Trump Media & Technology Group Plummets

Linked to Trump Approval Ratings, Recent Decline Accelerates

Lock-up Period Ends on September 19... Will Selling Pressure Increase?

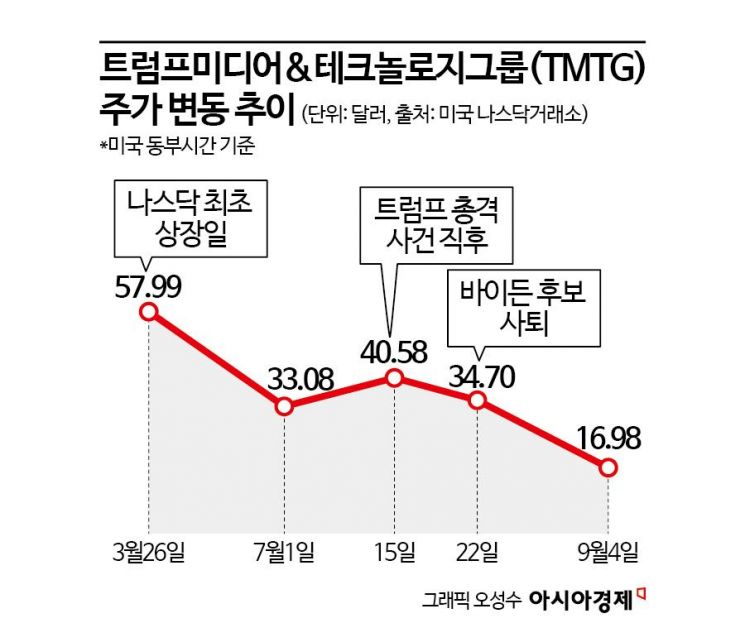

The stock price of Trump Media & Technology Group (TMTG), the parent company of Truth Social, a social networking service owned by former President Donald Trump, fell below the $17 mark for the first time since its listing in March, hitting an all-time low. The stock price has plummeted nearly 80% from its peak, further freezing investor sentiment.

This sharp decline is analyzed to be due to Vice President Kamala Harris slightly leading in the U.S. presidential election polls, increasing the likelihood of former President Trump’s defeat. With the continued stock price drop, concerns are rising that when the lock-up period for TMTG shares ends on the 19th of this month, early investors including former President Trump may engage in massive sell-offs. Until Trump’s approval ratings see a significant rise, a stock price rebound is expected to be difficult for the time being.

TMTG’s Continuous Plunge... 78% Drop from Peak

According to The New York Times (NYT), on the 5th (local time), TMTG’s stock price was trading at $17.40, up 2.47% from the previous close. After falling below the $17 mark for the first time since its March 26 listing, when it recorded $16.98 the day before, it slightly rebounded. Nevertheless, it remains 78.08% lower than its all-time high of $79.38 since listing.

The main reason for this sharp decline is that former President Trump’s approval ratings have not been able to significantly surpass those of Vice President Harris. According to a poll conducted by SSRS, a U.S. polling agency, commissioned by CNN from the 23rd to 29th of last month, Harris leads in 2 out of 6 battleground states, Trump leads in 1, and the remaining 3 are extremely close contests. Vice President Harris leads in Wisconsin (50%) and Michigan (48%), while former President Trump leads in Arizona (49%). Georgia, Nevada, and Pennsylvania remain too close to call.

As concerns grow that former President Trump may lose the election, investor sentiment toward TMTG has weakened significantly. CNBC analyzed, "TMTG stock trades more like a 'meme stock' driven by online rumors rather than a traditional investment stock," adding, "The stock price is bound to fluctuate depending on former President Trump’s political fate."

Lock-up Period Ends on September 19... Trump’s Selling Decision Key Amid Financial Struggles

The most significant upcoming event affecting TMTG’s stock price, along with former President Trump’s approval ratings, is the lock-up expiration on the 19th of this month. When the lock-up on 59% of TMTG shares held by former President Trump, his associates, and early investors is lifted, a massive sell-off could trigger a sharp decline.

Although former President Trump has not yet commented on whether he will sell his shares, considering his current financial difficulties, analysts believe there is a high possibility he may sell at least part of his holdings. The Trump campaign is facing worsening cash shortages due to election expenses as well as various legal costs.

According to Forbes, as of the end of July this year, the estimated cash balances remaining in the Democratic and Republican presidential campaigns were approximately $219.7 million (about 293.6 billion KRW) and $151.3 million (about 202.2 billion KRW), respectively. The Trump campaign has lagged somewhat behind the Democrats in fundraising and has seen increased expenditures due to Trump’s legal fees. Former President Trump’s personal net worth, which was $10 billion (about 13.365 trillion KRW) in 2016, has decreased to about $2.6 billion (3.4749 trillion KRW) as of the end of Q1 this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.