88% of domestic corporate finance, accounting, and tax professionals believe that investment in artificial intelligence (AI) is necessary for finance, accounting, and audit tasks, and 40% are currently using AI in their work or considering its adoption.

On the 2nd, global accounting and consulting firm EY Hanyoung released the results of the ‘2024 EY Hanyoung AI and the Future of Finance’ survey conducted last month. A total of 616 employees from finance, accounting, and tax departments of domestic companies participated.

When asked about the current level of AI adoption in finance, accounting, and audit tasks, 17% responded that they are already using AI in their work, 23% are considering adoption, and 60% have no plans to adopt it yet. Among all respondents, 50% of companies with assets of 2 trillion KRW or more and 29% of companies with assets under 500 billion KRW have either adopted or are considering adopting AI in finance, accounting, and audit tasks. Additionally, 18% of respondents said they are utilizing generative AI (Gen AI), including conversational AI services.

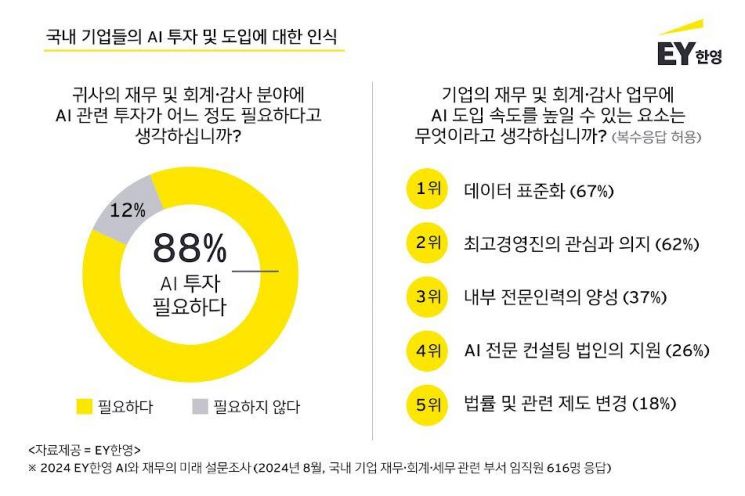

The majority of respondents viewed AI-related investment in finance, accounting, and audit fields as necessary. While 88% agreed that AI investment is needed, only 12% said it was unnecessary. Finance, accounting, and tax professionals considered cost burden (65%) as the biggest challenge when considering AI investment. This was followed by uncertainty about AI technology (55%), lack of internal experts (51%), and the possibility of legal and regulatory violations (19%).

For successful AI adoption, respondents said data standardization (67%) and management’s interest and commitment (62%) are the most essential. Many also emphasized the cultivation of internal experts (37%), support from AI specialized consulting firms (26%), and changes in laws and related systems (18%).

Regarding the primary considerations when developing and implementing AI, ‘reliability and accuracy’ was ranked first, followed by ‘information protection, monitoring, and security,’ ‘legal and regulatory compliance,’ and ‘fairness and bias.’

Lee Kwang-yeol, Head of the Audit Division at EY Hanyoung, stated, “Following the global trend of active AI adoption, domestic companies are expected to soon introduce AI in finance and accounting fields, capturing the two benefits of improved work efficiency and reliability of financial information.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)