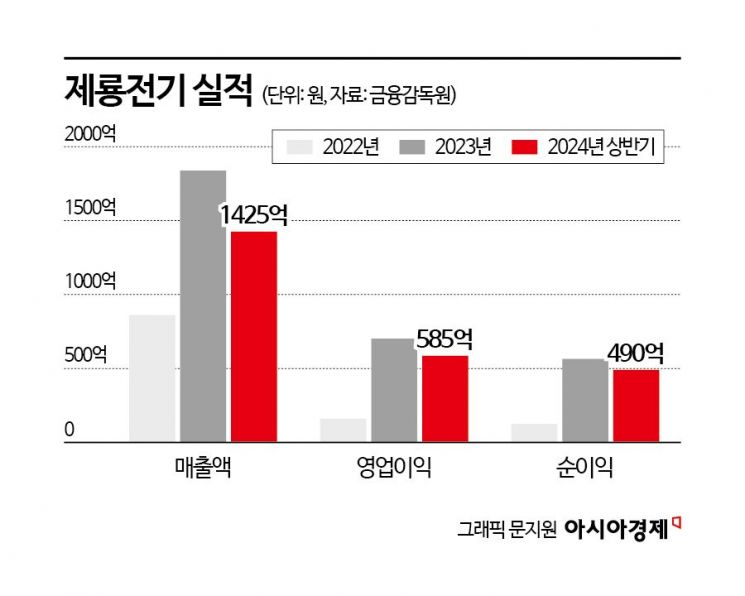

Until July 16 this year, Jeryong Electric's stock price surged 387.8%. Expectations that power demand would increase as the artificial intelligence (AI) industry developed pushed the stock price up. Jeryong Electric is a transformer manufacturer. Operating profit of Jeryong Electric also surged this year. In the first half of this year, cumulative sales reached 142.5 billion won, and operating profit was 58.5 billion won. These represent increases of 86.7% and 107.1%, respectively, compared to the same period last year. The average operating rate of the Daejeon factory in the first half reached 130%.

Jeryong Electric's stock price, which had drawn a steep upward curve for more than six months, began to falter from mid-July. Institutional investors and foreigners started profit-taking ahead of the second-quarter earnings announcement. Operating profit in the first quarter increased by more than 200% year-on-year, but operating profit in the second quarter increased by 66%. Since profits had sharply increased from the second quarter of last year, the growth rate slowed in the second quarter of this year. As of the end of June this year, the order backlog was 293 billion won, slightly down from 305.6 billion won at the end of March. The decrease in order backlog raised concerns about a slowdown in growth.

This is similar to the disappointment selling that occurred after Nvidia announced its second-quarter earnings this year. Although Jeryong Electric consistently achieved good results, the stock price retreated as it failed to meet heightened expectations. The stock price decline continues as domestic institutional investors and foreigners show a selling bias. Individuals are responding with bargain buying. Over the past month, individual investors purchased 26.5 billion won worth of Jeryong Electric shares. The average purchase price per share was 63,700 won. Based on the previous day's closing price of 46,950 won, the evaluation loss rate was 26%.

A financial investment industry official explained, "HD Hyundai Electric, the leading stock in the sector, also fell more than 30% from its peak," adding, "It is similar to how the secondary battery sector led the market in the first half of last year but sharply declined from the third quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)