Automatic Transfer Debit Priority Adjustment

Priority Repayment of Long-Overdue Debts

Revision of Loan Product Descriptions, Maintenance of IT Systems and Work Manuals

The Financial Supervisory Service (FSS) will strengthen guidance to help debtors make favorable choices in debt repayment by utilizing the right to designate priority repayment debts, thereby enhancing consumer rights. Even when priority repayment debts are not designated and multiple debts are repaid through automatic transfers, improvements will be made to establish and apply a reasonable withdrawal priority to prevent disadvantages in advance.

On the 1st, the FSS announced together with the Korea Federation of Banks that it will strengthen guidance on the right to designate priority repayment debts to provide debtors with the opportunity to repay debts that yield greater repayment benefits first. When a debtor cannot repay the full principal and interest due but can only make a partial repayment, the debtor has the right to designate which debt to prioritize for repayment.

Contents related to the right to designate priority repayment debts will be added to product brochures to enhance consumer explanations, and in the event of multiple debt delinquencies, separate guidance on utilizing the right to designate priority repayment debts will be provided via SMS and other means.

The FSS stated, "As a result of surveys targeting banks, procedures reflecting the debtor’s opinion on repayment order when only part of multiple debts is repaid were generally found to be insufficient," adding, "Although debtors could designate priority debts through communication with bank branches, active guidance on the right to designate priority repayment debts was not conducted."

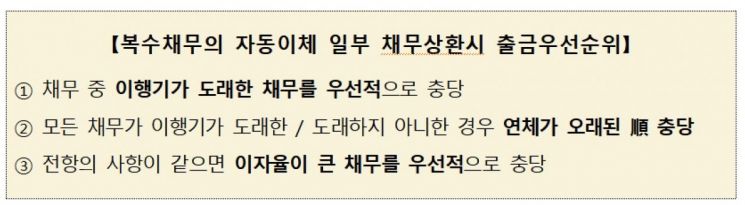

Additionally, an automatic transfer withdrawal priority considering the debtor’s repayment benefits will be established and operated. Considering the priority repayment of principal and interest on loans with long overdue days and loans with high interest rates, the FSS judges that prioritizing the prevention of risks such as loss of term benefits and credit score decline caused by delinquency aligns with the debtor’s universal interests.

Accordingly, the FSS has prepared a standard automatic transfer withdrawal priority plan for banks to prioritize repayment of debts with longer overdue days for multiple debts, and if the overdue days are the same, to prioritize repayment of debts with higher interest rates.

The FSS stated, "Debtors will be fully guaranteed ample opportunities to actively exercise the right to designate priority repayment debts when partially repaying multiple debts, allowing them to make favorable choices in debt repayment," and added, "In the third quarter, we plan to revise product brochures and other materials to strengthen guidance on the right to designate priority repayment debts, and complete the maintenance of each bank’s automatic transfer systems and operational manuals within the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)