Samsung Biologics Rose 4.48% Last Month

Touched 1 Million Won Intraday, Nearing Return as Royal Stock

Foreigners Led Net Buying Last Month Supporting Price Increase

Samsung Biologics is attempting to stabilize its stock price in the 1 million KRW range as its strong performance continues. Last month, foreign investors purchased the most Samsung Biologics shares, leading to the company's return as a 'king stock.'

According to the Korea Exchange on the 2nd, foreign investors net bought Samsung Biologics shares worth 285.8 billion KRW last month, making it the most purchased stock. While foreign investors had focused on semiconductors earlier this year, they began shifting from semiconductors to pharmaceutical and bio stocks last month. Despite net selling 2.8686 trillion KRW in the KOSPI market last month, foreign investors maintained their buying momentum in Samsung Biologics.

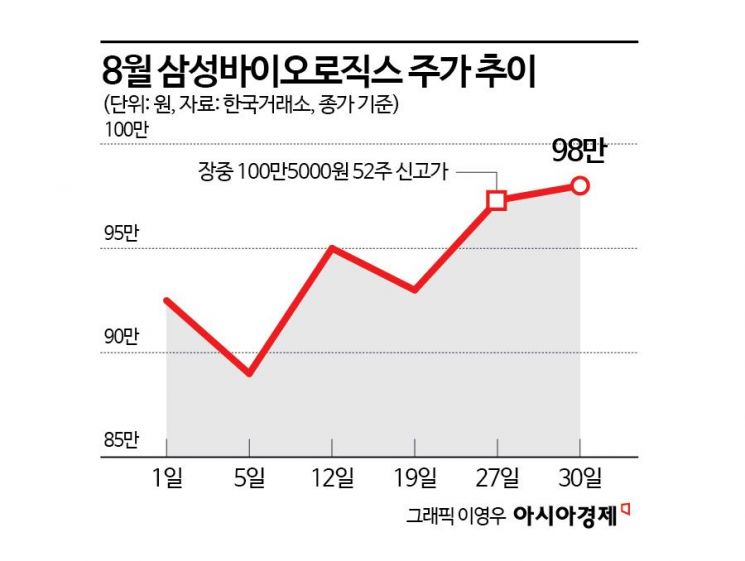

Supported by steady foreign buying, Samsung Biologics rose 4.48% last month. Although the stock price fell below 900,000 KRW during the crash on the 5th of last month, it rebounded afterward and reached an intraday high of 1,005,000 KRW on the 27th, signaling the return of the king stock. The stock price exceeded 1 million KRW for two consecutive days but has yet to close above 1 million KRW.

Brokerage firms' price targets for Samsung Biologics far exceed the 1 million KRW mark. This month, NH Investment & Securities initiated coverage with a target price of 1.2 million KRW, and SK Securities also started coverage with the same target price. SK Securities analyst Lee Seon-kyung stated, "Samsung Biologics' contract manufacturing organization (CMO) order performance has grown from 3.1 billion USD in 2016 to 12 billion USD last year, a fourfold increase. Beyond quantitative results, the increasing number of regulatory approvals for contracted products is also a positive sign. The expansion in product types indicates that Samsung Biologics' capability to handle various forms of antibodies is being validated, and this technological competitiveness will positively influence additional contract acquisitions."

Samsung Biologics is also expected to maintain solid performance. According to financial information provider FnGuide, the consensus forecast for Samsung Biologics' performance this year (average of brokerage estimates) projects revenue to increase by 20.34% year-on-year to 4.446 trillion KRW and operating profit to rise by 22.31% to 1.3622 trillion KRW.

Along with strong performance, new momentum is anticipated. Samsung Biologics is set to complete a dedicated production facility for antibody-drug conjugates (ADC) in December this year. NH Investment & Securities analyst Han Seung-yeon said, "For valuation expansion, stable performance growth plus new momentum is necessary, and attention should be paid to next-generation modality ADC. Since WuXi XDC, the world's second-largest ADC contract development and manufacturing organization (CDMO), is expected to be impacted by the Biosecurity Law, excluding Lonza, there is a lack of major competitors, which is expected to benefit ADC contract development (CDO) demand." He added, "Long-term performance level-up is expected due to mid- to long-term strengthening of ADC capabilities." Yuanta Securities analyst Ha Hyun-soo explained, "Samsung Biologics aims to operate the ADC dedicated production facility within this year and will be able to provide one-stop ADC production services combining antibody production with linker-payload conjugation. The company continues to invest in ADC-related technology firms through its Life Science Fund, which not only improves ADC production capacity but is also expected to expand into future CDMO contracts for these companies' development pipelines."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)